1. R&W market faces potential $1bn claim from EQT telecoms deal

The representation and warranties (R&W) market is braced for a claim that sources estimated could range from $700mn to as much as $1bn, lodged by private equity firm EQT on a US telecoms deal from 2019, this publication can reveal.

Sources said that EQT was looking to claim on a condition of assets clause in its R&W policy on the deal, after the PE house found the condition of the infrastructure not match its expectations.

If the claim does indeed pay out, it has been suggested it will be the largest in R&W market history.

It is understood that Euclid Transactional leads the policy, which is brokered by Lockton. The exposure will, however, be spread across the US and London markets.

The news of the deal comes as claim activity begins to tick up in the R&W – also known as warranty and indemnity – space.

While this is in part due to the increased M&A activity since the pandemic, participants in the market are keeping a wary eye on claims development as rates trend downwards.

A July update from Euclid said that from January to July, the MGA received an average of 26 claims per month, a near-21% increase from the 21.5 per month notices in 2022 and nearly twice the 14 averaged claims per month in 2021.

2. Truist insurance sale: The short but bumpy path to an expected spin-off

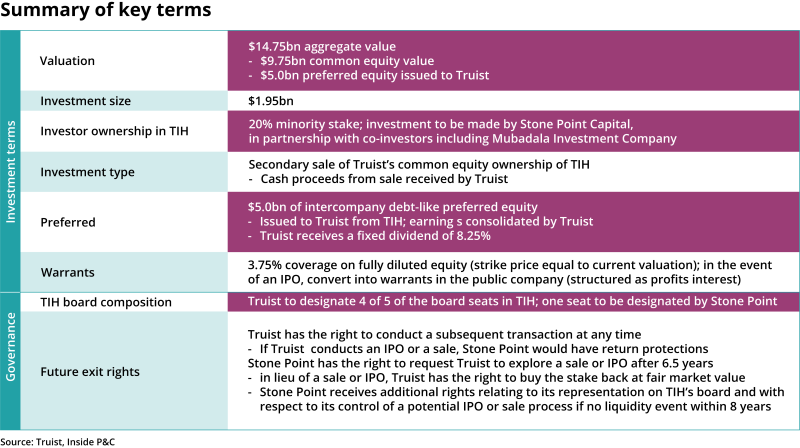

Earlier this week, news emerged that Truist is in talks to sell the remainder of its insurance operation to private equity house Stone Point, a minority investor in the business, for a $10bn price tag.

Inside P&C independently confirmed that the bank is working on full sale plans to Stone Point with Morgan Stanley as adviser, but some sources were skeptical about the reported ~$10bn potential consideration if a deal is consummated, given the ~$15bn valuation the unit secured earlier this year.

In February, when the bank signed a deal to sell a 20% stake in the insurance unit to Stone Point, banking sources suggested that a listing of the insurance operation would follow in 12-18 months.

This publication argued that IPOing and divesting retail broker McGriff would make more sense than selling a stake in the insurance arm.

Yet a direct sale to Stone Point looks like the shortest path to spin off the franchise right now as the banking sector braces for a tighter regulatory environment.

3. AIG reshuffle sees McElroy take on GI chairman role as Bailey appointed NA insurance CEO

AIG global head of distribution and field operations Don Bailey was promoted to North America insurance CEO, in place of David McElroy who will assume the newly created role of chairman, general insurance in January.

The appointments were part of a senior leadership reshuffle announced Wednesday. In tandem, Jon Hancock has been named as international insurance CEO. He is currently CEO of international general insurance.

Bailey and Hancock will lead the underwriting, distribution and business teams in North America and internationally, respectively. McElroy, having served as the carrier’s NA general insurance CEO since June 2019, will now focus on advancing client development and building distribution partner relationships.

All three will report to CEO Peter Zaffino and serve on AIG’s executive leadership team.

This publication has written that resolving the talent question is key for AIG’s next step to turning around the business under Zaffino, who signed another five-year deal in November 2022, and that the carrier would now have to define what its next iteration will look like.

During H1 2023, AIG saw four departures from its senior ranks: CFO Shane Fitzsimons, interim CEO Mark Lyons, general insurance CUO Kean Driscoll and North America GI CEO Michael Price.

In July, the carrier promoted Christopher Schaper to global CUO and in June tapped Sabra Purtill as CFO on a permanent basis.

4. September rate filing data: California DOI permits further personal lines rate rises

California Department of Insurance is now approving much-needed rate increases in the state, according to the Inside P&C Research team’s analysis of personal lines rate filings approved by the regulators in the US.

This year, the California market has thrown this topic into the spotlight. Among industry insiders, the state’s Department of Insurance has been known for its reluctance to allow rate increases in personal lines while loss costs were escalating.

However, recent rate filing data show positive signs for insurers writing business in California.

Data from early October shows that the weighted average rate approved in the state was 18.4% for personal auto, and 17.8% for homeowners’ during September. Overall, in the US, the weighted average rate increase for September stands at 7.7% and 10.4%, respectively.

A chart indicating California's weighted average rate change in the three years since September 2020 shows a long halt in auto rate approval in the embattled personal lines insurance market, which ended around a year ago.

On the homeowners' side, state regulators approved significant rate hike requests, leading to a nearly 18% weighted average increase during September. This is the largest change in a single month since April.

While such indicators are undoubtedly positive for carriers in California, the Inside P&C research team writes that the US P&C industry is still in the “new normal”, seeing an uptick in catastrophe and non-catastrophe losses on the homeowners’ side and persistent pressure on the auto side.

It's too early to declare victory.