The increasing complexity of risks, technological advances and climate challenges all seem tailor-made for bespoke E&S solutions.

However, as this publication has written, the nature of the E&S ‘Golden Age’ is evolving. Property is doing more of the heavy lifting on rates and growth, while as noted in AM Best’s most recent landmark E&S report, overall growth at least recently has slowed.

Inside P&C considers some key questions attendees at this year’s conference should be considering on the boats and marinas of San Diego’s harborside.

1. Is slowing growth a harbinger of a new, elevated normal and sustainability, or a turn?

While AM Best’s most recent update noted once again robust E&S growth of 19.2% in 2022 to just under $100bn, it also mentioned that in H1 2023 that growth slowed to 15.9%, nearly half the 32.4% in the same timeframe of 2022.

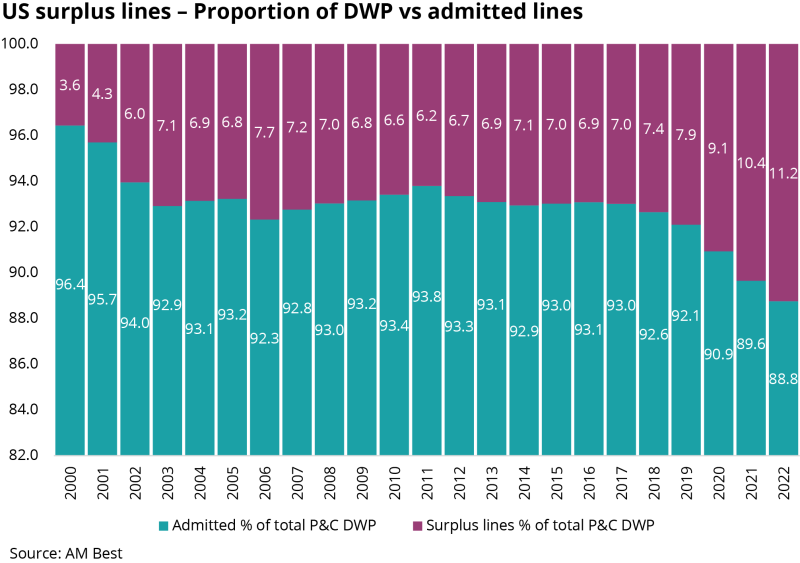

At the same time, E&S now reliably makes up over 10% of direct premiums written in the US P&C market. That number was just 6.2% in 2011 and at the time on the decline from a 2000s high of 7.7% in 2006.

Is the slowdown the harbinger of a turn? Or, as this publication has written, does it just point to the fact that as the E&S market matures and becomes a prized part of the insurance landscape, growth expectations simply need to be reset? We would bet many in San Diego would say the latter.

One thing to watch out for, as AM Best noted, is a change in the pricing cycle for E&S-dominated lines, like cyber. E&S accounted for over 57% of DPW market share in cyber as of the end of 2022.

“A notable change reflected in the mid-year 2023 data is that cyber liability premium written in the surplus lines market had moderated with a 15% drop in premium,” AM Best analysts noted.

This follows about two years of a hard market and could affect E&S growth overall. D&O is another line that will be watched closely in this regard, given professional liability is one of the largest E&S lines according to stamping data (with the caveat that stamping data does not represent all of the data captured by AM Best).

E&S premiums have grown outsized to policy growth during the Golden Age.

2. How reliant is current E&S momentum on property?

This brings us to our next point of discussion for WSIA. Is the E&S market now too leveraged to the property market for growth?

This publication has noted the historically hard property market is reflected in unprecedented rate increases.

With property rate increases as high as 30-40%, as noted by executives in Q2 conference calls and recent industry reports, it might be easy to hide less stellar gains in other lines.

However, the data doesn’t seem to bear this out. RPS CEO Joel Cavaness said Thursday during an investor call that in the first two months of the third quarter, RPS data shows open brokerage renewal premium increases of more than 14%.

About 80% of RPS’s business saw renewal premium increases, with property renewal premiums up about 22% and most of lines outside of D&O up mid-single digits.

That seems to suggest other lines are holding their own, albeit at a lesser magnitude. Cavaness also noted that carrier partners are still unwilling to deploy large limits on any one risk, suggesting that E&S carriers might not overextend on property and pricing could remain elevated.

But there are also questions around how much more insureds can bear after multiple years of rate rises and if insurers can absorb looming higher reinsurance costs. This publication has written that where cat risk sits in the value chain is a key question more generally for the value chain.

Stamping data underpinning AM Best’s recent report was broken down by line of commercial business for the first time, showing that property is still the smaller segment and personal property in particular a minority.

Commercial liability came up as the leading segment in terms of premiums captured by the stamping offices, accounting for 39% of 2022’s total. Commercial property accounted for another 29%. Personal property lines, on the other hand, constituted a small portion of less than 5%.

There is also the likely not yet captured fact that high net worth business is increasingly flowing into the E&S market as the admitted market no longer has the flexibility to accommodate increasingly complex risks in that space.

According to AM Best data, eight of the top 10 lines of the E&S segment’s coverage grew their DPW by more than 10% in 2022, led by the commercial property, commercial auto, and general liability lines, with the latter including boosts from umbrella and excess liability, cyber, and professional liability segments.

3. The fronting question after Vesttoo

Fronting companies have been key to ongoing E&S growth, with AM Best-rated companies now writing over $4bn in DPW, contributing meaningfully to E&S growth.

But recent events, mostly the fallout from the crisis of confidence stemming from Vesttoo’s fraudulent LOCs, need to be carefully managed to maintain this line of growth for the E&S market.

“If risks are not initially assessed properly, the fronting company can be subject to residual tail risk, which could strain the collateral,” said AM Best analysts.

Vesttoo has been on most people’s minds, and lips, recently, and will likely be a key discussion point at WSIA.

Official comment on fallout has generally been scarce, but the impact on fronting companies has been undeniable, with a number of sales processes paused and significant surplus impacts recorded, as this publication has reported.

“Strong relationships with their reinsurance partners is a hallmark of successful fronting companies,” said AM Best.

It seems certain there will be greater scrutiny around the capital arrangements of fronting companies; whether that impacts E&S growth overall remains to be seen. AM Best’s own review of the sector will also be pivotal here.

4. How many new entrants is too many?

Companies writing surplus lines have expanded over the last two years, as AM Best data shows, after a period of relative stagnation.

Existing surplus carriers have also received capital injections, with investors likely heartened by ongoing solid financial performance and news of hard market conditions in many segments.

New entrants don’t automatically translate into more deployed capacity, of course, and some of the changes might just be shifting capacity around internally for other reasons.

However, an increase in supply could affect competitive balance and temper the pricing pressure on coverage lines that still need improvement.

Yet, competition in the US E&S is anticipated to continue rising as the current boom draws the interest of various domestic and international carriers.

Last year, for instance, Axis opened a new wholesale unit and tapped Carlton Maner to lead the division reporting directly to CEO Vince Tizzio, while earlier Zurich NA created a standalone wholesale unit headed by Chris Lewis.

Meanwhile, this year foreign players are looking to venture into the US E&S market with UK insurers Beazley and Lancashire having already announced plans to launch operations. (See: Opinion: Beazley and Lancashire E&S launches underscore Lloyd’s competitive challenge)