Fronting

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

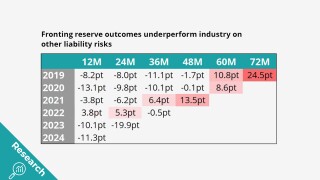

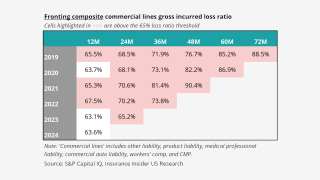

Fronting doesn’t look any better when it’s broken down by segment.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Sources said that Howden Capital Markets is advising the fronting company.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.