Construction

-

A district court judge had dismissed the case in September, with prejudice.

-

Ford had purchased a builder’s risk policy from the insurer.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The executive will join Howden’s new US retail broking operation.

-

The case is now headed to appellate court.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The executive succeeds current CEO Petway, who is retiring.

-

GL and workers’ comp, however, may benefit from a more competitive environment.

-

The move will impact around $50mn of gross written premiums in total.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

The segment is also seeing double-digit loss cost inflation.

-

The move consolidates the company’s leadership of primary and excess construction casualty lines.

-

The alleged insurance fraud targeted anyone who could fund the settlements, argued the plaintiffs.

-

The executive briefly exited the firm last month for a role at Marsh.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

The MGA and parent company Roosevelt Road Re have until July 21 to file a second amended complaint.

-

The carrier has scaled up its international insurance offering in recent years.

-

The changes are aimed at improving underwriting and operational performance.

-

Growth in construction projects is increasing the need for coverage.

-

The two deals bring the combined company’s Ebitda to about $25mn-$30mn.

-

The executive had previously been at Aon for over 15 years.

-

The company’s diverse portfolio could provide protection, but has heavy exposure in construction and transportation.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

SiriusPoint will provide capacity for a new construction liability program.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

Auto and homeowners’ insurance will see effects from the tariffs.

-

The executives will join the company in the coming weeks.

-

This follows the firm’s exit from primary aviation.

-

Bradley was construction team leader for US casualty at WTW.

-

The complaint accuses a new law firm, Liakas Law, of involvement in a fraud scheme.

-

The recently filed suit names several personal injury law firms.

-

Plaintiff Ionian has alleged a “fraudulent scheme” under the Rico laws.

-

The duo have several years’ experience in specialist construction risk.

-

The lawsuit names additional attorneys, doctors and medical practices.

-

The promoted employees have all been with BHSI’s Singapore offices for years.

-

While the alleged fraud is shocking, could it suggest the industry is under-investing in claims?

-

The complaints are the first effort to crack down on existing suspicions.

-

Manufacturing now accounts for 41.7% of all claims, from 15.2% previously.

-

The first RICO complaint targeted medical providers and training centers.

-

Seven members of the construction team have resigned, including construction practice leader Patrick Baker.

-

The executive has over 20 years of experience in construction risk management.

-

He brings more than 20 years of industry experience to the role.

-

Rina Visconti is joining the firm’s national casualty practice after 27 years at CRC.

-

Across three offerings, Victor increased coverage maximums by $33mn.

-

The promotions are within RT Specialty's environmental and construction professional practice.

-

CoreLogic’s report for April 2024 saw rising costs across four common loss scenarios.

-

WTW said adverse development “is evident” in auto liability lines from 2015 to present.

-

This continues a consecutive quarterly gain of over 6%.

-

The firm took a major reserve charge and has gone into remediation mode.

-

Intact Ventures, Era Ventures, Greenlight Re and Spark Capital also participated.

-

The ratings agency assigned a group financial strength rating of A, with a stable outlook, to three new member companies of Builders Insurance.

-

John Schwirtz will report to Matt Waters, head of Axa XL's US mid-market business, and build out a mid-market underwriting team.

-

Jeff Banasz will serve as EVP with the Cobbs Allen division, establishing an inaugural office in Philadelphia.

-

Inside P&C’s news team brings you all the top news from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C takes a closer look at the NY construction market, which represents a unique challenge to insurers and insureds due to density and strict labor laws.

-

Ryan Powers will report to QBE NA president of commercial insurance Mike Foley.

-

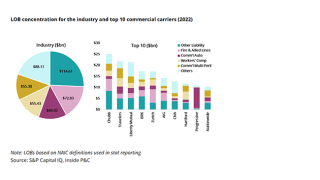

Competing forces of loss cost inflation and mixed rate action yield uneven trajectories for the largest commercial lines.

-

The MGU has secured up to $10mn follow-form capacity on a non-admitted basis to cover general liability on complex construction projects in the US.

-

Longo was previously underwriting manager for Axa XL’s construction group.

-

WTW said driver shortages continue to force contractors to use younger, often less experienced drivers, potentially putting upward pressure on losses.

-

Banking crisis contagion could lead to a decline in construction projects and demand for coverage, while inflation is driving loss costs ever higher.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

He will coordinate product management and development of related products, which are anticipated to be available in the late second quarter of 2023.

-

Primary liability rate increases currently range from flat to 10% for most commercial projects, private broker Lockton disclosed in its annual construction market report.

-

Intact financed the acquisition of the US builders risk portfolio through a $188mn term loan that was repaid before quarter-end, according to its Q3 statements.