Axis Capital

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

Company alum David Murie will lead the new business unit.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

Pricing was “virtually flat” in the second quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

The changes are aimed at improving underwriting and operational performance.

-

-

Primary and excess casualty in the US saw double-digit rate growth and remained above loss trends in Q1.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

New roles include CUO for primary and excess casualty and practice leader for complex specialty.

-

Axis is retroceding $2.3bn of reinsurance segment reserves to Enstar.

-

Markel had announced the exit from the line of business in the US last year.

-

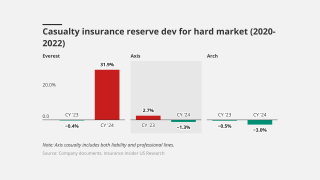

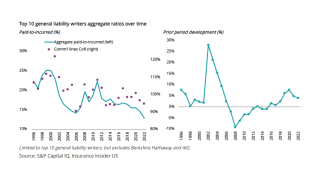

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

The PE firm held over 6.7 million Axis shares, around 8.2% of shares outstanding.

-

The carrier also grew TL written premiums by 11% in Q4 and 24% for the full year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

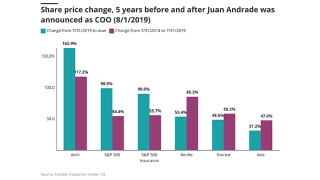

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

The three lines add up to 80% of the deal.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

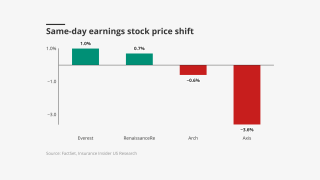

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

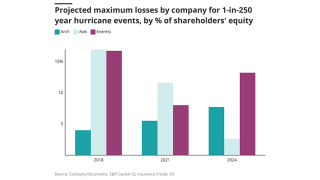

Arch stands out among hybrids, but Axis and Everest grind it out.

-

The company’s reshaping of the book will be substantially completed by year end.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In tandem, John Posa joins the primary casualty team as vice president.

-

The executive moves from his current role as chief risk officer for Axis Managing Agency.

-

Mark Gregory will retire next March, while Sara Mitchell will initially join as a strategic adviser.

-

The executive struck a cautious note on the industry’s reserve adequacy for the 2021-23 accident years.

-

-

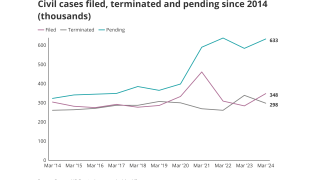

Civil case, nuclear verdict and claims count data show worrying trends.

-

Severe convective storms, wildfires and hurricanes increasingly moving inland are top concerns for the industry.

-

The outage is not expected to impact Axis’s financials at this time.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive will replace Habib Kattan, who joined the company last summer.

-

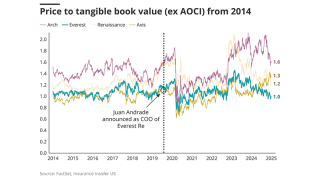

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

Launched in 2021, Axis is both an investor and capacity provider.

-

The two join the company from Navigators, a subsidiary of The Hartford.

-

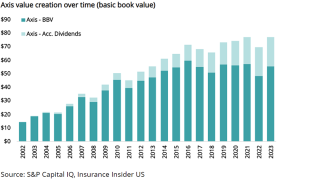

Industry trends show the Axis book value growth goal may be hard to hit.

-

New leaders of these reinsurers have started strong, but Axis still has work to do.

-

The primary casualty book was down by “some 26-odd percent from the prior year”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Pauline Morley will report to John Van Decker, head of global financial lines.

-

The executive is also CUO of Axis Managing Agency.

-

The executive’s exit is part of a reassessment of Axis’s primary casualty book.

-

Dejung spent 13 years at Scor, most recently as cyber CUO.

-

It will begin underwriting from April 2024.

-

Marty Becker was previously chair of QBE Insurance and Alterra Capital.

-

The executive will continue in his role as global head of distribution.

-

With mixed results in the reinsurance space, the specialty pivot remains a "show-me" story.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

The firm will still be prepared for ‘modest changes’.

-

Insurance Insider US runs you through the earnings results for the day.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

Axis shares were trading at almost $59 after closing at around $55 Tuesday.

-

More than 100% of the reserve charge came from pre-pandemic years, as the slight release of $40mn that offset the full-year increase of $452mn was from 2020 to 2022 accident years.

-

The reserve strengthening was related to liability and professional lines related to 2019 and prior accident years, the firm wrote in a preliminary earnings disclosure.