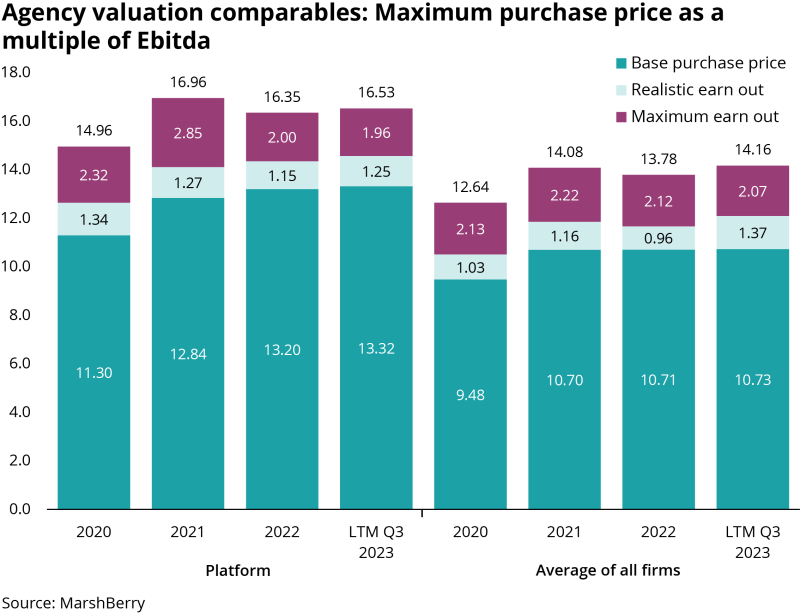

MarshBerry said that the average maximum purchase price as Ebitda multiple for platform assets was 16.53x while average firms recorded 14.16x at Q3, up 1.1% and 2.7% from 2022, respectively.

Meanwhile, the Ohio-based bank reported 454 deals year-to-date, up from 271 transactions at the end of Q2.

MarshBerry noted that through Q3 private equity-backed buyers represented 74% of all transactions, up 4% from the same period last year.

In addition, the top ten acquirers accounted for nearly half of dealmaking in the first nine months of the year, with BroadStreet Partners taking the lead with 37 acquisitions.

BroadStreet was followed by Hub International (29 deals), Risk Strategies (28), Inszone Insurance (27), World Insurance (26) and AJ Gallagher (19), MarshBerry noted.

Takeovers involving specialty distributors (wholesale/MGAs) accounted for 24%, or 107 transactions, according to MarshBerry.

Specialty firm deals have increased by a CAGR of 22% from 2018 through 2022, a trend that is anticipated to continue as traditional retail brokers expand into the wholesale and delegated authority space, the bank said.

While rising interest rates have impacted some active buyers and overall M&A activity over the last months, MarshBerry said there are still well-capitalized players that will likely continue pursuing deals.

Outlook

MarshBerry forecast that both agency valuations and M&A volume will remain strong in Q4 and into 2024 but noted that pending fiscal policy decisions are a cause for uncertainty.

The bank added that current macroeconomic conditions and geopolitical unrest could shift the balance of supply and demand.