Everest

-

The company announced four internal promotions this week.

-

Habayeb will start next May following Kociancic's retirement.

-

The move comes after Everest sold renewal rights for its global retail business to AIG.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

A re-focus on reinsurance nearly brings Everest back where it started.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

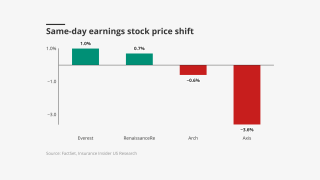

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

Jason Keen joined Everest in 2022 as head of international.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The move is the latest in a series of casualty leadership shake-ups at the insurer.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

The executive most recently served as head of North American treaty reinsurance.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Jill Beggs was most recently COO for reinsurance.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

The carrier has scaled up its international insurance offering in recent years.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The remediation process is on track for completion in the fourth quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

The executive was named group CEO in January.

-

Joe Fobert will report to William Hazelton, EVP of Everest.

-

Jeanmarie Giordano joined the company last September.

-

The executive was Everest CEO from 1994 to 2013 and has served as board chair since 1994.

-

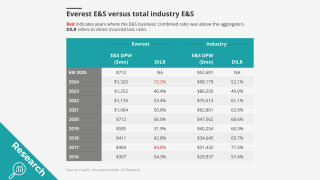

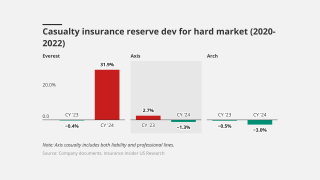

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

John Howard was appointed as an independent, non-executive member.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

The agency said it does not expect a “material impact” from the charge.

-

At January 1 renewals, prices dropped 5%-15% for loss-free programs.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

The carrier’s year-end kitchen sink action is a make-or-break moment for a troubled franchise.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.