Some market participants expressed concerns about Vesttoo’s impact on the MGA/MGU sector by increasing the barriers to access legitimate sources of alternative capital.

Separately, some wondered if the InsurTech’s fallout will bring to a halt – or at least slow down – the meteoric growth that the fronting segment has seen over the last years. (See: Opinion: Fronting companies should be valued like insurance companies, not brokers)

“Have we hit peak fronting?” one executive wondered.

While it’s still too early to know the full scope of the case and the consequences it will have on the broader market, one of the first apparent outcomes is increased scrutiny between MGAs and capital providers.

Broking sources noted that, for instance, they are seeing both program managers and carriers following more strict due diligence processes over the last couple of months.

“Now MGAs want to be more involved, they ask more questions,” one broker said. “This was exacerbated after Vesttoo.”

E&S growth – competition, talent and opportunities

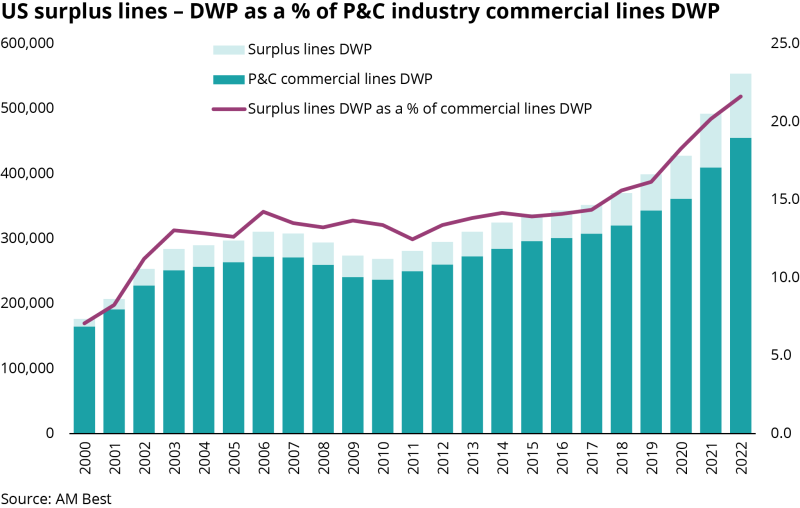

Over the last years, the US E&S segment has been growing and, as AM Best recently reported, it is expected to outpace the overall commercial lines market in the coming years.

The space is benefitting from a skyrocketing property market and the increased flow of business from the admitted market into non-admitted. One senior E&S executive told Inside P&C that he is seeing submission flows rising faster in cyber, transportation and environmental lines.

The 20%+ year-on-year growth of the US E&S space has drawn insurers’ interest, with Everest, Beazley and Lancashire the most recent examples.

Yet, the increased competition is set to drive a talent shortage, as the market’s talent has not been able to expand at the same pace, pushing wages up across the board.

BMS EVP and co-head of programs Desmond Bohan said the increase of the cost of talent “is significant” adding that the shortage is a bigger issue in middle management positions.

The E&S expansion, however, has also led incumbents to capitalize on the growth seen in several lines of business.

For instance, Axa XL recently began providing excess habitational coverage in the US with limits of up to $3mn for the first $5mn.

But it is not only in the rock-hard property market that carriers are looking for opportunities, including by partnering with MGAs in some classes.

BMS EVP and co-head of programs John Speckman said that (re)insurers’ appetite to deploy capacity in casualty has increased this year.

“I’m seeing this in workers’ compensation, general liability and even commercial auto,” he said.

Commercial auto and cyber

Commercial auto remains a tough class as higher frequency and severity have been outpacing recent rate hikes of 10%-15%.

One E&S senior executive used phrases such as “transportation is a mess” and “people forgot how to drive during Covid” to describe the current state of the market.

Cover Whale CEO Dan Abrahamsen said the commercial auto space is seeing a loss ratio of around 70% while the trucking class has a loss ratio of over 80% given its increased exposure.

The executive mentioned that his MGA is seeing lower figures than the industry average thanks to its coaching program, which is also drawing the attention of paper providers.

Abrahamsen noted that now some carriers are willing to talk about capacity in the segment, whereas “two years ago it was impossible, no one wanted to talk about it.”

Another hot line of business at WSIA was cyber, a market that is going through a softening but that is expected to rebound as ransomware attacks spike.

“I don't think that’s going to happen until probably the second quarter next year, and it won't be with the same degree of severity that we saw in 2019 to 2021,” said RPS cyber head Steve Robinson.

“Lower pricing with higher claims frequency, it's not a recipe for sustainability,” he added.

Click here to read all Inside P&C’s WSIA coverage, including video interviews.