The report sent shares up over 6.6% to close at nearly $29.30 per share, their highest level since early September.

Inside P&C has independently confirmed that the bank is working on full sale plans to Stone Point with Morgan Stanley as adviser, but some sources were skeptical about the reported ~$10bn potential consideration if a deal is consummated, given the ~$15bn valuation the unit secured earlier this year.

As Truist embarks on the long-anticipated spin-off, the bank is set to face some challenges along the way.

In February, when the bank signed a deal to sell a 20% stake in the insurance unit to Stone Point, banking sources suggested that a listing of the insurance operation would follow in 12-18 months.

Moreover, this publication argued that IPOing and divesting retail broker McGriff would make more sense than selling a stake in the insurance arm.

Yet a direct sale to Stone Point looks like the shortest path to spin off the franchise right now as the banking sector braces for a tighter regulatory environment.

A full sale of the unit could lead to a higher valuation than selling parts of it. It is also a faster exit than an IPO, which typically involves dealing with SEC regulators and long reporting requirements.

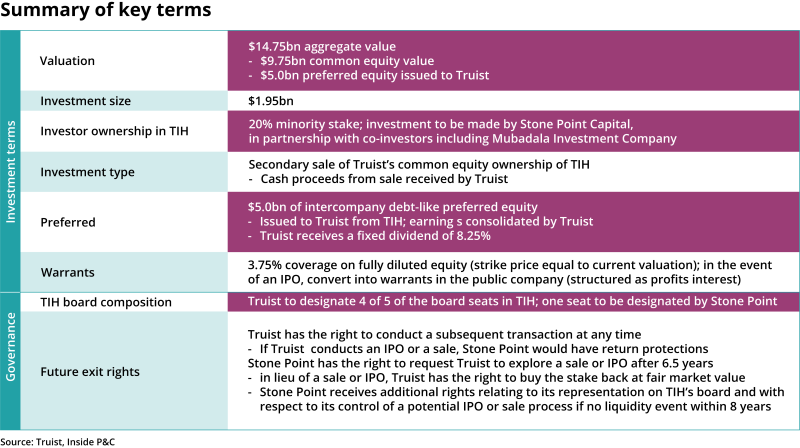

In addition, Stone Point is well positioned to be the buyer of the broking and MGA business buyout. As this publication has discussed, its minority stake acquisition included a range of measures designed to protect its downside. (See: Opinion: Truist Insurance – One foot in, one foot out.)

At the time of the buy-in, Stone Point negotiated “return protections” in the case of an IPO or sale, as well as the right to request a sale or IPO after 6.5 years (see below). The PE house also has the right to additional board representation and control of a potential IPO or sale process if there is no liquidity inside eight years.

However, a $10bn+ deal presents some challenges for Stone Point given the size of the deal, less than a year after sealing the minority interest transaction.

So, let’s take a closer look at both parties’ path to this point.

Truist: Primed for insurance divestiture

Truist (and the broader regional banking sector) are in a different place from a year ago, when it began exploring the minority stake sale of its insurance arm.

Higher interest rates continue to put pressure on banks’ balance sheets and tighter regulation is expected to follow as authorities – both international and local – look for ways to avoid another banking crisis after the collapse of Silicon Valley Bank (SVB) and other regional institutions.

Capital adequacy ratios are forecast to rise along with other constraints regulators, including the Fed, will likely impose in the coming years.

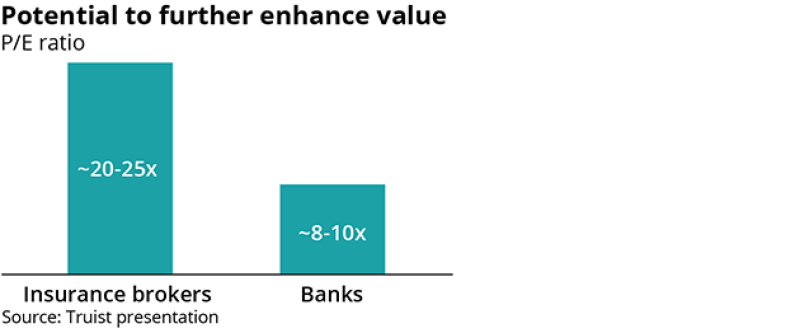

Regional banks have turned to their insurance distribution arms in a bid to either find capital relief and shore up their balance sheets, or capitalize on the higher valuations that broking firms are seeing – or both.

In a February presentation to investors outlining the rationale of the stake sale, Truist itself highlighted the delta between bank and insurance broker trading multiples (see below). Since then, the delta between banks and broker multiples has likely increased in recent weeks.

In a couple of recent examples, Eastern Bank has sold its insurance unit to AJ Gallagher for $510mn while later Inside P&C revealed that Southern bank Cadence had put its broking arm up for sale.

Amid a more challenging banking environment and a flurry of broking divestitures, Truist has been under pressure with issues of its own.

The need to increase its capital support, create value for shareholders, address massive unrealized losses or boost its solvency levels have been only some of the topics around Truist’s orbit in recent months.

A recent note highlighted the group’s depressed valuation compared with its peers and claimed discontent with Truist's performance was increasing among investors after the 2018 BB&T-SunTrust merger.

With current challenges and future expected regulatory obstacles, Truist is turning its sights to insurance – its largest non-banking asset – as a resource for capital.

The call

While activist pressure doesn’t seem to be a key factor driving Truist plans, investor frustration and the need to turn the business around has clearly been on leadership’s mind.

Last month, on a call with analysts, president and CEO William Rogers said: “As a shareholder, I'm highly aware that our financial performance has not met all of your expectations, not met mine either.”

The call included a several hints about Truist considering strategic options that involved its insurance arm.

Rogers told analysts that Truist has over 200 bps of additional capital flexibility given its residual 80% ownership stake in Truist Insurance, which “continues to perform extraordinarily well evidenced by the 9% organic growth in Q2”.

“We continue to evaluate all of our strategic options with respect to Truist Insurance holdings, with the objective of creating long-term shareholder value,” he said on the September 11 call.

The bank will be more “targeted” in its capital allocation, “and our undervalued ownership stake in Truist Insurance Holdings gives us strategic flexibility”, Rogers added.

Stone Point’s challenge: Higher cost of debt and a larger check

The buyout of Truist Insurance still seems like a bumpy road for Stone Point given the massive amount of debt it will have to raise at a higher price than some months ago. (See: Broker M&A: When private equity’s interest cools.)

The minority deal in February came in with favorable financing, with $5bn of internal preference shares paying only 8.25%. Now, the PE firm would be expected to raise around 6x-7x Ebitda of debt at probably 11%-12%.

In addition, the minority deal represented a ~14x multiple based on the adjusted Ebitda the unit was marketed off, over $1bn compared on a like-for-like basis with other private deals.

Now, a complete takeover would imply a higher multiple of around 16x Ebitda that the New York-based PE house would have to pay for the business.

Stone Point could bring additional investors like Mubadala Investment Company – which participated in the first deal – into this process as well.

Yet, the question that remains for the coming months: What if the transaction isn’t consummated?

Mammoth broking deals in recent months have seen several PE firms co-investing via minority stakes, with Hub International the latest example. In Hub’s case, Blackstone and other investors joined Leonard Green & Partners just months after the first minority interest sale earlier this year.

But if the company doesn’t find enough appetite in the market, a 2024 IPO would be the safest bet, although the public markets still seem an unlikely option for brokers despite a recent spike in carrier activity.

Finally, selling some of Truist Insurance’s assets such as CRC or McGriff is another option to inject cash into the bank faster than the IPO process.

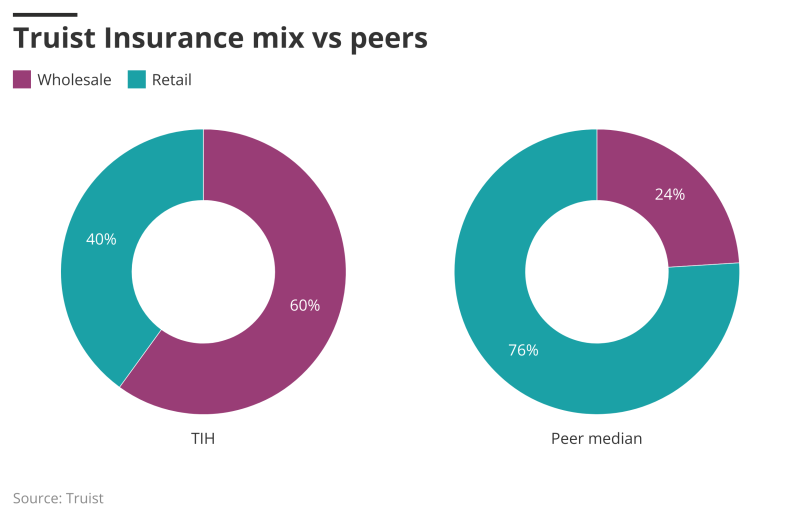

While selling CRC could be more challenging and impose regulatory challenges because of its size and the higher concentration in the wholesale market, McGriff could be brought to market as a prior step before the IPO.

Despite the increased cost of capital, competition in the retail segment remains robust, as seen with recent deals, as there is strong appetite – particularly among strategic buyers like AJ Gallagher, MMA or USI – for bank-owned broking assets.

Among all the options, a full sale to Stone Point is still the shortest path towards a full exit. Yet the route of infusing the necessary capital into the bank is challenging.