As earnings season gets closer to wrapping up, for companies with any commercial lines exposure, the focus remains on reserve releases, negative reserve adjustments and underlying loss picks.

We continue to take a cautious view on all three of these issues, as previously discussed in our loss reserve review note. The conference calls this season continue to focus on how management will respond to these changes and what it expects in an uncertain environment.

Our analysis shows that, overall, for the companies that have reported, underlying loss ratios improved by 0.9 pts. Is it rate over loss cost trend or lack of full realization of the shift in the loss environment? We continue to lean into the second camp.

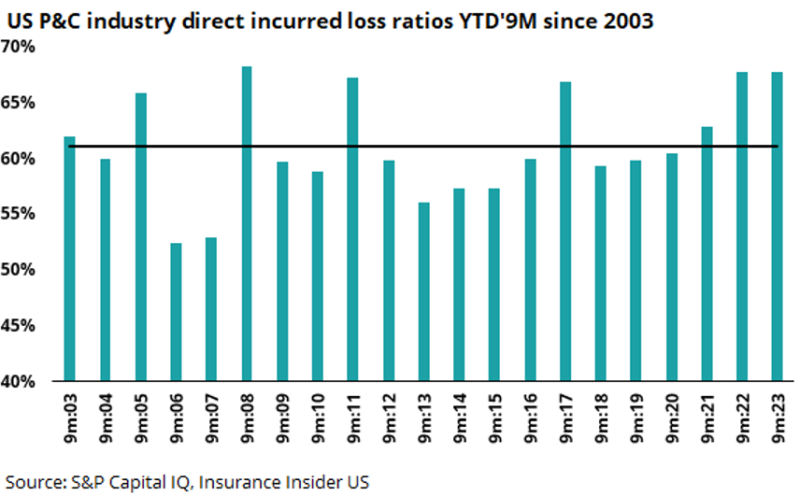

We also revisited the nine-month industry numbers on an overall basis as we await the publication of the updated 2023 annual numbers. Factoring in the catastrophe losses for 2023 vs. 2022, on an industry level and given the 9M 2023 number, leaves room for deterioration.

Finally, our note compared how the loss trends evolved from 9M 2022 to year-end 2022 and what insights it provides for 2023.

We discuss these in greater detail below.

First, this quarter reflects more good news than bad news

The table below shows the underlying loss ratio for the companies that have reported to date. Note that this excludes catastrophe losses and prior-period development where disclosed.

What is apparent looking at the numbers is that, for many companies on an overall basis, the underlying loss ratios improved year over year and quarter over quarter. The carriers ascribe this to the impact of rate over rate exceeding the loss trend, resulting in margin expansion.

Taking a step back, we would have preferred more caution in loss picks, and how this scenario develops over 2023 remains to be seen.

Second, industry loss picks remain a question mark

The loss ratio has increased in the long term when comparing the 9M numbers. But one also needs to factor in the catastrophe losses for 2022 and 2023. For 2022, the industry’s insured catastrophe losses were $100bn, and they were $67bn for 2023. Adjusting 9M 2022 and 2023 loss ratios proportionately by 10.5% and 6.5%, we get to 57.3% and 61.4% in that period respectively, which means that as of 9M 2023, loss picks improved.

Taking a step back, the new data will show if year-end reserve additions are enough to push the loss ratios for 2023 above the industry loss ratio of 67.1% for 2022, and we would be surprised if that change is meaningful.

Third, on a longer-term basis, workers’ compensation releases will continue to diminish

The table below shows the pluses and minuses between various segments. It also gives an insight into how much the loss ratios moved by segments from 9M 2022 to year-end 2022. Commercial lines, other liability, commercial auto, inland marine and CMP deteriorated from 9M 2022 to year-end 2022.

Another interesting point emerges from this exercise when comparing 9M 2023 with 2022 for commercial lines. Only CMP showed meaningful deterioration. The other lines are mainly in a much smaller range.

A lack of meaningful movement from 9M 2023 to year-end 2023 would give us concern and potentially signal additional deterioration over the next few years.

In summary, although some carriers reported adverse reserve movements in fourth-quarter earnings, underlying loss picks appear to signal margin expansion. This could prove optimistic if loss trends for AY 2023 worsen. Additionally, on an industry level, a lack of additional deterioration in loss picks from 9M 2022 to year-end 2023 could signal more pain over the next few years.