Since then, there has been a fair degree of consolidation (willing or forced). The earliest arrivals have generally done better, while the successive classes have struggled. Amongst this, Aspen has held an uneasy place.

The company IPO’d on December 4th, 2003, and after initial successes, ran into problems we have often seen with some of these companies. A concentrated bet on catastrophe classes did not pay off and the company, in its attempt to fix it, ran into reserving difficulties. A collapse in the stock valuation followed. Apollo Global Management eventually acquired Aspen for $2.6bn, and the company was delisted on February 15, 2019.

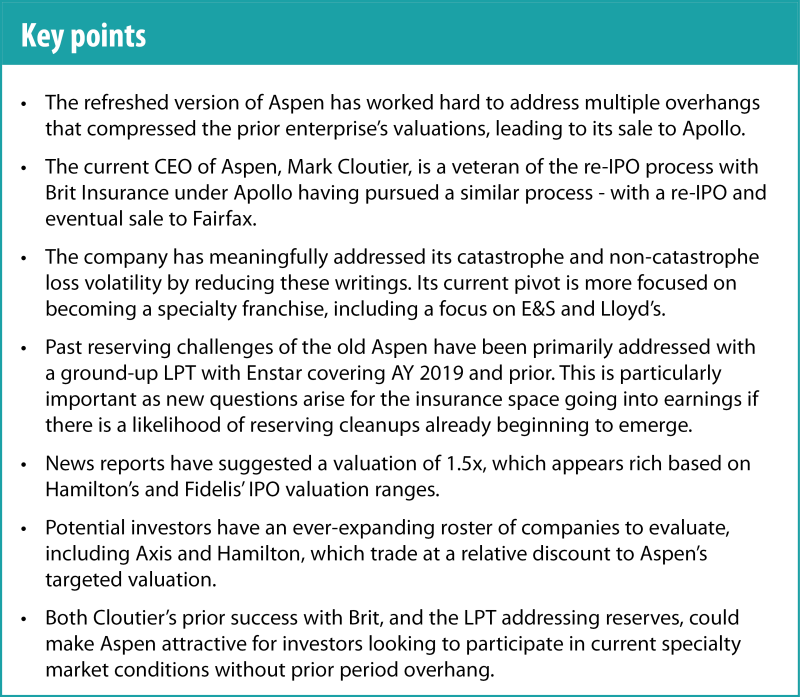

Last month, like a phoenix rising from its ashes, Aspen filed an F-1 for its re-IPO, expected to target a $4bn valuation, according to reports from our news team. That equates to a lofty 1.5x multiple (more on that later). This new and improved version of Aspen is anchored in four specific areas of improvement: focused underwriting, reduced volatility, improved operational efficiency, and culture.

Although many companies talk the talk, Aspen might just be able to walk the walk with its efforts. The one key differentiation where Aspen has a leg up vs. other failing or failed franchises is the Brit/Apollo/Mark Cloutier playbook. This name might be less familiar to the US audiences, so below is a quick recap.

Brit Insurance IPO’d on the LSE in 1999 and, after a meandering path and challenges, was acquired by Apollo and CVC for £888mn in late 2010, with the offer price equating to close to 1.0x net tangible assets. Subsequently, Mark Cloutier (Aspen’s current CEO) was parachuted into Brit’s CEO role to transform that business.

Mark’s success allowed Apollo/CVC to re-IPO Brit at a 1.5x valuation in 2015 and a subsequent sale to Fairfax at a 1.7x net tangible assets multiple. In a matter of history repeating itself, several factors for Aspen seem to be lining up similar to Brit. However, the key difference is that 2023/2024 is shaping to be different from the mid-2010s.

Gone are the monoline specialists, with several companies embracing the hybrid model over the past few years. Further compounding the potential IPO valuation is a confluence of macro and sector-specific factors. Insurance and reinsurance pricing is coming off its peak, and reserve issues seem to be rearing their head.

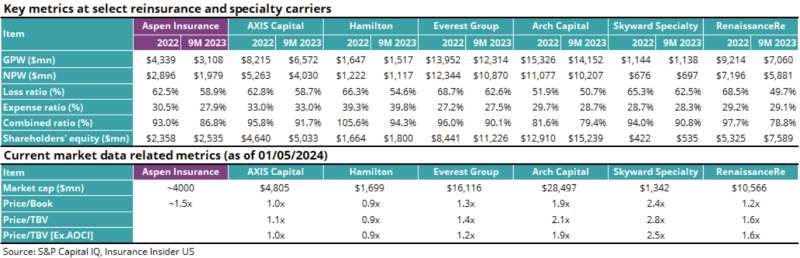

Additionally, the recent stock moves in this space present many opportunities for investors looking for names that have excelled at value creation, are experiencing their own pivots, or are trading at relative discounts. These include Axis Holdings and Hamilton trading above and below book - or RenRe, Arch, and Everest, who are trading at a premium to book but have demonstrated value creation over a period of time. In our view, this makes Aspen a show-me story, and we would be surprised if the company can achieve a valuation similar to RenRe or Everest Global.

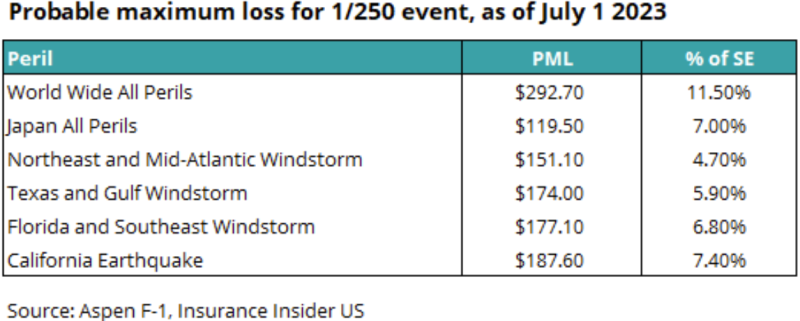

Part of the show-me story goes back to Cloutier’s commendable job fixing Aspen (see appendix for shift in combined ratio and business mix). The old Aspen was known for cat loss volatility and reserving noise. Under his leadership, the company has meaningfully reduced its exposure, as evidenced by the shift in its disclosed 1 in 250-year PML. However, as we have seen, peak limits are one thing, and investors want to see the level of catastrophe and non-catastrophe losses remaining manageable over a period of time.

Beyond catastrophe losses, as we’ll demonstrate later in the note, is the level of reserve movements, which created a perception issue for the old Aspen.

To cap this noise, Aspen under Apollo entered into an adverse development cover (ADC) with Enstar in June of 2020, which was later absorbed into a bigger loss portfolio transfer in January of 2022, covering 2019 and prior reserves. As a result, recent results do not reflect any material reserve movements removing this prior overhang.

The note below discusses valuation, catastrophe losses, and shift in exposure and reserves in greater detail:

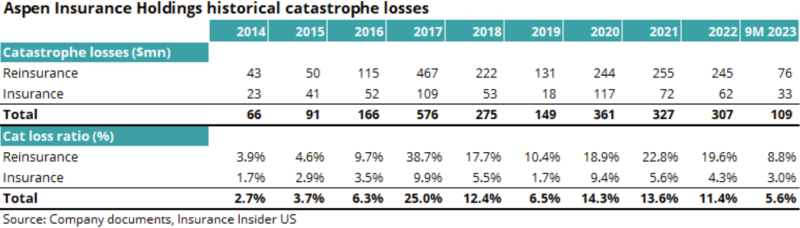

Catastrophe losses and exposure have declined materially

The chart below shows historic catastrophe losses for Aspen, and what is apparent is the declining level of cat losses as a proportion of loss ratio. This comes when the industry faces the new normal of higher catastrophe losses over the past six years and reflects Aspen’s attempts to rein in this noise.

What is even more interesting in our view is the by-segment view, where the catastrophe losses for the reinsurance segment have declined precipitously vs. the peak of 2017.

Apart from re-underwriting and non-renewal, the shift is also due to a reduction in PMLs, which have fallen 69% vs. 2018, as disclosed in the IPO document.

Even with this level of the re-underwriting, one of the driving forces of Aspen’s stock performance after its IPO will be how the company continues to be battle-tested from catastrophe and non-catastrophe losses vs. the peer group.

Loss portfolio transfer reduces reserve development risk

In our 2024 outlook published earlier this month, we discussed the industry's reserve risk for AY 2015-2019. Consequently, we had taken a cautious stance on these buckets of reserves developing adversely for the industry and commercial insurers in particular.

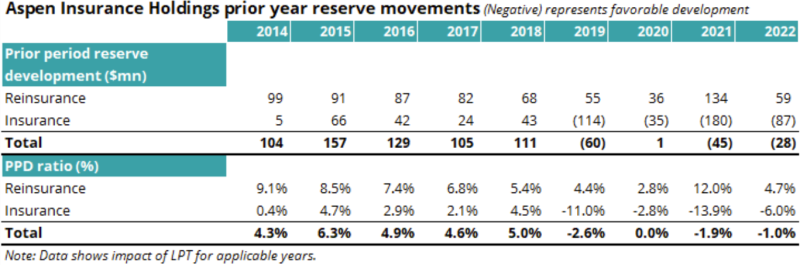

The chart below shows Aspen's reserve development over time, which was one of the other factors creating an overhang before its sale to Apollo. For smaller companies, consistent adverse development creates a perception that management is delaying the inevitable large charge and bleeding it slowly. Aspen witnessed meaningful adverse development for several years, as shown below, primarily in reinsurance and insurance.

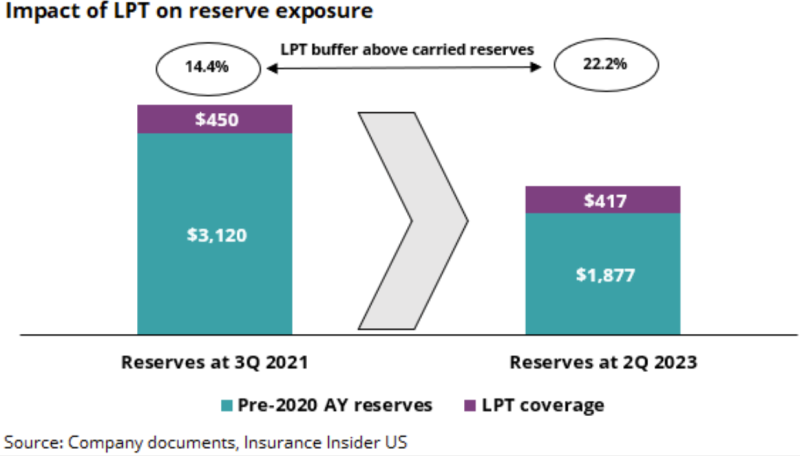

Following Aspen’s sale to Apollo, it was expected that the company would undertake a reserve cleanup. In 2022, Enstar and Aspen signed a loss portfolio transfer agreement, which subsumed a prior adverse development cover between the two. Under the LPT shown below, Enstar will reinsure losses incurred on or before 12/31/2019. The LPT resulted in Enstar assuming net loss reserves of $3.12bn with a limit of $3.57bn ($3.12bn +$0.45bn). In our view, the LPT buffer allows for meaningful protection even if loss trends worsen from here.

This LPT assures investors that reserve development is capped and will not bleed into current results.

A 1.5x expected valuation seems lofty in our view

Recent IPOs in the insurance space have resulted in different outcomes for the companies making their debut. While Skyward’s stock has been one of the best performers in the space following its IPO, Hamilton and Fidelis have had a more lukewarm response (although both had unique and sometimes complicated stories to sell to investors). This stock performance signifies that the investors are looking for really differentiated stories.

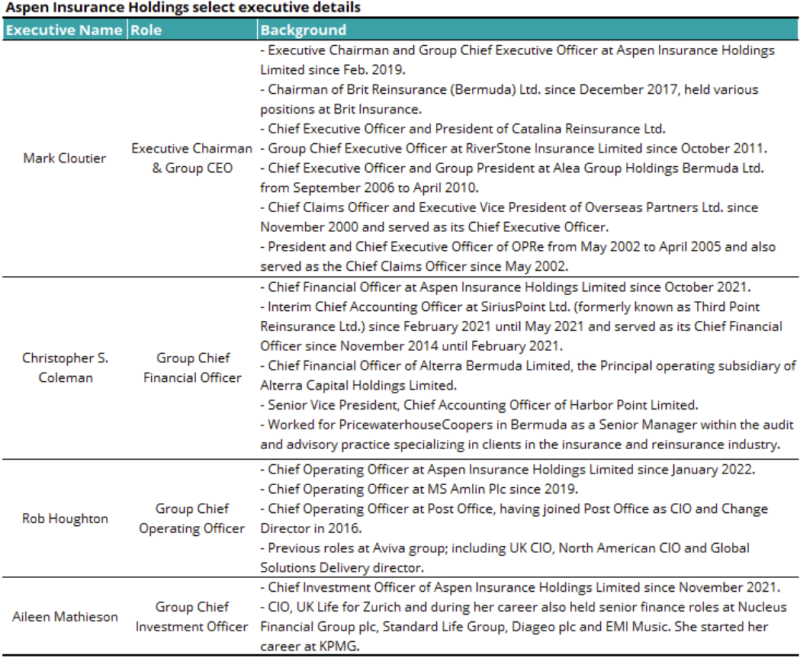

Aspen does have a clean story to tell with a strong management team (see appendix), but will it be enough to cross into industry-leading stock multiple territory?

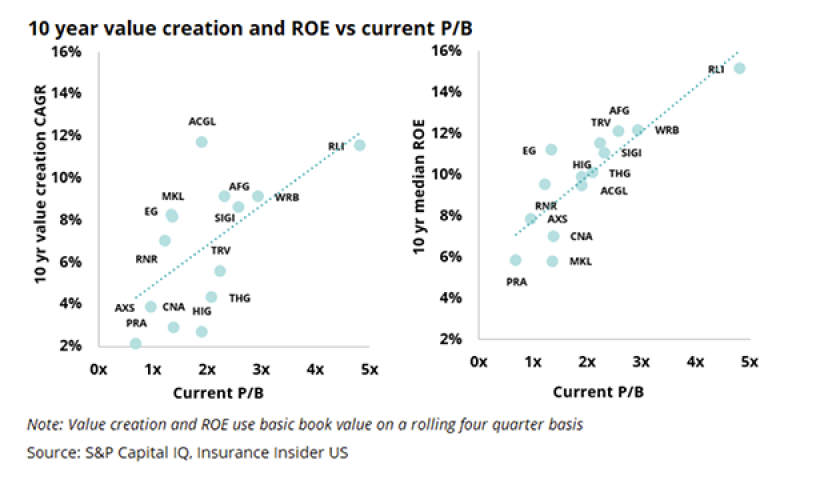

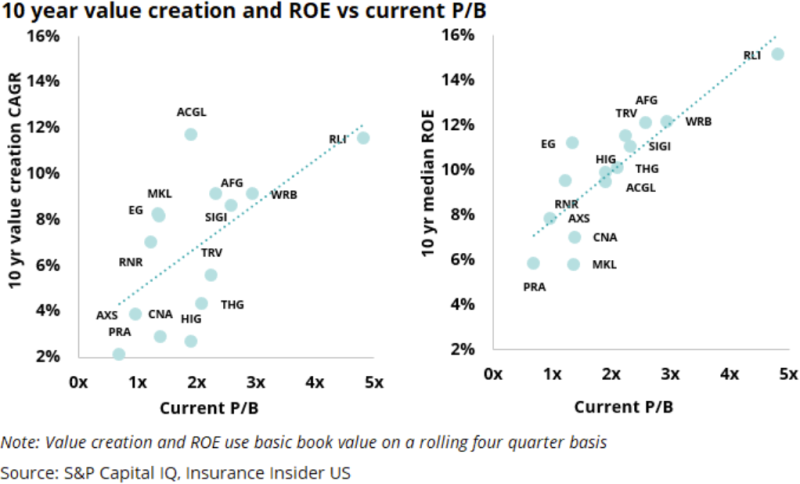

The chart below shows two different regressions. One shows the price to book vs. value creation and the other shows the price to book vs. ten-year ROE. It is no surprise that higher value creators with higher returns over a period of time generally tend to trade at a higher multiple.

Taking a step back, investors reward long-term consistency in returns. With Aspen still coming out of its turnaround, investors would await the company building a track record.

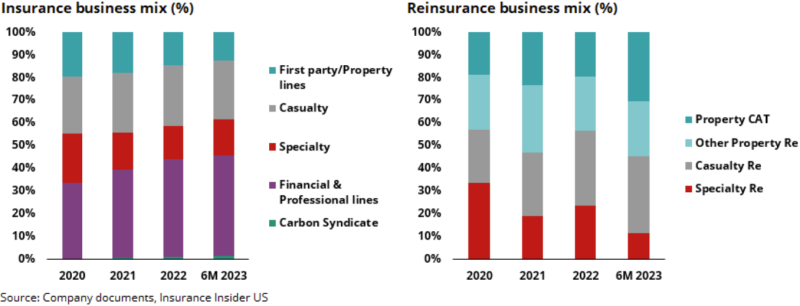

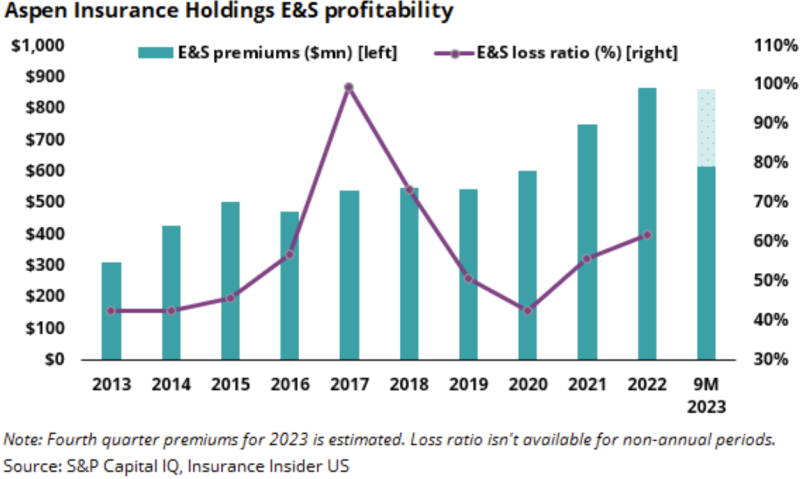

Another way to look at this issue is to compare the price to book and other metrics for a select group of companies vs. Aspen. In its F-1, Aspen highlights the business's specialty aspect, including its E&S and Lloyd’s of London presence (see appendix). However, many other companies at competing valuations also have a presence in these markets.

The comparison below shows that at the anticipated valuation of 1.5x for a $4bn IPO, investors can also look at Aspen, Hamilton, and even Everest Global. Investors also have the option to evaluate Arch and Renaissance Re, which are industry leaders in value creation.

In summary, Aspen's new and improved version provides another opportunity for investors looking to evaluate a clean specialty franchise with the LPT removing reserve overhang. However, the valuation also has to factor in other competitors trading at a similar or discounted multiple, which may divert the attention of investors.

APPENDIX

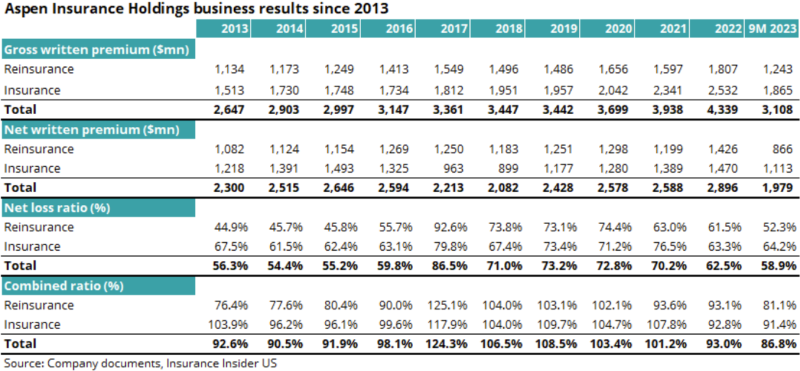

Historical Segment Results

Historic Premium Mix shift

Management and background