Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Latest News

AssuredPartners News from Insurance Insider US

Competitor news

Competitor news

Competitor news

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The executive most recently served as the company’s chief broking officer.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker will join Ron Borys’ financial lines team.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The layoffs will mostly affect workers in Michigan.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

The move marks Acrisure Re’s first investment in Latin America.

-

The executive was formerly EVP and central regional leader at Aon.

-

The executive has been at the broker for over 20 years.

-

The executive has worked for Aon for almost two decades.

-

The business is beginning to integrate following a $9.8bn acquisition.

-

Cyberattack/data breach remains in the top slot.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The executive will join Howden’s new US retail broking operation.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The platform aims to “bend the loss curve”.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The executive has been serving as COO since February.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

The broker has filed a motion to dismiss the lawsuit by Marsh.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

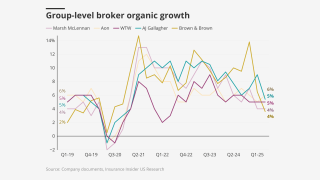

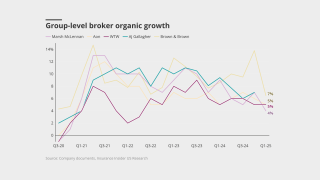

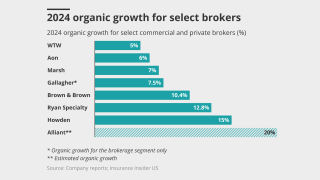

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

The Risk Strategies parent company had also been the subject of bids from Marsh and Howden.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Some E&S business is flowing back to the admitted market but so far it is “anecdotal”.

-

This is its second significant wholesale acquisition this year following the $54mn takeover of NBS.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

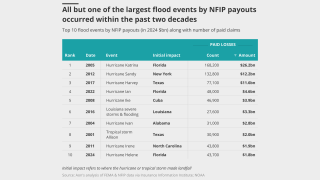

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

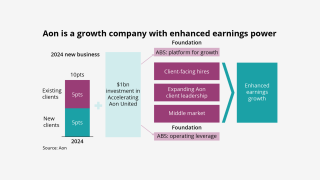

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

The executive briefly exited the firm last month for a role at Marsh.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

US events accounted for more than 90% of global insured losses.

-

The broker has expanded the number of global industry verticals to seven from four.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The broker noted a “significant variation” in renewal outcomes.

-

The executive will report to US construction practice leader Jim Dunn.

-

In North America, the median W&I claim payment in 2024 was $5.5mn, the highest on record.

-

The platform will capture and standardise data from all submissions, the broker said.

-

Coverage has broadened while limits have increased, the broker said.

-

The executive was formerly head of cyber solutions, North America.

-

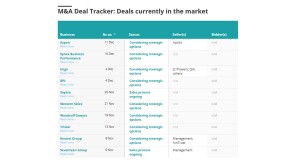

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The ongoing demonstrations could have law enforcement liability implications.

-

Volante’s syndicate may still support select transactional liability risks, but it will not have an in-house team.

-

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The documents figure in a potential criminal case against a CCB employee.

-

The broker is targeting run-rate synergies of $150mn by the end of 2028.

-

The $10bn acquisition of Risk Strategies is the biggest broker deal relative to size we have seen.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The acquirer will carry out a ~$4bn equity placement to help finance the transaction.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The offering comes after Acrisure’s $2.1bn convertible pref share raise.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The executive will remain CEO of reinsurance until September 1.

-

Most of the losses are attributable to a supercell storm in Texas.

-

Acrisure recently raised $2.1bn from investors in its latest step towards an IPO.

-

Acrisure followed the recaps of Hub International and Broadstreet Partners.

-

The executive will also continue as MD overseeing Caribbean fac.

-

Two large storms hit the Midwest and Ohio Valley regions on May 14-17 and May 18-20.

-

Additional investors include Fidelity, Apollo Funds and Gallatin Point.

-

Sources said that negotiations are proceeding well with a path to do a cash deal.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

Growth in construction projects is increasing the need for coverage.

-

Q1 was the ninth consecutive quarter of below-average deal volume.

-

The industry is seen as “resilient” amid a volatile risk environment.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

He was appointed executive chairman for international in 2021.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

The deal will place the highest ever private valuation on a broking firm.

-

The preferred shares will mandatorily convert to common equity on an IPO.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The executive was previously a top US casualty broker.

-

In an economic downturn, the kneejerk reaction is to treat insurance and risk management as a cost.

-

The executive had previously been at Aon for over 15 years.

-

He takes over from Amanda Lyons, who was promoted to global product leader last year.

-

It will be tough to pull off prior goals despite management assurances.

-

The firm acquired total assets of $65mn and assumed liabilities of $11mn.

-

Q1 rates in most lines were consistent with prior quarters but slightly down on 2024.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

Insurance Insider US explores the economics of the lift-out growth strategy.

-

Insured losses were the second highest on record for the first quarter.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

In Partnership With AXISAXIS has Combined its A&H Insurance and Reinsurance business, which gives the company an advantage in the market, said Jay Hamilton, head of the newly combined operation.

-

In Partnership with Moody'sJoin Insurance Insider for a free webinar, offered in partnership with Moody’s, at 10:30 EST/15:30 GMT on 22 January

-

How do struggling governments across the globe tackle stagnating economic growth?

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider US

Commercial lines rate increases slow to 3.8%: WTW

The figure is down from 5.9% in Q2 2024.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider ILS

Ascot aims to establish Wayfare Re as an 'evergreen' source of capital

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.