And for the broader insurance market, it is little more than a nick.

A Florida hurricane in late August also lacks a significant surprise factor. Indeed, if there is anything surprising about the loss, it is that you can have a strong Cat 3 storm that will inflict such limited losses.

The recent wildfires in Hawaii and the frequency/severity of severe convective storms in H1, along with the sheer meteorological weirdness of Hilary, are certainly more consequential in flagging the latent risk that continues to emerge in the cat market.

Nevertheless, Idalia will leave the marketplace with something like a $5bn-$10bn insured loss, with a weighting to Florida. (Some are placing a lower bound of $3bn on the loss, which feels hopeful.)

Florida homeowners’ insurers have pushed huge rate through their books over the last couple of years, leaving them profitable enough to bear a single retention loss and any reinstatement costs for those overweight the loss. Their increased robustness also reflects the removal of the most rotten wood over the last 12-18 months.

Idalia does, however, set them up for a real test if it is the first in a sequence of losses, with 2023 becoming another year of initials like 2005’s KRW or 2017’s HIM. And there is a long way to go from here, with the overwhelming majority of Atlantic hurricane risk to come and sea surface temperatures incredibly warm.

The market better hope Idalia is the main act, and not just the warm-up.

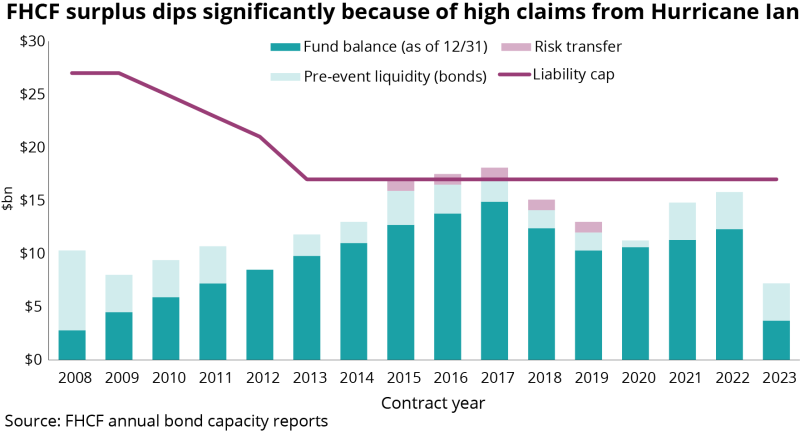

This week’s storm also looks too small to trouble the Florida Hurricane Catastrophe Fund, perhaps the worst capitalized reinsurer in the world, which looks a likely candidate for a state bailout in the years to come absent a significant run of luck. (See Ian Gutterman’s excellent work on this.)

In terms of the 2023 cat tally, Idalia also increases the chance that the year will be an above-average cat loss year compared to the 10-year burn rate, which sits at $36bn.

At the end of H1, we were at $53bn globally based on Aon’s numbers. Since then, we have had ~$5bn of Hawaiian losses: $600mn from Hilary, and $5bn-$10bn from Idalia in just two months. In a normal period, there are also some under-the-radar cat losses that will add to the tally without hitting the headlines.

This could leave us at ~$70bn with most of the Atlantic hurricane season to go, as well as Japanese typhoon season and US wildfire season.

Taken as an insurance event on its own, however, Idalia looks as if it will be a “minorburger” – despite the tragic consequences for the people directly affected.

Moreover, what Idalia will decisively not be is a reinsurance event of note.

In the 2010s, Florida hurricanes with only a couple billion dollars of residential losses would be heavily ceded to reinsurers. With more taken net and pushed through captives due to affordability issues over the last couple of years, an event this size may tickle the bottom layers of some programs – but it will largely be a retained loss for primary homeowners’ writers. Commercial lines insurers take even more net.

Painful events for commercially owned reinsurers in Florida probably start at $25bn-$30bn.

A tale of two cohorts

Panning out from Idalia, the shape of the loss will underscore that the cat market has crossed a watershed around the apportionment of losses between insurers and reinsurers.

H1 and Q2 results provided early proof points around the shift, with the impact of a high number of small cat events much more clearly legible in the results of insurers, than the Bermudians that have significant reinsurance in their mix.

The Bermudian cohort took cat impacts of two to four percentage points on the combined ratio, with two of the three names seeing a lighter cat load this year and RenRe broadly flat.

One final point of contrast. In the second quarter, Travelers – a conservatively run insurer with a good track record of managing cat – posted a combined ratio of 106.5% with 16.1 percentage points of cat losses. RenRe – still arguably the posterchild for cat treaty despite its diversification – put up a 80.3% combined ratio, with 4.2 percentage points of cat losses. Its property segment’s combined ratio was 63.0%.

The upstreaming of cat risk

The results reflect a multi-year journey of cat risk being “upstreamed” towards the ultimate source of risk in the value chain – the insured.

Starting at the beginning of 2019, there was an upstreaming of cat risk from the retro/ILS market to first-tier reinsurance, and thereafter – intensifying from 2022 – it has been pushed from reinsurers back to insurers.

This journey came in tandem with the end of the large-limits strategy from AIG and FM Global in 2018/19, which pushed much cat property into the shared and layered market and triggered rate hardening in the underpriced primary market.

Both represent an attempt to resolve the question of where cat risk should sit in the value chain and how much should be charged for it in response to the run of elevated losses from 2017 to date.

The large admitted carriers have been trying to work through the same problem this year, with dislocation particularly intense in California where the regulatory hand is gripping the premium spigot particularly tightly.

From 2017-22, cat losses skewed heavily to a combination of the ILS market, reinsurers and the London market. It seems 2023 could mark a decisive shift in the paradigm.

Reinsurers achieved rate rises of 40% to 70% on loss-free cat excess-of-loss treaties at January 1. But, potentially as consequential were the increases in retention that were directly imposed or encouraged via prohibitively high rates.

The changes were more variable than rate, with some cedants managing to hold their retentions, many having to increase 25%+, and some required to double. But all told, there was a concerted push to scale back the coverage below a one-in-10-year return period, with limit very difficult to obtain below this threshold.

This was combined with a further dialling back of the availability of quota-share capacity, with some blue-chip insurers dropping proportional cat deals. There was an even more pronounced effort from reinsurers to eliminate aggregate deals, with Zurich dropping its deal, and Travelers one of its two aggs.

As predicted back in August last year, the tighter reinsurance market has left insurers facing challenging trade-offs. (For background see: Bonfire of cat limits: Trade-offs loom for the primary market)

The choices are particularly stark in the homeowners’ market. Here insurers find themselves caught between the rock of an unprofitable and volatile book with reduced reinsurance support, and often populist regulators restricting their room for maneuver in the admitted market.

Particularly in California where wildfire risk magnifies the issues, this has left some insurers playing a game of brinksmanship with the regulator around withdrawal from one of their largest markets.

On the commercial lines side, insurers may be forced to choose between buying expensive bottom layers and securing the significant increase in vertical limit they need to reflect inflation around building material costs/labor.

And, of course, they face a trade-off between increased projected profitability from surging primary rates, and material increases in volatility.

All the while, insurers have to balance the need to maintain their value proposition to customers and brokers.

The more they slash lines, increase retentions, and restrict coverage the more they undermine the perceived relevance of the industry and damage relationships. The six rounds of rate rises customers have been asked to absorb only exacerbates this challenge.

A problem that isn’t going away any time soon

Stepping back, it is clear that insureds, brokers, carriers and, ultimately, government are still wrestling with the question of where cat risk should sit in the value chain and how enough money can be injected into the system to make it sustainable.

It is not clear in a period when climate change is driving a secular increase in loss costs, exacerbated by other man-made factors, that there is a satisfactory answer at this stage.

Insureds continue to want a free lunch (or perhaps a free roof). Governments don’t want to underwrite major new liabilities. Insurance commissioners don’t want stones thrown at them for rate rises. Carriers don’t want to absorb underwriting losses, or to have more volatile earnings.

The problem isn’t going away anytime soon.