Chubb’s central point around litigation financing (LitFin) and the insurance sector is right.

Don’t sleep with the enemy.

It didn’t put the point quite so provocatively last week, but this was effectively what it said.

And I want to echo the point, and reinforce its importance.

LitFin companies are one of the fundamental causes of runaway loss-cost inflation in casualty, which is probably the sector’s single most important challenge right now. They are the enemy of the P&C sector.

So. Don’t. Help. Them.

Specifically, don’t provide them with insurance cover. And, critically, don’t provide them with credit wraps to help them hedge the downside they have to losing cases against insurers. And don’t allocate capital to these funds, directly financing the enemy’s operations.

Regardless of how much this stance will achieve in practice, it’s a prohibition the industry should be taking because consistency demands it.

You can’t maintain credibility on social inflation when you simultaneously bewail LitFin’s contribution to this loss driver and seek to profit from it.

P&C insurers need to pick a side and stick to it.

Chubb’s three-part casualty strategy

Stepping back, I want to sketch out a three-part framework for Chubb’s concerted casualty offensive over the last 10 days – because I think it’s been quite deliberately designed as a package.

Nudge the market towards claims-made, while making an “offer” to clients on capacity to underscore that Chubb is a problem-solver, not a troublemaker

Pressure P&C insurers that are sleeping with the enemy, with a view to undermining the contingent/credit wrap space, and knocking insurer/asset managers out of the market

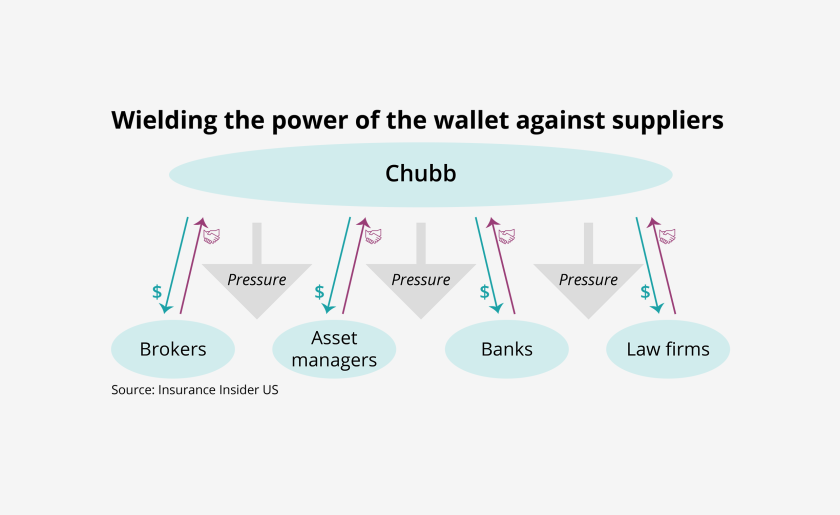

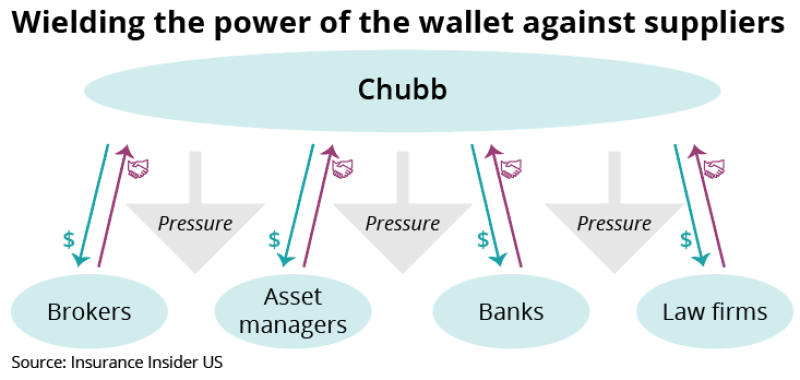

Wield the power of the wallet against your suppliers – including brokers, banks, law firms and asset managers – to ramp up pressure on LitFin firms by disrupting their trading relationships

This kind of strategy is particularly noteworthy because typically the insurance industry responds to challenges in lines of business by pulling one primary lever (pricing), and then some secondary levers (limits, attachments points, T&CS). In this case, Chubb already went hard on these moves in Q4 2023, pulling the broader industry in its wake, and helping to trigger the current casualty microcycle.

The biggest lever would, of course, be tort reform including things like transparency around LitFin and getting rid of juries for decisions around civil damages. But it’s pretty hard to get your hands on that lever with any purchase.

We’ve written at length on the nudge to claims made, so I’ll just note that it would be a big win for insurers to prevent stacking claims across multiple policy years, and to address latent drivers of claims i.e. the next sexual molestation. How far this gets in a market not in an acute crisis will heavily turn on the discounts Chubb and Zurich offer versus occurrence pricing when they quote it over the coming months.

Pressure P&C insurers that are sleeping with the enemy

Pressuring P&C insurers by publicly (or at least semi-publicly, given it was a session closed to the media) calling out competitors that are seeking to profit from LitFin was a move that could get traction.

Partly this is a question of encouraging CEOs to connect the dots, and we assume some will have left Chicago more inclined to do this.

But some CEOs will have been extremely clear-sighted on wanting to avoid sleeping with the enemy already. However, insurance companies – particularly large ones – can be complex and unwieldly organizations, with many moving parts. It is not an unreasonable assumption that there are arcane parts of the book that CEOs are not totally familiar with where their companies are picking up exposure.

Small MGA books, parts of larger portfolios, reinsurance treaties – all could be sources of exposure to LitFin.

The most pernicious element of this is the contingent/credit wrap product that is being written in the market. This allows LitFin firms, operating using debt, to hedge their downside exposure to losing a case – or, more often, a basket of cases.

Just think that through, and how staggering that proposition is in the broader context of the travails of the US casualty market. Insurers are helping LitFin firms seeking to profit via litigation against insurers protect themselves in case they lose.

If this cover were eliminated from the market, it would rob LitFin firms of the ability to hedge their risk. Losing that ability would increase the volatility of their returns, worsening the risk/reward dynamics for their investors.

Losing that return-smoothing cover may not make a fundamental difference, but it would hurt the LitFin firms at the margins.

Alongside this, the obvious area where clear-eyed CEOs would look to pull back is from their asset management businesses, some of which operate LitFin strategies. This is money that directly finances LitFin, which insurers are minting fees from. There have been rumours that some insurers directly invest in LitFin, but we have no confirmation of that.

Wield the power of the wallet against your suppliers

As for the third strategy – the supplier squeeze – its prospects look uncertain. Much will turn on whether other insurers are willing to follow suit. One CEO last week told me that he had asked his procurement team to explore making the same move.

But it’s unclear that the industry has the necessary ruthlessness of corporate culture to wield the power of the wallet quite so brutally.

If they do, I suggest they focus on two groups.

First, broking groups.

Reinsurance broking is a lucrative business, and major cedants like Chubb are worth tens of millions of dollars and sometimes upwards of $50mn to their largest brokers.

This gives them major leverage over intermediaries, especially given that one firm – Aon – has already taken a stance on dropping US LitFin clients, providing an alternative.

The leverage the other way is not as strong, though it’s far from a one-sided calculation. While a major broker can’t turn off the taps on Chubb, it can turn them down.

Chubb is of course an extreme example given its market power. But the skew in the economics between large account reinsurance broking and retail broking that I am trying to illustrate here will also apply with smaller dollar numbers at other intermediaries.

If only AIG, Travelers and Zurich were prepared to act, the reinsurance broking revenues – and high associated profit margins – would likely be enough to tip the scales for the major broking groups in favor of dropping LitFin clients. Aon’s very public move last year on US LitFin firms already creates pressure on the others to respond.

Second, asset management firms. Third-party asset management firms manage hundreds of billions of P&C assets. They make far more here than they do via LitFin investment strategies, with total LitFin assets under management at around $15bn, according to litigation finance advisory firm Westfleet.

Again, this creates leverage.

If Chubb were followed by other major insurance groups in moving all their assets from asset managers that invested in LitFin, they could potentially prompt changes in asset allocation away from LitFin at the large asset management firms.

Time to take a stand

To run the Chubb playbook, carrier leaders would need to turn away revenues and accept real stress on important trading relationships.

This is not typically the way the sector operates.

And what you have here looks like a classic collective action problem where acting to address the issue could hurt individual proactive companies, with the benefits socialized across the industry.

The temptation for insurer CEOs will be to hope that someone else does the heavy lifting while they sit quietly so they can participate in the upside.

But, ultimately, the status quo in casualty is deeply problematical. Doing nothing is not a zero-cost option.

Sometimes you just have to take a stand.