On Thursday last week, Global indemnity announced that it was suspending its previously announced exploration iof the sale or merger of its E&S arm, Penn-America – or the entire company.

The stock closed at $28.75 on December 7, giving back most of its gains from $25.21 on May 19.

Was this a surprise? Probably not. Does this suspension mean bad tidings for the James River process? Again, probably not.

In late May, our news team broke the story that Global Indemnity was weighing the sale of its $500mn E&S arm, Penn-America, or possibly the entire company. Following that, in our note evaluating Penn-America’s disposition value, we highlighted a few challenges any partner would face.

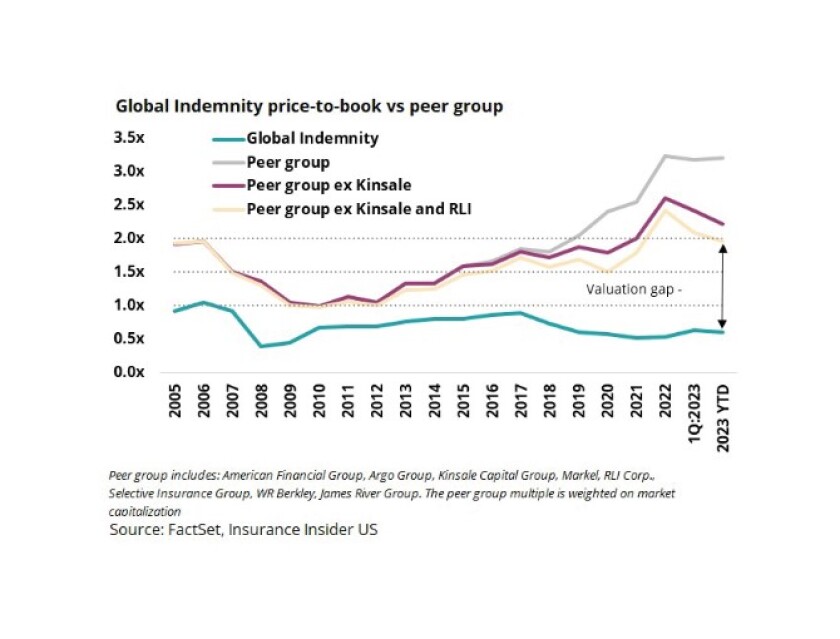

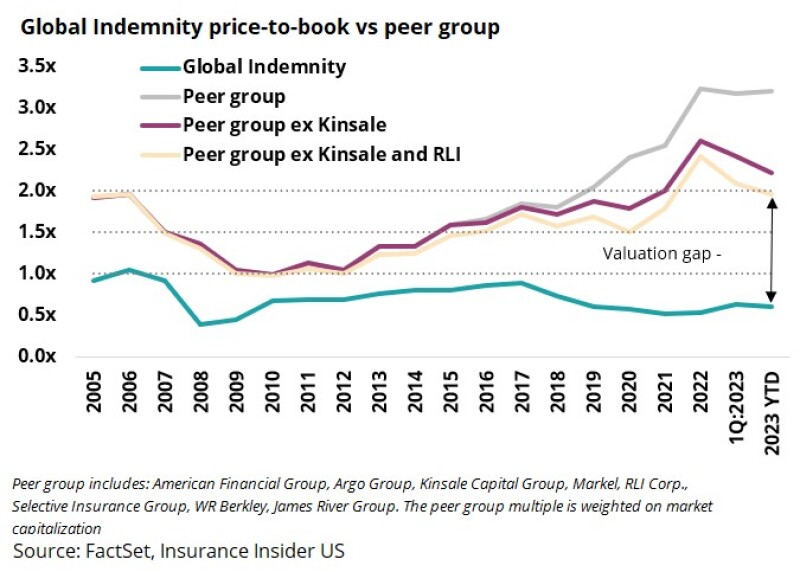

With Global Indemnity these include: the company’s chairman Saul Fox controlling 43.5% of the entity - making him too close to any process - historical results of the company, and the perceived valuation gap between the company and its peer group.

The other thing complicating this scenario is the bifurcated view of the market. Even though current market conditions are the strongest for a decade or so, recent discussions continue to focus on the 2016-19 accident years for casualty lines.

Additionally, buyers have other, more capital-light options to exploit the current conditions in specialty, such as MGAs or reciprocals – neither of which come with concerns around prior-year adverse development, or volatility.

So, logically, we have to ask: is the Golden Age of E&S coming to an end? Last week at an industry conference, comments from Rob Berkley suggested the E&S market is still in a good position. So, we don’t see this development as a negative readthrough on the surplus lines market.

Below, we discuss these ideas in more detail.

Firstly, one abandoned deal is not an indicator of a slowdown in deal activity, and is more reflective of the franchise.

We have some history covering both Global Indemnity (United National) and Penn-America in our past lives and understand some of the historic challenges in putting these two entities together.

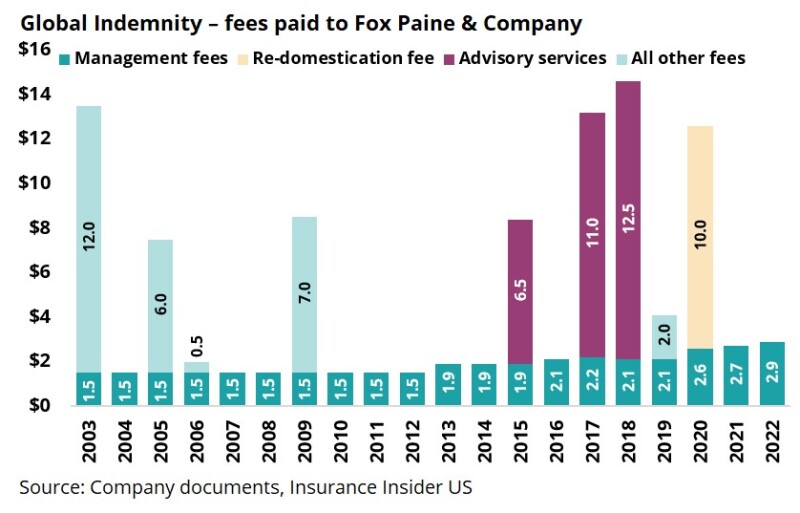

Over the years, this has also resulted in consolidation of Saul Fox’s ownership via his Fox Paine entity. The latest proxy shows Fox Paine with 27% ownership of Class A shares and 76% voting power.

Additionally, Fox Paine over the years has benefited from fees paid to it by Global Indemnity, and any sale would put an end to that relationship.

As such, there is incentive to continue collecting these fees, and revisit the process further down the road.

Beyond the intertwined relationship, Global Indemnity’s stock has traded at a meaningful discount to the peer group over a period of time, which makes meeting in the middle difficult for any potential buyer.

If the franchise is not imploding and a massive gap exists between the bid and the asking price, a potential seller could wait and hope for a better outcome over time.

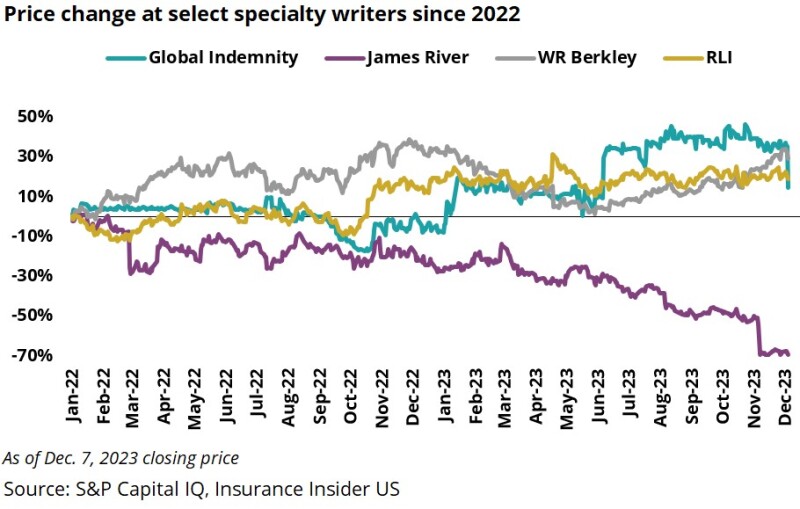

In the case of James River, no such complicated relationship exists between its management and the stock holdings, with insider ownership at a low 3.4% – making the read-across in this respect limited.

In our view, the unique situation at Global Indemnity would require additional due diligence in order for any potential buyer to develop the necessary comfort on a deal.

Secondly, prior accident years remain an unknown unknown.

In our analysis of both Penn-America and James River we had shown what potential take-out could look like with a degree of reserve adjustment.

In the case of James River, a loss portfolio transfer already exists on some of the noisier years. But even then, recent commentary on conference calls continues to debate how accident years 2016-19 will shape up, and if enough IBNR exists.

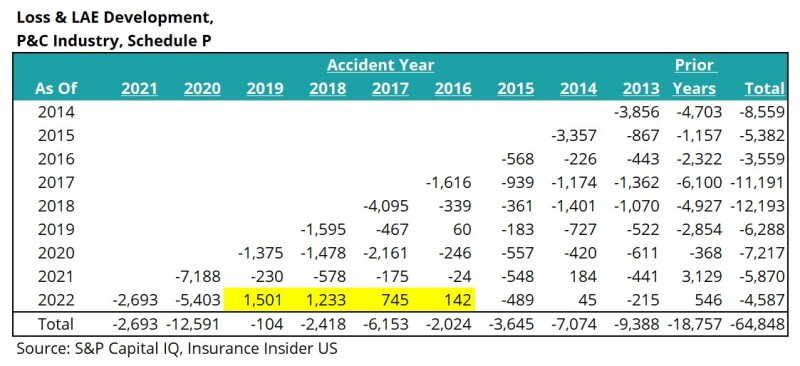

The graph below shows industry loss ratio development using statutory data as of year-end 2022. We would highlight the yellows in this graph which shows that accident years 2016-19 developed adversely during calendar year 2022.

It is likely that the industry took down reserves too soon and how has to go back to strengthen these reserving buckets.

WR Berkley’s Rob Berkley at an industry conference last week said 2016 through 2019 have proven to be challenging years for the insurance industry. The executive said some who saw it earlier chose to respond in time, and others have to play catch-up more or later in the game.

Thirdly, the Golden Age of E&S remains strong, driven by commercial property.

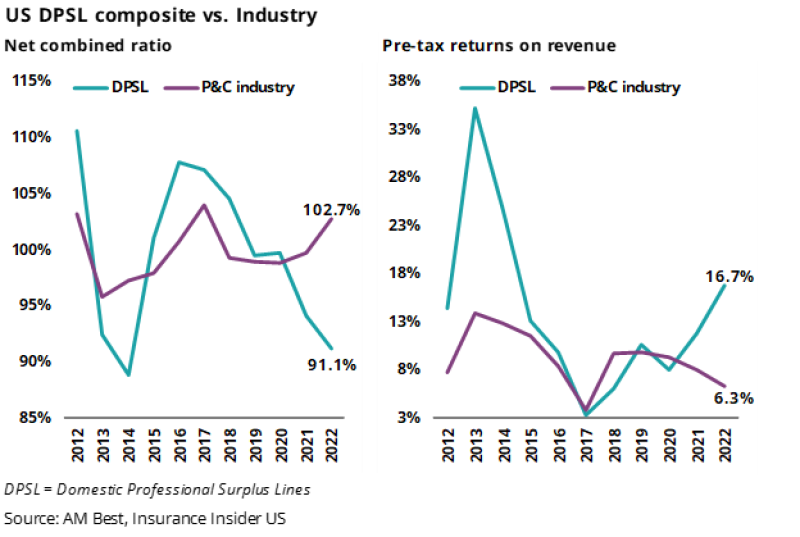

The chart below shows the results of E&S carriers vs. the broader US P&C industry. Note the meaningful gap for both combined ratio and returns. For 2022, the combined ratio for the E&S space was better by 11.6pts while returns were better by 10.4pts.

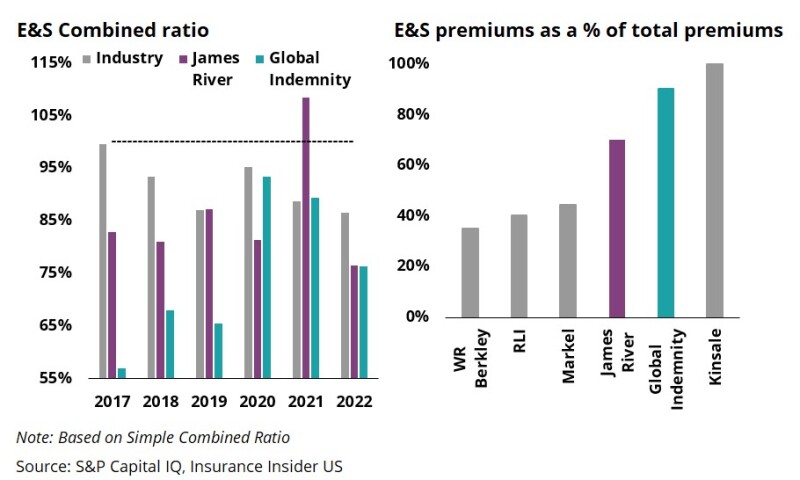

The chart below shows the combined ratio and James River and Global Indemnity on the left and the percentage of E&S business they write.

When asked about the E&S marketplace, Rob Berkley said with the world becoming more complicated, specialty writers are becoming even more critical. Given the speed with which the world is changing and the more “fixed” nature of other writers, the specialty market should continue to do well.

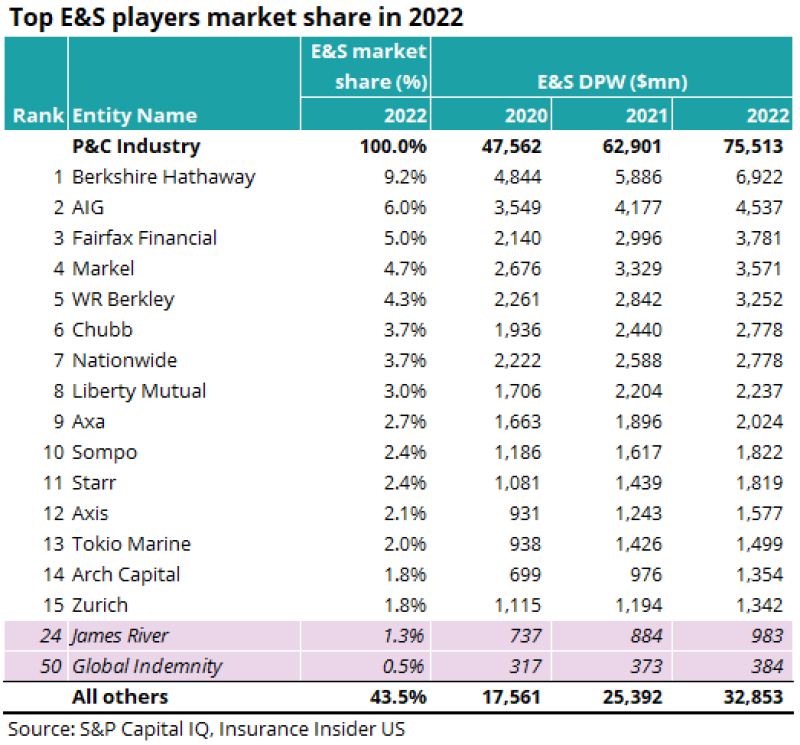

Taking a step back, the table below shows the rankings in the E&S space and decent-sized E&S books which can be scaled up.

In our view, both Penn-America and James River would be on the radar of any buyer either looking to add $500mn-$1bn in E&S premium to existing books or looking for an entry point into the space.

In summary, we believe the Penn-America sale abandonment is likely reflective of Global Indemnity’s unique relationship with Saul Fox, its book of business and the valuation gap.

Even though there are reasons to be cautious on prior-year reserve development, E&S performance remains strong, and the postponement of the Penn-America sale is likely not a negative read-through on the E&S space.