In our recent notes, we analyzed the industry's 2023 statutory financial data, as well as the rate filings of 2024 thus far. The industry suffered another underwriting loss in 2023 and ended the year with a combined ratio of 101.6%, a slight improvement over 2022's 102.7% that came more so from declining expenses rather than improved losses.

Despite being offset by difficulties across commercial lines, gains continued to be made in personal auto, where the net loss ratio for the sector improved by 3.9 points year-over-year to 75.2%.

When considered alongside the recent rate filings in which we saw continued increases, it is evident that personal auto insurers are maintaining their pricing discipline. They are continuing to gradually improve their profitability and effectively combat ongoing loss-cost inflation.

Turning to the CPI data released on Tuesday, we find it tells much of the same story as the January data we previously covered. Personal auto insurance inflation remains unchanged in February from January at 20.6% and up slightly from 20.3% in December 2023.

Consequently, we still believe the ball is in the court of the insurers, who would do well not to become complacent in the face of potentially moderating trends.

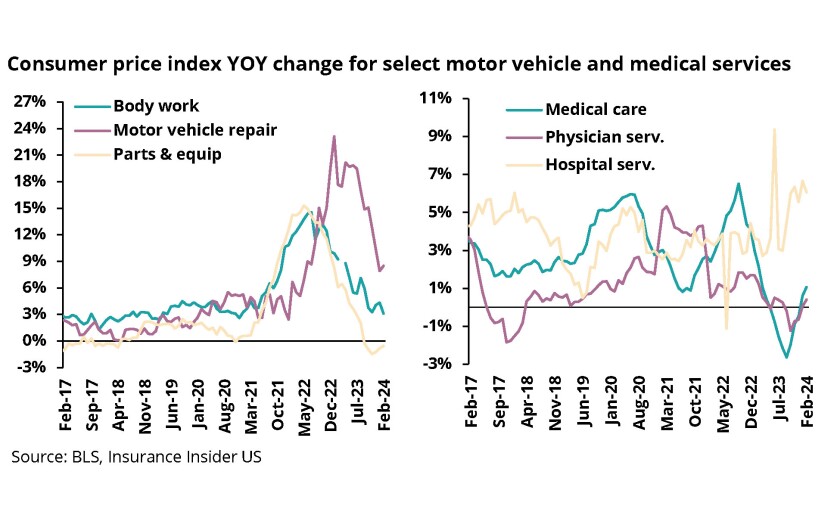

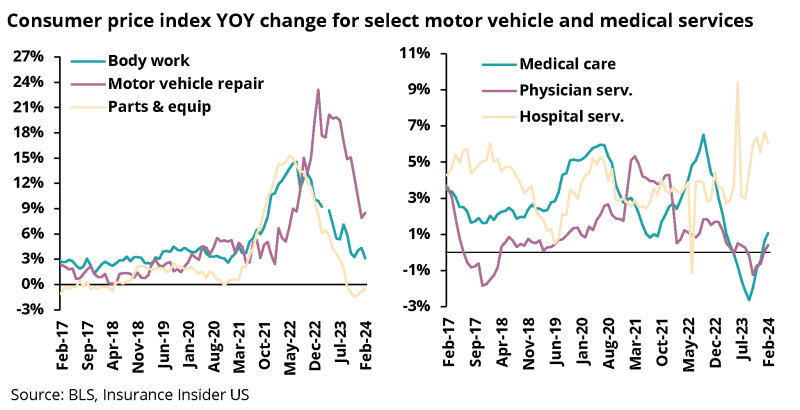

Looking at the chart above, we see that motor vehicle services have remained largely unchanged from the previous data release. We observed fluctuations of less than one percentage point across bodywork, motor vehicle repair and parts and equipment categories. Specifically, motor vehicle repair and parts and equipment have increased slightly, whereas bodywork has declined to 3.1%, the lowest rate of increase we have seen since December 2020.

The slight uptick we previously noted in medical care and physicians services has continued, albeit by less than one percentage point. However subtle it may currently be, this continued upward trend reinforces our concerns regarding the volatility of these categories.

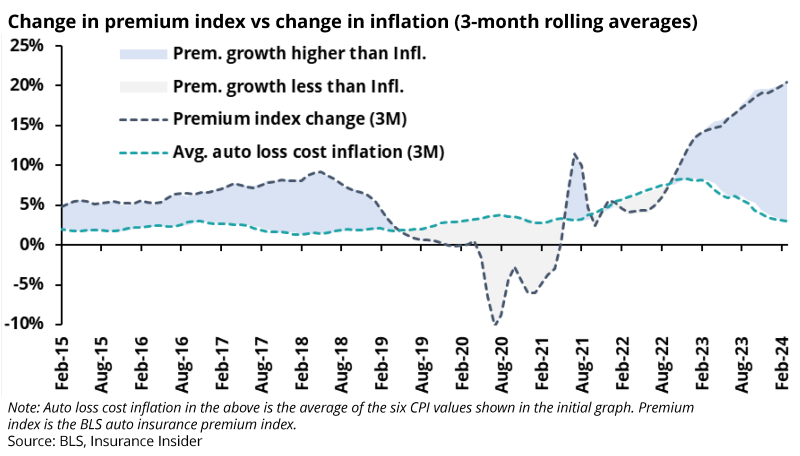

Turning to the chart below, we once again find that premium growth is exceeding inflation. This aligns with what we have observed in the recent rate filings as well as statutory data, which similarly showed the efficacy of many insurers’ rate filing actions as of late. The blue space shows where premium growth is higher than inflation, whereas the grey space shows where premium growth was less than inflation.

Note that during the economic recession triggered by the Covid-19 lockdowns, inflation remained largely stable in the low single digits, while premium growth rates declined significantly due to rebates and decreased rate-filing action. This is observable in the chart below, where the grey space completely offset the blue space during this period.

It is also important to note that these CPI data points, though insightful, are only proxies with numerous caveats. One must also consider the results of individual carriers when discussing such trends and the broader state of affairs within the P&C industry.

In short, we continue to see inflationary trends moving in a positive direction for the P&C industry, which itself has seen numerous rate changes that have benefited many key carriers. However, insurers would do well to stay their course as property damage trends moderate but medical services trends rebound.