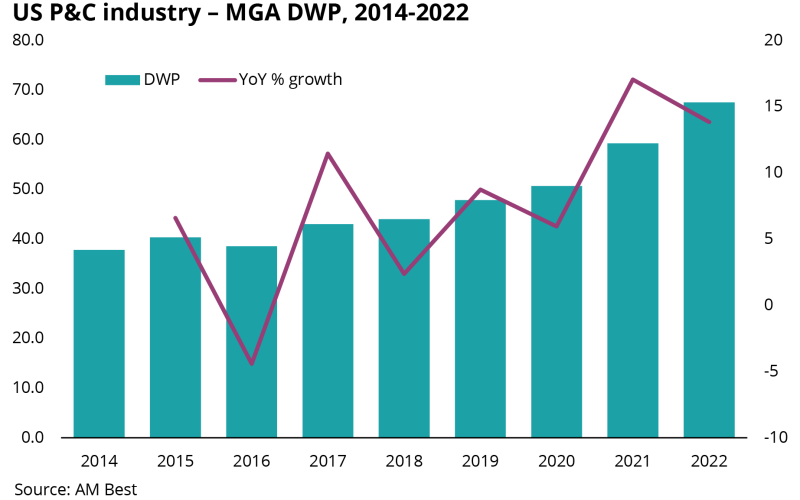

The sector has benefited from structural tailwinds that have contributed to its growth story, with rising business flow, hard rates, increased private equity appetite, talent influx and tech development all fueling the upward trend.

This growth trajectory led to all-time highs in program manager valuations, as illustrated over a year ago by Carlyle’s record acquisition of NSM from White Mountains for $1.8bn, equivalent to roughly 18x Ebitda and ~1.5x premiums written.

However, as this publication has previously discussed, macro conditions and recent controversies are challenging the MGA market and setting the stage for a slow squeeze of the sector and a likely deflation of valuations.

As the delegated authority approaches an inflection point, Inside P&C explores four questions to be addressed in the annual gathering.

1. Has the market reached peak capacity?

One of the consequences of a tighter macro environment has been a capacity crunch over recent months.

One of the most dramatic examples came right after Hurricane Ian last year, after AIG and QBE discussed paper withdrawals from Truist-owned giant cat MGA AmRisc.

More recently, this publication revealed that Berkshire Hathaway pulled its capacity support from Texas-based MGA Kemah Capital.

But, despite a recent contraction, sources at WSIA noted that there is still (re)insurer appetite to deploy capacity – particularly in casualty lines.

At Target Markets, it remains to be seen whether carriers maintain the bullish view on casualty and what their take is on property as the market continues through a hardening cycle.

Moreover, as the sector’s structure reshapes and appetite changes, another question for the market is – how much capacity is still there to be deployed?

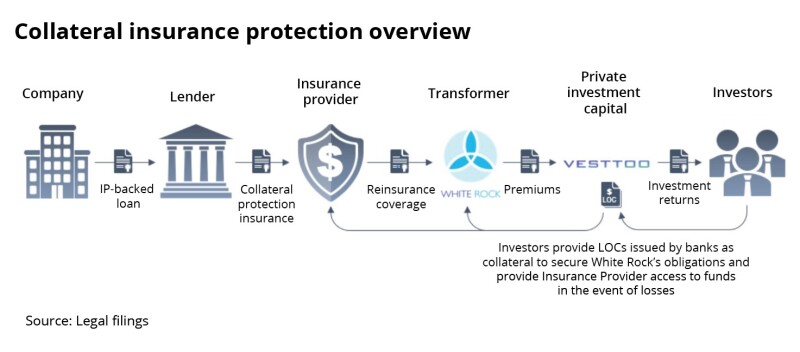

2. In the wake of Vesttoo, where does the fronting market stand?

If the James Allen controversy arrived as a tropical storm for the program manager market, Vesttoo made landfall as a Category 4 hurricane only a few months later.

The scandals exposed the breaches of a value chain that operates with an increasingly complex modular structure.

The ILS platform’s downfall showed the vulnerability of a market when fronting companies, MGAs (re)insurers and brokers are not aligned.

Vesttoo, the alleged fraudulent letters of credit (LOCs) and the consequences for the broader industry have been discussed in recent forums.

At WSIA a few weeks ago, market executives said MGAs and carriers have been following more strict due diligence processes in recent months in the wake of the scandal.

Later, at Inside P&C’s annual conference, executives on the MGAs panel questioned the current value chain model as some push for a better alignment of interests between program managers and capital providers.

As the industry gathers at Target Markets, the discussion around how to improve transparency and boost scrutiny across a modular value chain will likely continue.

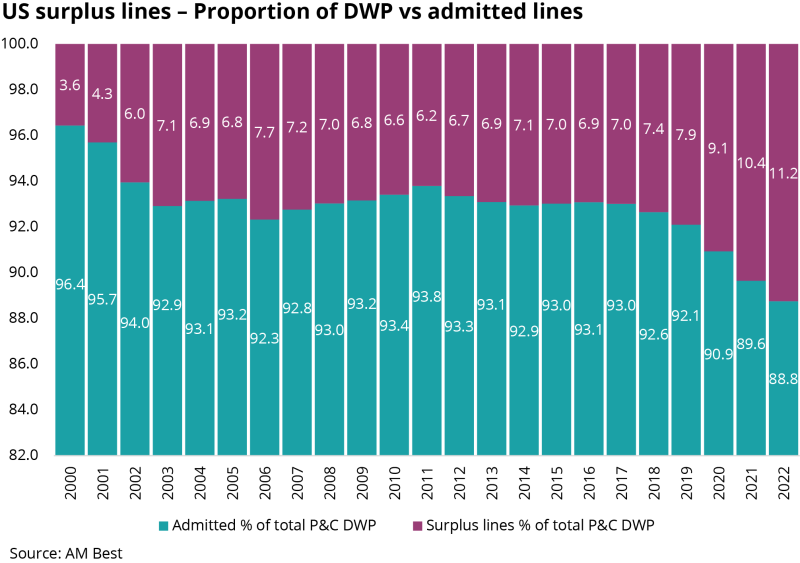

3. Will the E&S power source keep going?

One of the main drivers of the MGA boom has been the Golden Age of the US E&S channel and the broader specialty sector, characterized by surging growth driven by standard lines business passing into non-admitted and ~50% compound rate rises across E&S and admitted specialty.

As this publication recently discussed, the Golden Age is showing signs of evolution, with the property market increasingly doing the heavy lifting around growth and rate rises, whilst promising the highest prospective returns,

The Golden Age label is still justified however, because the E&S market is still growing at a rapid pace while property rates hit all-time highs as insurers remain dominant and brokers scramble for capacity.

But an inflection point looms, and the outlook is uncertain.

While AM Best’s most recent market update reported robust E&S growth of 19.2% in 2022 to just under $100bn, it also mentioned that in H1 2023 growth slowed to 15.9%, nearly half the 32.4% in the same timeframe of 2022.

Moreover, the growth in submission flows has slowed and, in H1, WSIA figures show transaction numbers rose only 3%, suggesting that the expansion was sustained mostly by rate and exposure growth.

Given this picture, will E&S momentum continue to fuel the MGA space?

4. Have MGA M&A multiples stabilized?

The MGA secular shift led to a boost in valuations. However, the transactions that followed NSM’s deal haven’t been able to secure a similar multiple as higher interest rates weigh on dealmaking.

K2’s sought to catch the valuations peak with the $1.25bn sale to Warburg Pincus but since then multiples have slowed both in the MGA and broking sector.

In recent months, the Fed has hiked interest rates, impacting cash flows and cooling M&A activity across the US economy.

More challenging macro conditions have impacted PE appetite with an effective doubling of the cost of debt to 10%-12%, debt ceilings coming down by ~1x-1.5x, and increasingly narrow arbitrage between tuck-in deals and platform sales. (See: Broker M&A: When private equity’s interest cools.)

Nonetheless, the MGA sector has remained active, with recent deals including Kentro and Amynta’s $400mn takeover of Brit’s MGU Ambridge.

The latest market test will be Doxa, as this publication revealed last month the MGA is exploring a sale process.

With Doxa and other program managers being brought to market, the industry will be tracking what kind of multiples are MGAs drawing, given the macro environment.