Enstar

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The take-private deal was announced in July 2024.

-

The reduction was due to impacts from investments and less favourable PYD.

-

Axis is retroceding $2.3bn of reinsurance segment reserves to Enstar.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

The three lines add up to 80% of the deal.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The take-private is expected to close by mid-2025.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

The company also announced a $5.1bn take-private deal with Sixth Street.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The transaction with Enstar covers $234mn of net Accredited reserves.

-

Berkshire Hathaway and Canada Life Re will provide as much as A$680mn of protection annually.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

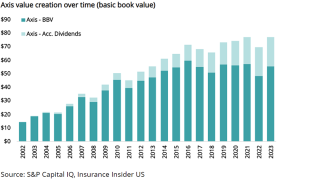

Industry trends show the Axis book value growth goal may be hard to hit.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

Enstar acquired 637,640 shares of James River in Q4 last year valued at nearly $6mn.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The San Francisco-headquartered alternative asset manager has invested $183mn in the run-off firm.

-

The legacy giant also disclosed a smaller buyback from Stone Point, with CEO Dominic Silvester also investing an additional $10mn.

-