Cincinnati Financial

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

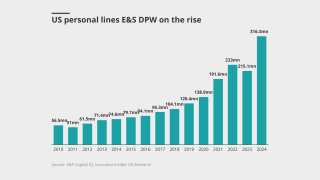

New business written premiums were up in the commercial and E&S segments, but decreased in personal lines.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The January wildfires did little to hamper their appetite, apart from California.

-

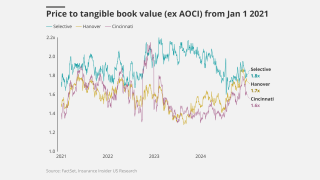

The LA fires and spring storms drove CinFin's CoR up 19.7 points to 113.3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier is only going to write new business on E&S paper, sources said.

-

Regionals and smaller carriers need to exercise vigilance when expanding commercial casualty lines.

-

The losses do not change the near-term assessment of CinFin’s balance sheet strength.