Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Brown & Brown News

Latest news from Brown & Brown

Competitor news

Competitor news

Competitor news

-

The federal judge said South has direct knowledge about a previous raid involving Aon.

-

The parties now have 60 days to file a stipulation to dismiss the action.

-

The company also promoted Zulma Suarez to CEO of Colombia and Venezuela.

-

The deal valued the tech-driven broker at over ~21x 2025 adjusted Ebitda, suggesting a hefty premium.

-

A motion to dismiss argues the case should not have been filed in federal court.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

The policy includes a $200mn limit with an additional $100mn for side A coverage.

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

Newfront’s business units will be combined with Risk & Broking and Health, Wealth & Career.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

Onex CEO Bobby Le Blanc will retire from Ryan Specialty’s board of directors.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

Fears relating to an economic downturn continue to dominate concerns.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Last month, Insurance Insider US revealed that MMA was set to buy Atlas following a sale process.

-

The executive was most recently head of US casualty at Aon.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

The executives are based in Seattle and New York.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

GC continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

A motion by defendants to dismiss the case was also denied.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The executive most recently served as the company’s chief broking officer.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The dismissal comes after the judge in the case had stayed it just a day earlier.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

Earlier this year, this publication revealed that Atlas was considering a potential sale.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Marsh is also suing a second tier of former Florida leaders.

-

The deal would follow AJG’s regional acquisitions of THB Chile, Brazil’s Case or the Colombian retail book of Itau.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The broker will join Ron Borys’ financial lines team.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

Early Q3 earnings reports point to worsening market conditions.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

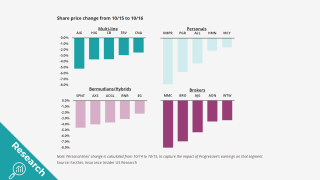

The selloff may hint at headwinds for equity investors.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

The motion claims the New York court has no jurisdiction in the case.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Jeremiah Bickham will be a strategic adviser until the end of the year.

-

The executive was formerly EVP and central regional leader at Aon.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The executive has been at the broker for over 20 years.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The executive will officially start in mid-November.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The executive has worked for Aon for almost two decades.

-

Cyberattack/data breach remains in the top slot.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The executive will join Howden’s new US retail broking operation.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

-

The platform aims to “bend the loss curve”.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

What were the defining moments that shaped the insurance market in 2025?

-

How do you harmonise distribution strategies in a rapidly evolving marketplace?

-

In Partnership with AXISMichael McKenna, Head of North America Specialty Insurance, AXIS, outlines the key trends shaping the industry as 2025 comes to a close and underscores that talent acquisition and rapid technology integration will be critical for specialty insurance in 2026.

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider ILS

Ascot aims to establish Wayfare Re as an 'evergreen' source of capital

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

From Insurance Insider US

WTW books 5% organic growth in Q2

The R&B unit posted organic growth of 6% in the quarter.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.