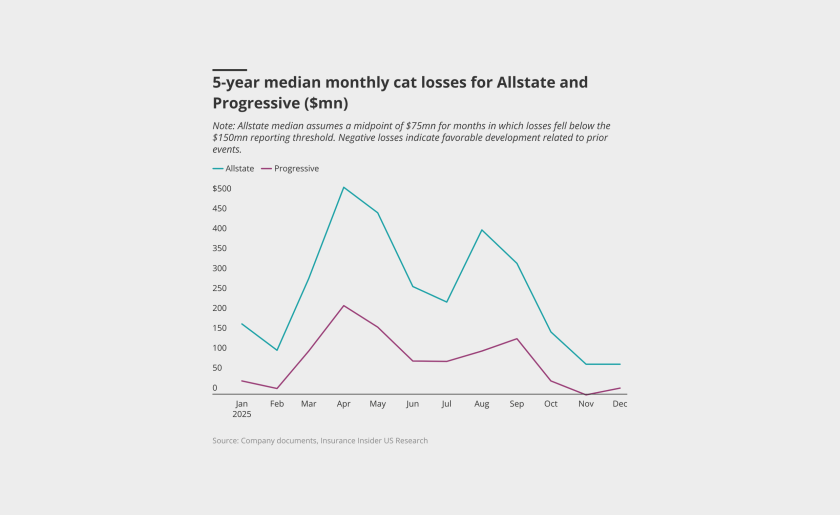

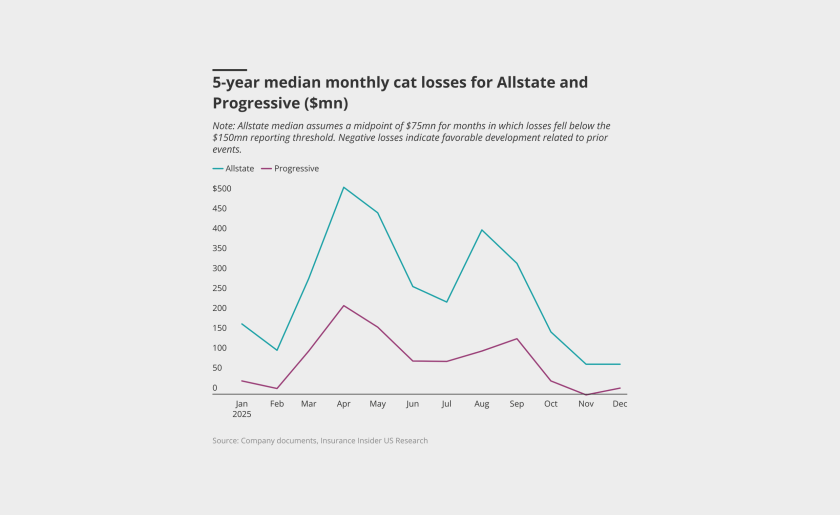

This past week, Allstate and Progressive reported their estimated cat losses for the month of February. Our cat loss analysis last month explored the impact of the California wildfires on January cat losses.

This past week, Allstate and Progressive reported their estimated cat losses for the month of February. Our cat loss analysis last month explored the impact of the California wildfires on January cat losses.