Earlier this week, second-quarter reporting for P&C insurers and brokers came to an end. Investors, companies, and industry observers revisited the discussion on the quality of reserves for the long-tail casualty underwriters, but not to the level we would have liked. The chart below shows how often topics have arisen over the past four quarters for the group.

Even though there was a bit more noise in the numbers from reserve adjustments, the level of discussion this time was not vastly different from past quarters.

The topic of reserves came up 297 times in Q2 2024 vs. 294 in Q1 2024, while loss costs were discussed 178 times vs. 165 times in Q1 2024.

However, the stock performance shown below was largely underwhelming, apart from the outliers on both sides.

Company-specific factors mostly drove outperformance and underperformance at the extremes. Goosehead recovered due to the company outpacing street expectations and reiterating its guidance. Recall that its stock had sold off following its Q1 2024 earnings, including a reduction in its guidance. On the other hand, Selective’s sell-off resulted from it moving ahead of its earnings schedule, which included adverse reserve development in its casualty lines from accident years 2020-23.

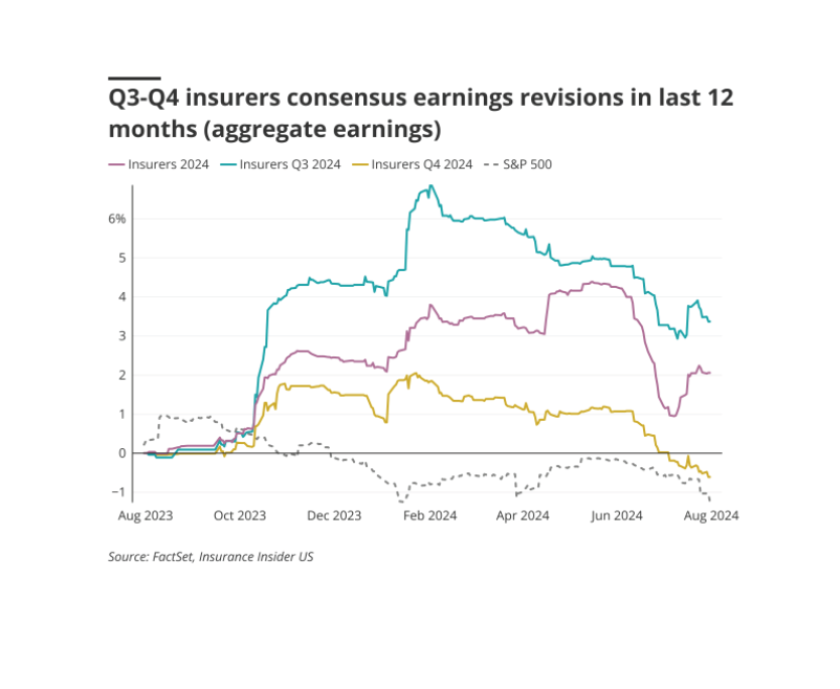

The chart below shows that estimates revisions, and numbers went up for Q3 and Q4 of 2024! This surprises us since the discussion on reserves has continued, with concerns not yet abating. Additionally, fourth-quarter results include deeper-dive reserving work which will likely lead to reserve adjustments.

Brokers' earnings estimate revisions, as shown below, also modestly ticked up.

Distilling the earnings season, we believe the following are the most relevant takeaways:

Casualty reserve discussions continued as more carriers reported adverse developments, but not at the level we would have preferred

In our second quarter preview, we noted that recent years’ reserve releases, soft-market general liability reserves, and workers’ compensation trends would be the focal points going into this past earnings season.

Travelers and Selective set the tone for the season, being the first to report adverse developments in their recent years’ casualty lines, offset by continued reserve releases in their workers’ comp product lines.

AIG, Chubb, and The Hartford were among several others that subsequently reported similar reserving moments: strengthening of casualty lines in recent accident years, and releases in workers’ comp lines. Senior management at both Travelers and Selective pointed to the challenging social inflationary environment as a primary driver of the struggles in these problematic casualty lines.

With most deep-dive reserve studies happening in the latter half of the year, we will continue to focus on the interplay between these rising loss costs and casualty lines reserving trends as well as how the underlying loss picks will shift over time.

We would also highlight our statutory analysis from Q1, which showed unprecedented levels of workers’ comp offsetting reserve development from the soft market as well as recent accident years.

Specialty growth continued, while regionals faced difficult results

One of the defining shifts over the past few years has been the continued growth in the specialty markets. The table below shows that the growth for many specialty players remained at levels seen above, greater than the larger commercial carriers. Additionally, we would also note the improved combined ratios for the group.

E&S data shows that on the casualty side, double-digit growth was seen in other liability lines and catastrophe-exposed property lines.

Hence, we would wait for the book to mature before declaring victory in this growth.

On the other hand, regionals continued to attempt to navigate the interplay between growth and maintaining the quality of book (i.e. personal vs. commercial lines business mix). Over the years, regionals have tweaked down personal lines exposure to limit the catastrophe volatility and leaned more into commercial lines business.

Selective was the first company to report adverse development, and cohort members overall ran at an underwriting loss or marginal profitability. In our recent deep dive, we discussed some of these issues in detail with regard to regionals, who we believe are at a pivotal moment. We will not be surprised to see other regionals revisit their reserves over the remainder of the year.

Personal lines seem to have walked back from the brink, but discipline is warranted

This sub-sector generally did better than the other P&C sectors. This follows several quarters of rate and underwriting action. Allstate highlighted the positive impact of rate approvals and its expectation of a policies in force (PIF) improvement over 2024. Progressive’s top line continued to improve as its earlier corrective actions bore fruit, and PIF growth accelerated while Horace Mann continued to execute on its underwriting turnaround.

Brokers continue to report strong earnings with sustained mid-single-digit organic growth

Brokers had another good earnings season, with the majority of the cohort reporting mid-single-digit organic growth of around 6%, while Brown & Brown posted double-digit organic growth.

One point worth noting here is that while the franchise-level organic growth varied among the names, there was a much narrower spread when focusing on the broking portion of the business, with almost all names coming in at 7%.

Larger names were brought down by the lower organic growth in consulting and other non-P&C operations, while Brown & Brown outperformed due to double-digit increases in its MGA segment.

These results have continued the strong trend from the past couple of years, as inflation has remained elevated despite Fed actions. However, if a recession does materialize, we expect the sector’s results to moderate, as broker revenues are heavily correlated with GDP.

Reinsurers/hybrids fared well, but all eyes are on the hurricane season

In the past, we have covered the great pivot from reinsurance to a greater focus on specialty insurance for this cohort in detail. This quarter, none of the hybrids reported significant reserve movement. However, the focus remains on the mix of business vs. catastrophe and severe convective storm (SCS) volatility.

Additionally, hurricane forecasts for 2024 predict an active season, although our past analysis has shown a coin-toss level of accuracy. On the property-catastrophe front, mid-year renewals aligned with lowered expectations, as expected. On casualty, reinsurance conditions varied by business class.

Nonetheless, hybrids have benefited from solid pricing in both commercial and reinsurance lines, with both beginning to come off their peaks.

In summary, this earnings season appeared to be a case of kicking the reserving can down the road. Although we once again noted a modest uptick in reserving adjustments in the general liability line, this was offset by workers' comp releases.

Specialty grew as E&S market dynamics continued to provide opportunities for expansion. Regionals arrived at a crossroads moment as they attempted to balance their casualty-predominant business mix. Personal lines did the best out of the other P&C cohorts, as pricing and underwriting rectification steps bore fruit. Brokers continued organic growth expansion, although this is slowing. Reinsurers and hybrd carriers continue to benefit from solid pricing in both commercial and reinsurance lines, but hurricane season is not yet over.

The interactive tables below show several relevant metrics related to first-quarter earnings for peer-group comparison.