Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Latest News

Latest News from Insurance Insider US

Competitor news

What Your Competitors are Reading

Competitor news

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Earlier this year, this publication revealed that Atlas was considering a potential sale.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

The $21/share pricing falls in the middle of the expected range.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider US’s comprehensive deal database.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

HNW family offices are now among investors considering the US MGA segment.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

The acquisition will expand PHLY’s presence in the niche market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

Sources said that the transaction valued the Californian auto F&I business at over $1bn.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The regulations are designed to address long-term solvency concerns.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Old Republic said the acquisition is expected to close in 2026.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Pre-tax cat losses were down 63% from the prior year quarter to $285mn.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The company is looking to grow through its new MGA incubator program.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

MGAs that are good operators will stick out compared to the rest.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Private capital–backed buyers accounted for 73% of the 513 transactions this year.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

Brian Church has spent 20 years at Chubb.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The MGA platform wants to expand into Europe and the UK and grow its wholesale business.

-

Lupica moved to the role last year as part of a staggered handover of responsibilities to Juan Luis Ortega.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The company will implement a new leadership structure after his departure.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

-

Sources said that Howden Capital Markets is advising the fronting company.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

AIG’s filing alleges copyright and trademark breaches, as well as violations of unfair business practice laws.

-

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

-

The company will continue its capacity partnership with the MGA until 2030.

-

The executive previously spent more than 16 years at The Hartford.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

He will drive the growth of Chubb's claims-made excess casualty facility.

-

With the deal, sources expect backers Tiptree and Warburg Pincus to exit the Floridian insurer.

-

Sources said the start-up has two $10mn+ Ebitda platform deals lined up.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Other parties that looked at the business include CPPIB, Permira and Carlyle, sources said.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

Onex is making the investment alongside PSP, Ardian and others.

-

This publication revealed earlier this year that the firm was working with Ardea to explore strategic options.

-

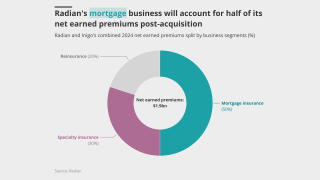

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The Inigo CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

Sources said the agency first considered a debt raise but recently pivoted to a sale process.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

This publication reported earlier today of the asset manager’s foray into the MGA space.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

As part of the transaction, PE firm Atlas Merchant has agreed to sell its interest in MarshBerry.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The boutique retail broker provides P&C and benefits services in the Mexican Caribbean hospitality sector.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The insurer has been under review with positive implications since March.

-

Andrew Robinson returns to Lloyd’s after his previous involvement via The Hanover’s Chaucer deal.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

Arkansas-based RVU provides commercial P&C and some specialty programs.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

A view into PE-fueled activity in the MGA sector, as LatAm carrier M&A accelerates.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

In Partnership with Moody'sJoin Insurance Insider for a free webinar, offered in partnership with Moody’s, at 10:30 EST/15:30 GMT on 22 January

-

How do struggling governments across the globe tackle stagnating economic growth?

-

In Partnership with Swiss ReThe global construction industry continues to expand, says Jimmy Keime, Head of Engineering and Nuclear, for Swiss Re.

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider US

Commercial lines rate increases slow to 3.8%: WTW

The figure is down from 5.9% in Q2 2024.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider US

Brown & Brown appoints Hearn to lead global operations

The executive has been serving as COO since February.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.