Aspen

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

The insurer paid tribute to the executive’s lasting contributions to the firm.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

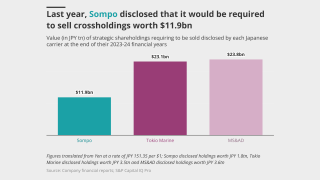

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

Analysis of market conditions, reserves show that this might not lead to an overnight consolidation boom.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The executive said the floor on D&O pricing is in sight.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The newly created role consolidates leadership across UK entities.

-

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

The underwriter has held positions at The Hanover, Liberty Mutual and Zurich.

-

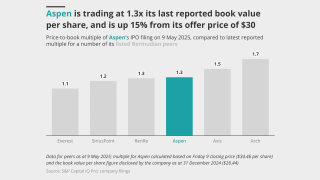

The company completed its upsized IPO last week and traded up to 1.3x book.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

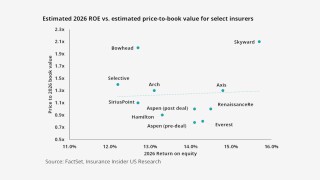

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The carrier is offering shares priced at $29-$31.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In October, this publication revealed that the carrier had resumed IPO preparations.

-

Cat losses in reinsurance rose 11.1% year over year to $45.1mn, driven by Hurricane Helene.

-

He joins from R&Q Insurance Holdings, where he has been chief accounting officer.

-

The business put up strong H1 numbers, and has named Christian Dunleavy group president.

-

Coalition Re to offer active cyber reinsurance via two products supported by Aspen-led capacity.