In our prior reviews of publicly traded insurance companies, we have noticed some persistent trends. Long-term stock price follows value creation. Once a company has run into reserving and loss cost inflation challenges, these tend to linger much longer than initially anticipated, and management often take too long to throw in the towel.

Earlier this month, James River had a difficult quarterly result, which included reserve noise, a sale of its casualty reinsurance business at a discount and a subsequent announcement of a strategic review.

Better late than never. In 2021 we had discussed some of these challenges for James River and the likelihood of a takeout. At that time the stock was trading at $28.94/share vs. its current price of $9.25/share.

The announcement that the company is evaluating its strategic options comes at an interesting time. It does coincide with ongoing runway in the so called “golden age of E&S”, with rates and submissions continuing to remain attractive. Could a James River slowly morphing into an E&S franchise be more attractive to a potential buyer vs. a prior company saddled with underperforming businesses?

However, Q3 earnings again included an adverse reserve adjustment in its E&S book along with current year reserve takedowns. The earnings conference call following the quarterly report lacked substantive details on these adjustments which would have allowed analysts to develop a worst-case scenario on these reserves. This lack of detail and the multi-year course correction has effectively depleted any store of goodwill left for the current management team.

James River’s stock closed at $9.04 last evening (November 20). A year ago, it was more than twice of that. Two years ago, it was four times that.

The stock seems mired in perception challenges, but sometimes a new buyer can reset the narrative. This does bring us to the difficult question of how much can this franchise fetch? Any potential buyer might have to debate on building a cushion for potential future negative reserve development which would have an impact on the offer price. However, the current market environment does offer a strategic reason to give this business some consideration. Could there be another Brookfield, Apollo or Fairfax to the rescue?

Our note evaluates these points in greater detail below:

Firstly, James River morphing into an E&S carrier could be its saving grace

We have often bemoaned the trend of every carrier referring to itself as a specialty carrier. Historically, that nomenclature was associated with E&S carriers, but over time this usage has drifted to encompass companies writing commercial middle market business as well.

James River’s three business units include its E&S segment, specialty admitted insurance segment, and casualty reinsurance segment. The Casualty Re business was already in runoff, along with an LPT on prior years, and with the recent earnings the company disclosed its disposition to Fleming International Holdings.

The Specialty Admitted business is a fronting business, with the company retaining 10-35% of the business with the fee income being the more important income contributor from this segment.

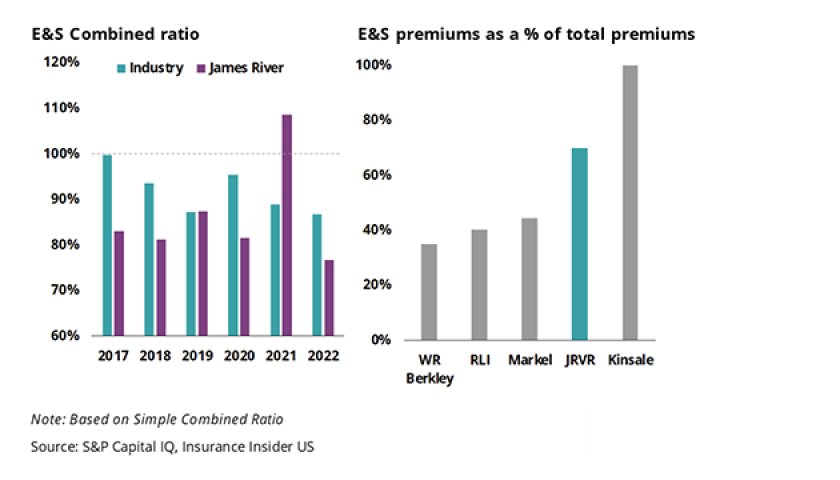

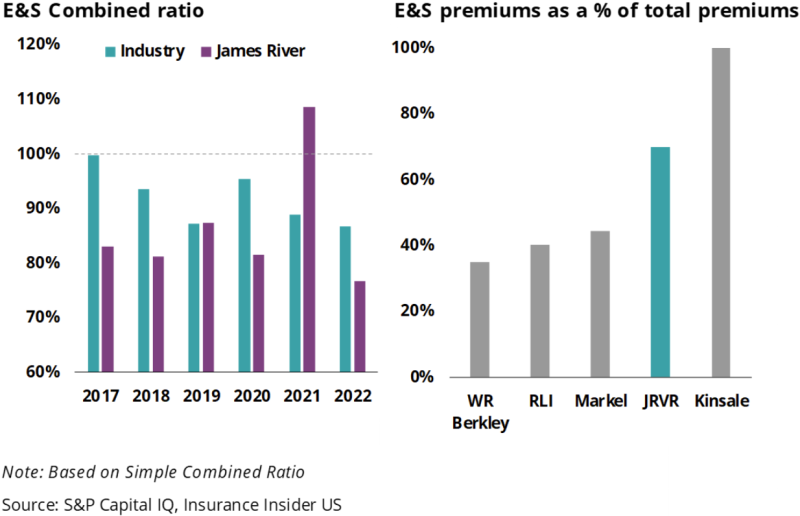

What this means is that the core piece of its business after these adjustments is mostly an E&S book as shown in the table on the right below. Since not all E&S is created equal, the chart below on the left shows its E&S business’ combined ratio vs. the industry .The chart does show that its E&S book has generally outperformed the industry over time, although recent results have some noise (more on this in the next point).

Taking a step back, this E&S focus could potentially allow a buyer to scale up. With the Q4 disposition of its Casualty Re business and an LPT on the commercial auto book, there is a lower likelihood for other distractions.

Reserve noise has been a persistent challenge

Historically, James River has seen adverse development in both commercial auto and casualty reinsurance. With an LPT on both of those books and a pending sale of its reinsurance business, the noise will likely be diminished.

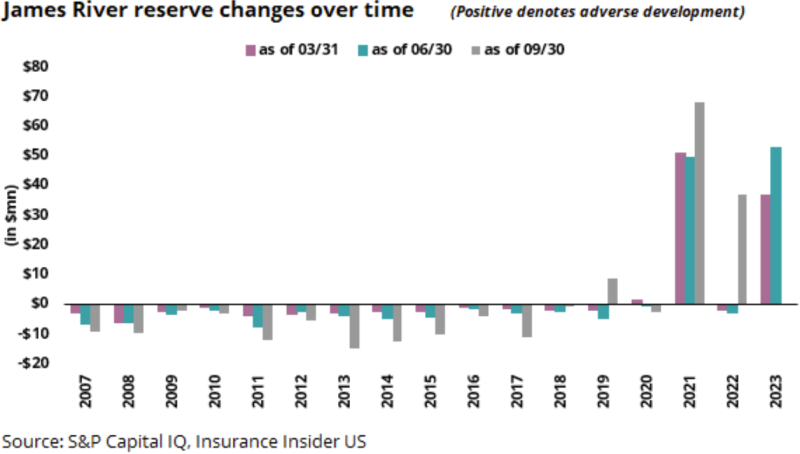

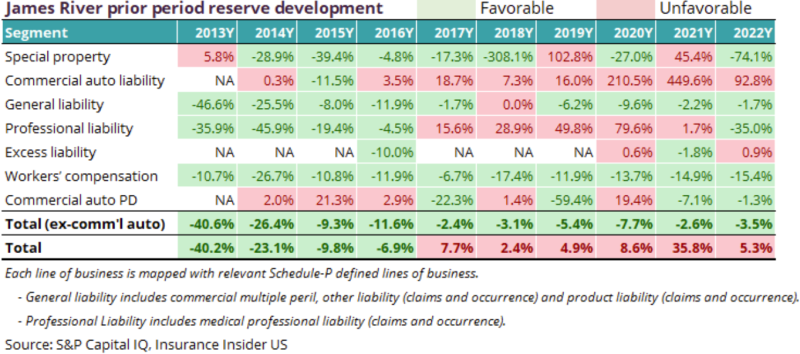

The chart below shows this development, with the jump in 2021 and continued elevation to the present.

Another way to look at the same development is shown in the table below, where commercial auto historically showed the biggest noise. (Note that historic numbers may not reflect the LPT). What is interesting to note is that the “Total (ex-comm’l auto)” line without commercial auto has generally trended towards favorable development over time.

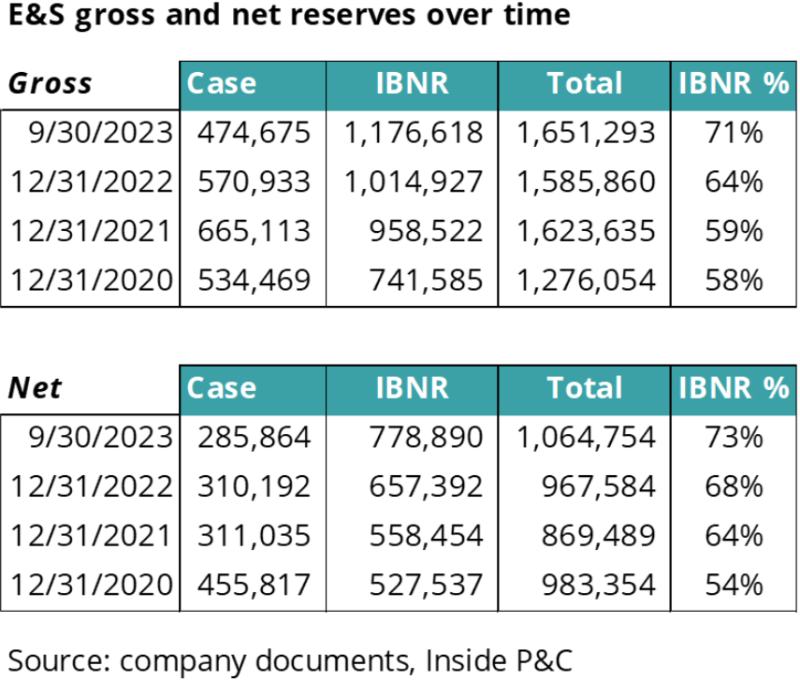

However, in the recent quarterly results, the company mentioned a modest degree of reserve development and touted its high level of IBNR as shown below in the E&S segment.

With the current and historic missteps, the question on everyone’s mind is how solid are these reserves and could other pockets of reserve noise emerge?

Taking a step back, any buyer is going to take a long and hard look at all the reserve pieces including the loss portfolio transfers and only then proceed to make an offer on this franchise.

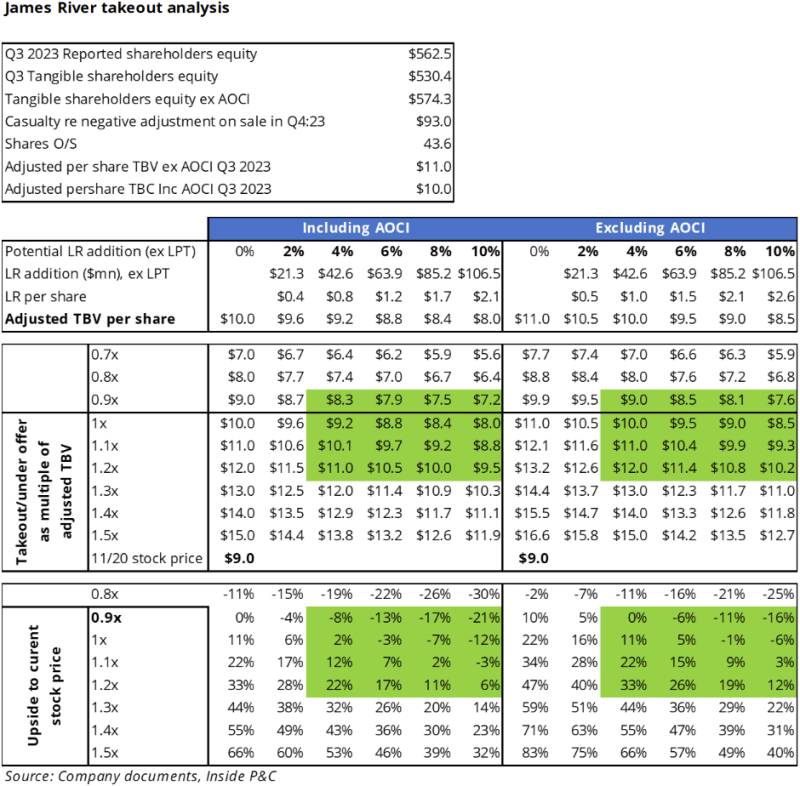

Our takeout analysis shows limited upside factoring in a range of reserve adjustments

To get a sense of the scale of this multiple in the context of James River’s reserving issues, we have completed the takeout analysis below. It shows a range of loss ratio additions, in a matrix with a range of possible offer multiples to arrive at the upside to the current stock price.

Note that the analysis also factors in the $93mn adjustment the company anticipates taking in the fourth quarter following the sale of JRG Re to Fleming at a 25% discount to book.

Any deal will likely factor in some level of reserve adjustments, so the table plays out some of the potential scenarios.

Looking at the results, there is a wide range of potential effects, even if we look at a narrower band. If the deal is close to 1x current value, almost any loss reserve addition would mean a real-terms below book value bid.

However, if they can inch just above that to 1.1x or 1.2x current value, there could be some upside for James River, even with reserve additions.

We would caution that this is a high-level analysis, and any buyer will look at much more detailed and sub-segment data. Further, a deeper analysis would likely also reveal pockets of reserve redundancies, which could offset any adverse reserve adjustments.

In summary, even though it’s better to be late than never, James River also faces a tough choice. Once you put the company publicly up for sale, investor pressure can increase as they pine for a quick deal. But on the other hand, potential buyers know that the clock is ticking before investors lose their patience. On the flip side, the golden age of E&S is also playing out and potential buyers could take a strategic view and see this as a good asset to own.