Our preview published on October 16 highlighted our expectation for this mixed bag going into the quarter. We were cautious on commercial, and we believe that caution is proving warranted as the industry balances the good news of rates vs. sufficiency of prior accident-year reserves.

On the large commercial side, Travelers opened this earnings season with good results, but the conference call’s rigid tone left listeners with more questions than answers. On the other hand, specialty companies have continued to print phenomenal results (the E&S “Golden Age” continues), with no expectation of an impending slowdown.

Travelers also gave an initial view on personal lines, but all eyes will be on the Allstate and Progressive calls. Kemper’s pre-announcement appears to be a franchise and loss-trend issue.

Wrapping up the early club were two brokers (three if you count Truist), Marsh McLennan and Brown & Brown, which kept the dream of extending the super-cycle alive, with the important supposition that we don’t head into a recession.

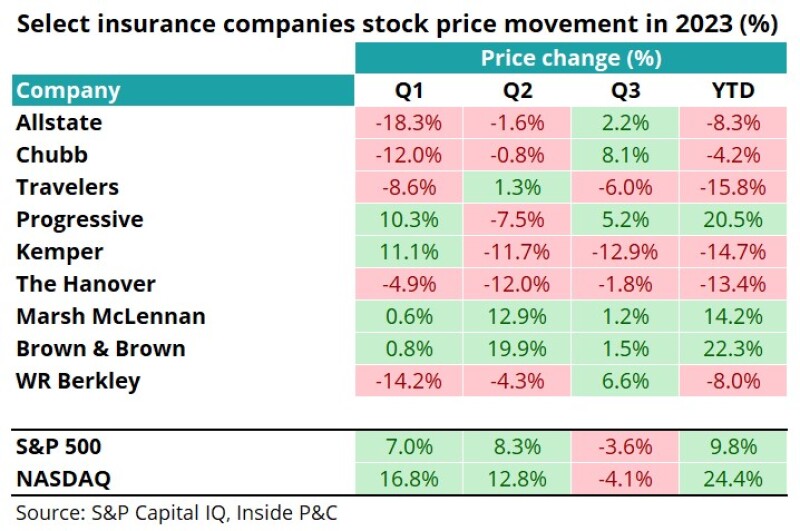

The stock performance shown below reflects this unevenness, with brokers stealing the show, specialty coming a close second followed by commercial, and then personal lines carriers coming in last.

Commercial pricing strong, but questions linger over margin expansion

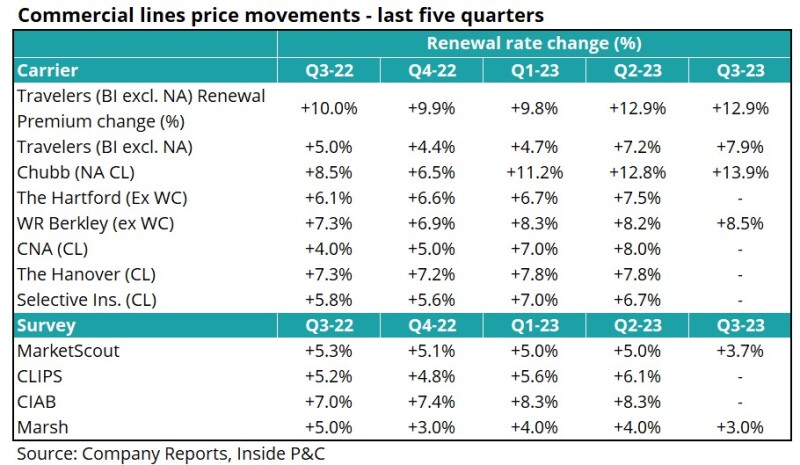

Travelers opened this season with an acceleration in pricing, even when excluding exposure. Berkley’s results showed a similar trend. The table below shows updates from various carriers, though we would caution against doing a simple comparison since sub-segments and the specialty contribution will differ. Even so, this quarter is turning out better than our expectations on the pricing front.

Commercial loss costs are stable for now

During our trip to Monte Carlo, two of the focus topics on long-tail lines were the potential for recent accident years to spoil the margin expansion story, and continued support from reserve development.

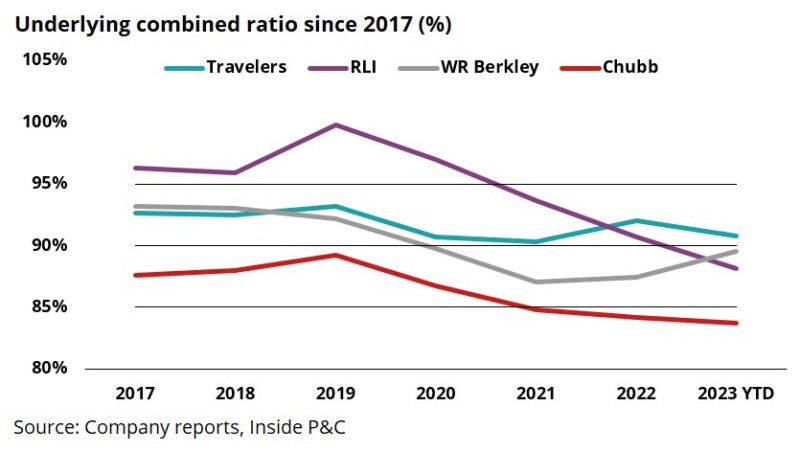

Following this theme, Travelers’ underlying results, as shown below, were strong, but there were questions surrounding the moving parts in its reserve development. One of the challenges of being the first reporter is the responsibility of being a bellwether for the earnings cycle, and listeners to the Travelers earnings calls were left wanting.

On the other hand, as is often the case, CEO Rob Berkley of WR Berkley leaned into the discussion on pricing, social inflation, and loss cost trends.

The chart below shows the underlying combined ratio over time for carriers, with margins overall stable or improving over 2022. WR Berkley’s uptick is due to a changing business mix and a cautious take on social inflation trends.

Taking a step back, even though rates have increased exponentially for commercial and specialty names, margin expansion continues its measured pace. This could eventually mean two things: a) If loss trends remain benign, expect a positive impact on earnings from reserve releases, or b) If loss trends reverse meaningfully due to worsening social inflation trends, be prepared for adverse development.

We are an outlier here, continuing to take a cautious stance on loss cost trends. Our caution continues to be predicated on the belief that there is no real precedent for this industry coming out of a pandemic environment. Historically, this industry has gotten loss trends more wrong than right, and we remain restrained in uncorking the champagne,

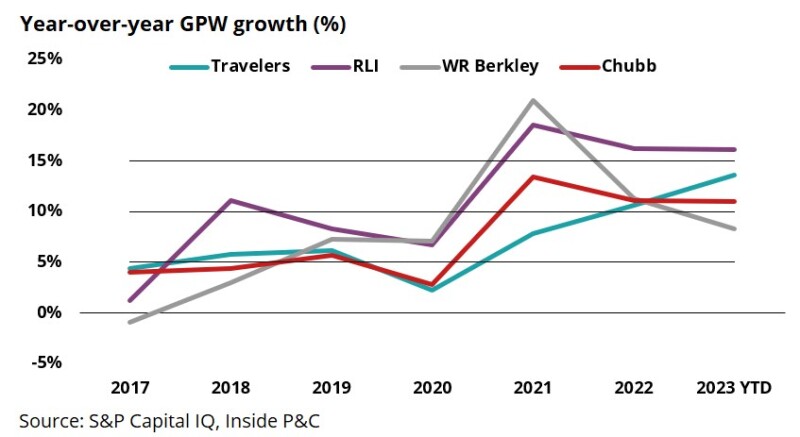

Growth expectations continue to come in modestly better, with the commercial predominant carriers continuing to press on growth, while Berkley’s decline also reflects its slight step back in reinsurance.

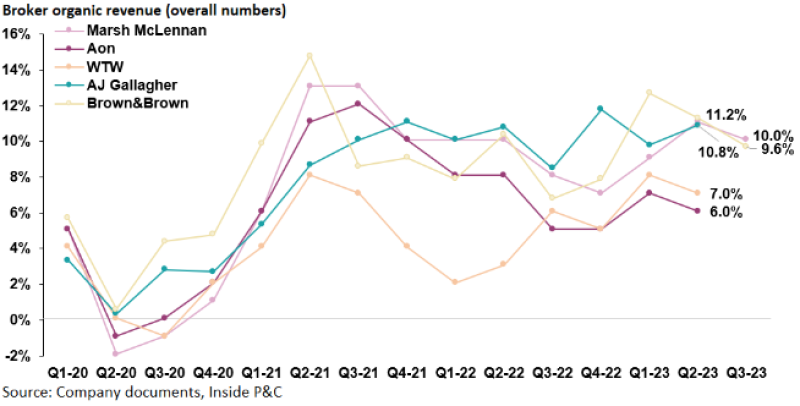

Broker results are more of the same, supported by macro stability

As we have said before, the recession is canceled. For brokers, the dark clouds we thought we had seen on the horizon might have meant an end to the double-digit growth. But as those fears have cleared, we have seen growth numbers staying strong the past few quarters.

Earlier reporters Truist, Marsh McLennan and Brown & Brown have set the tone with strong results, with Truist reporting 6.3% organic growth, 9.6% for Brown & Brown, and 10% for Marsh.

We would highlight two things. First, Brown & Brown and Marsh McLennan have been two of the higher-performers in terms of growth in the cohort the past few earnings. So, while this does bode well for the cohort directionally, there is a material gap vs. Aon and WTW for the past few quarters, so we do not expect the double-digit trend to apply to everyone.

Second, these numbers reflect drastically different business mixes, with all three reporting companies having different concentrations in wholesale, retail, and other components to the franchise, such as Marsh McLennan’s consulting arm.

Brown & Brown is an excellent example, with organic growth in retail at 8%, national programs (MGA) at 12.1%, wholesale at 13.4% and services at 3.2%. Knowing how these segments have fared leads us to expect some choppiness in the remaining results.

In summary, this earnings season is a mixed bag, with specialty running at the front of the pack along with brokers. Commercial franchises are a close second, with personal lines at the back of the pack.

That said, we are at an inflection point whereby we’ll hear more about how reinsurers attempt to navigate January 1 next week, which could impact the rate stickiness across commercial and personal lines sectors.