Energy

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

Longbrook Insurance will write multiple lines of business.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The subsidiary will offer primary and excess liability.

-

JH Blades, Southern Marine and Energy Technical Underwriters will merge to form the new brand.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Appointments include leadership in transportation, energy, marine and others.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

The executive has spent 13 years in the broker’s marine division.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

It is the second deliverable of the FIT Transition Plan Project.

-

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

Competition for specialty reinsurance talent remains high.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

The MGA secured backing from buyout heavyweight KKR in March 2021.

-

The report aims to plug the gap in insurance-specific guidance.

-

The promoted employees have all been with BHSI’s Singapore offices for years.

-

Severe convective storms, wildfires and hurricanes increasingly moving inland are top concerns for the industry.

-

The downstream market is also starting to soften after a “massive influx” of premium income.

-

The broker said achieving profitability “remains challenging” for insurers.

-

The all-items CPI increased 3% year-over-year, down from 3.3% in May.

-

The lineslip will focus on coverage for the energy transition space.

-

Mizell will be based in IMA’s Houston office, its fastest-growing regional division.

-

The CEO said companies are still taking charges on years 2013 to 2019.

-

WTW predicted that ‘meaningful softening’ could creep into energy markets during the year.

-

Increased reinsurance retentions left some insurers with their worst net results in a decade.

-

Graham Knight will become chairman of natural resources.

-

The companies originally established the capacity agreement in January 2023.

-

The facility will target operators across the US, onshore and offshore.

-

It will begin underwriting from April 2024.

-

The business will be led by Alex Kirkby, new head of marine and energy.

-

The appointment comes two weeks after this publication revealed that the executive had resigned from Lockton to join the rival broker.

-

The broker said it anticipated new entrants in the downstream class following a profitable 2023.

-

The alternative energy warranty captive solutions will be available throughout the United States and Canada.

-

The pair will be responsible for managing underwriting activity across their respective lines.

-

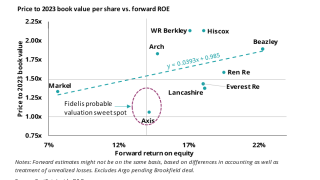

The Fidelis IPO has no clear precedent, but there is an appetite for investment in the specialty space, as seen earlier this year with the Skyward public listing.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Highlander has $300mn of insurance coverage, placed by Ed Broking and led by Munich Re Syndicate.

-

Human rights groups have issued a complaint to a US mediation body alleging that Marsh has violated OECD guidelines for corporate standards.

-

The book of business was performing poorly, and was exposed to major claims from the 2021 Huntington Beach oil spill in California.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The settlement is welcome news for the loss-hit downstream market, where there were fears of a claim as high as $1.3bn.

-

Former renewables head Hamish Roberts has moved to work as growth leader for the broker in the UK and Ireland.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

The hail which hit Texas in early summer 2022 alone resulted in solar losses estimated to exceed $300mn.

-

The carrier will no longer invest or insure contracts and projects directly relating to new oil and gas fields, new midstream oil infrastructure and new oil-fired power plants.

-

Loss activity is escalating in the class of business, leading underwriters to question rate softening.

-

The carrier said geopolitical factors had given “new urgency” to the green transition.

-

The broker said the fallout from the Russia-Ukraine conflict was increasing competition for business.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

The managing director is the latest in a series of hires at WTW’s natural resources division.

-

The loss comes hard on the heels of a large BI claim stemming from the Freeport LNG refinery.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Regulatory burdens mean that restarting the Freeport refinery could take longer than first hoped.

-

An abundance of capacity is leading to price reductions in the downstream sector.

-

Debenport joins the energy practice within NFP's specialty business.

-

The platform will be launched with the support of listed energy company NextEra, with paper provided by its captive Palms Insurance.

-

Challenging loss activity for battery storage projects has led to a capacity contraction in the sub-sector.

-

It is understood that the account includes oil platforms, crude barrels and 12 vessels, and is one of the largest accounts in the South American country.

-

Clients face under-insurance for BI if their coverage is not adjusted to reflect energy price rises.

-

The Peruvian government is suing Spanish oil company Repsol over the January incident which affected 700,000 residents.

-

Helmed by former Aon global energy chief Bill Farnan, the Houston-based company sees AN opportunity as public companies lean away from oil and gas.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The scale of the claim deals a substantial blow to the subsection of the energy market, but is not as large as first feared.

-

The broker said there was “genuine pressure” for downstream rate reductions, whilst renewable rate rises were single digit.

-

Dunbar’s appointment will enable the company to further enhance its exceptional client service and spearhead new business initiatives.

-

The CPI rose 1.2% in March from a month earlier, the Labor Department said Tuesday, accelerating from February’s 0.8%.

-

Large energy property damage losses in 2020-21 saw a significant reduction, accounting for a total of $500mn across the two years.