Claims trends

-

Kemper and Selective’s woes stem partly from own issues, but industry-level issues persist.

-

Many nuclear verdicts become much less radioactive on appeal.

-

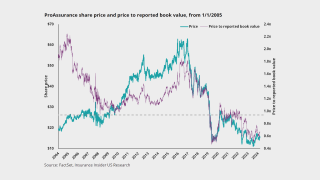

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

The executive said the claims industry is going to “be transformed”.

-

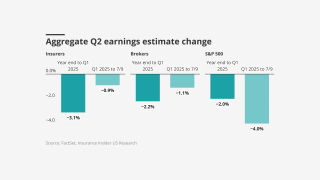

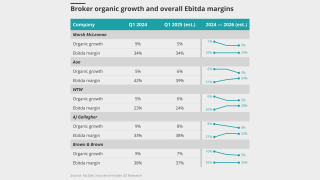

Social inflation, reserving, and organic growth are the topics to watch this earnings season.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

Coverage has broadened while limits have increased, the broker said.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

Chubb told insurers to look inward in the fight against LitFin, but insurers are also tied to that industry.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

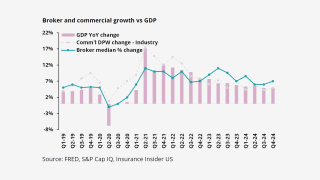

Competition and ample capacity are pushing premiums lower.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

The CEO spoke after Chubb chief executive Evan Greenberg’s call to action at RIMS.

-

Writing credit wraps for LitFin firms and steering third-party assets to them should stop.

-

The carrier said it is prepared to drop asset managers, lawyers, banks and brokers.

-

As the industry gathers in Chicago, Insurance Insider US reviews key discussion points.

-

He will replace Scott Lee, who is retiring after 40 years in claims.

-

Economic unease will join cat losses, renewals, and organic growth as Q1’s key topics.

-

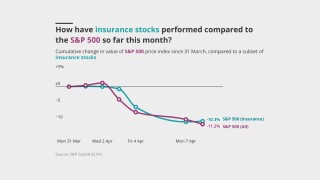

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

P&C has strengths that will help it survive this crisis, but not without some pain.

-

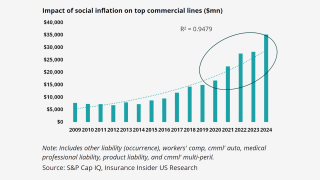

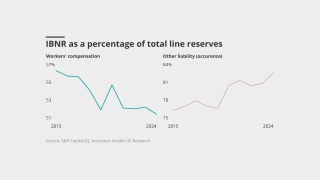

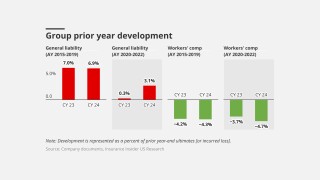

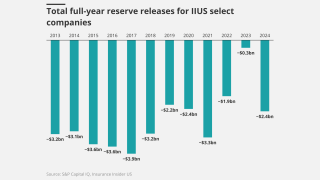

What past trends can tell us about the future of commercial reserving.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

The amount of change over the past year falls short versus the discourse.

-

What insurers can learn from the history that led to this deal.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

Casualty reserve concerns continue to mount as releases remain elevated.