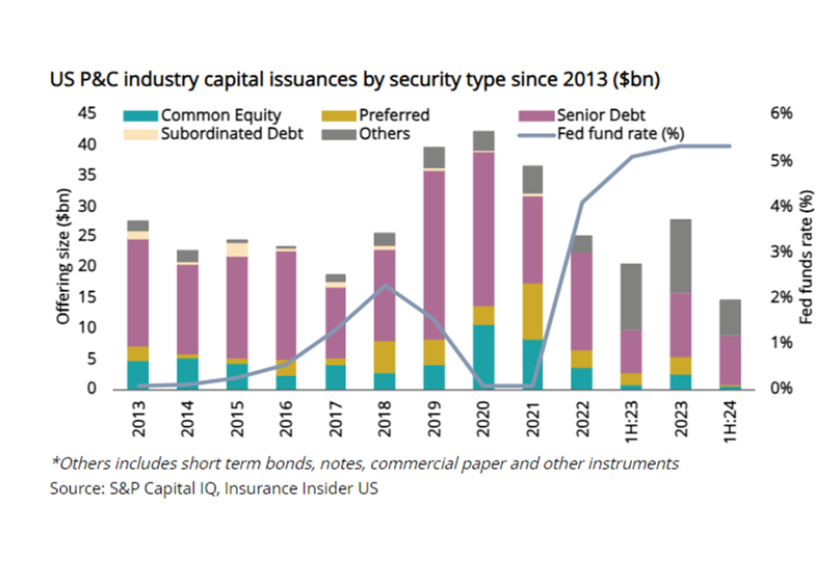

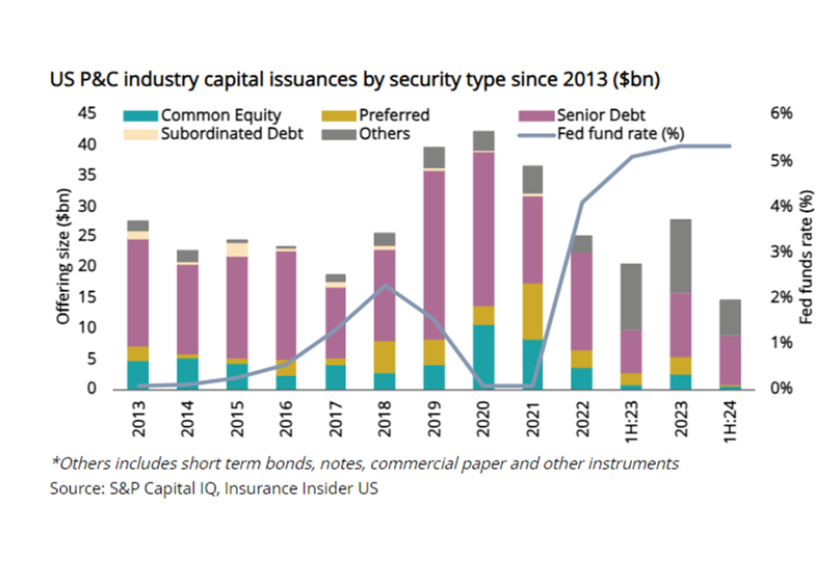

Insurance and capital are interlinked and vary depending on sector-specific and macroeconomic factors. Capital is needed to set up new segments, grow existing businesses and acquire other entities.

However,

Insurance and capital are interlinked and vary depending on sector-specific and macroeconomic factors. Capital is needed to set up new segments, grow existing businesses and acquire other entities.

However,