Below we discuss the three issues that might play out similarly to what we saw with California wildfires and Pacific Gas and Electric’s (PG&E) role in them.

PG&E issues parallels

One of the emerging issues in recent days has been who was responsible for the wildfire and whether there was any negligence. Again, it's early days, but news reports have debated whether the power lines were responsible for igniting nearby trees and if Hawaii Electric, the leading power utility company, should have done more to mitigate risk.

This is similar to what happened to PG&E regarding the 2018 wildfires and the eventual discovery that it could have done more to address the vegetation next to the power lines and the maintenance of the distribution network.

Subrogation settlement

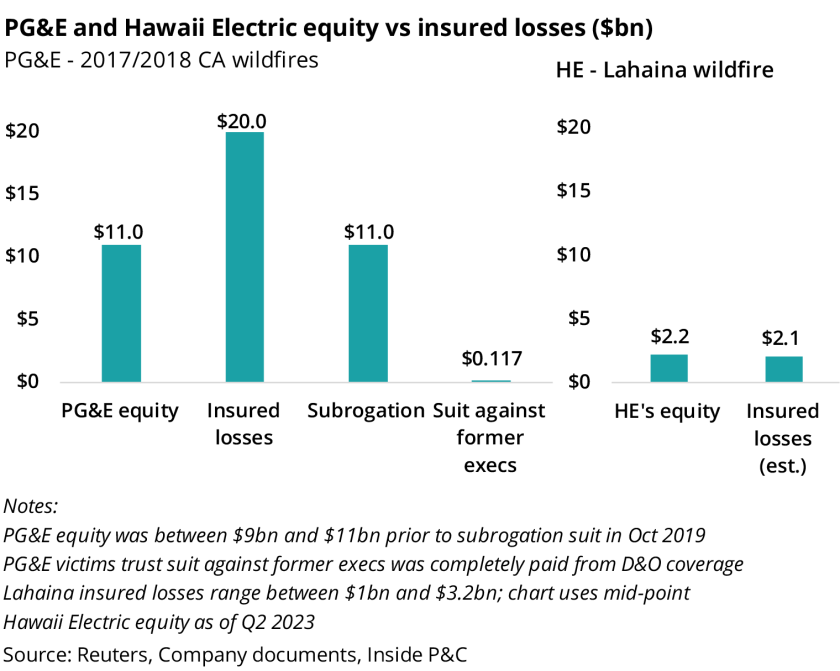

Although PG&E has been involved with various wildfire settlements, we looked at the 2018 wildfire as an illustration of how the situation could unfold. Insurers at that time sought compensation from PG&E for paying out insurance losses. The total insured losses were close to $20bn, with the insurance industry reaching an $11bn settlement with PG&E, eventually leading to its bankruptcy.

As the chart above shows, PG&E's equity was close to $9bn to $11bn shortly before the settlement. In comparison, the recent 10-Q shows Hawaii Electric's shareholders’ equity at only $2.2bn as of Q2 2023. This means that if insured losses continue to snowball and, hypothetically speaking, if Hawaii Electric is liable for negligence related to the wildfires, it's unclear how insurers would succeed in their subrogation attempts if the insured loss number grows.

Management liability

Recent news reports have discussed Hawaii Electric management's role in not taking additional steps as the fire spread, as well as failure to take preventive measures. In the case of PG&E, its former executives and directors eventually settled for $117mn late last year in relation to a series of fires.

With regards to the Lahaina Fire, recent news reports already indicate class action lawsuits being filed against Hawaii Electric. Maui County has also been named as a potential defendant, which adds an additional wrinkle to ascribing responsibility.