Fronting

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

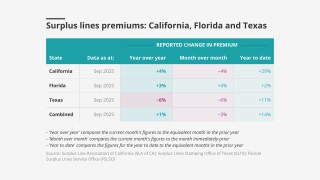

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

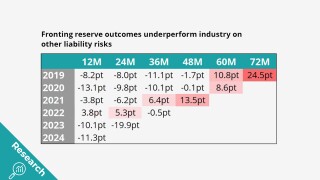

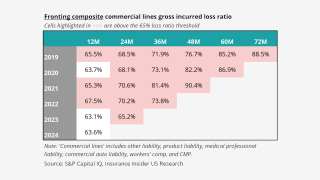

Fronting doesn’t look any better when it’s broken down by segment.

-

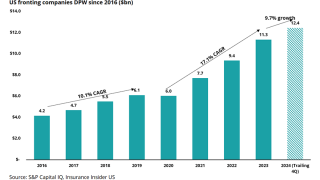

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Sources said that Howden Capital Markets is advising the fronting company.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

Kestrel stock will begin trading on Nasdaq tomorrow under the symbol KG.

-

The MGA market now makes up 10% of the overall P&C market.

-

The company has reduced its exposure on large commercial auto and property.

-

The reinsurer also promoted Ethan Allen to chief program officer.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

The move will enable Hadron to deliver more admitted insurance solutions to clients and policyholders.

-

Live since May 2023, the reinsurer has over 40 trading relationships currently.

-

The new CEO hints at expansion into MGA markets.

-

Consolidation options include fronts merging, competition, larger fronts becoming carriers and fronts being acquired by carriers.

-

The company is on target to write around $700mn in premiums this year.

-

The change comes after an ownership restructuring.

-

The transaction comes after Kestrel explored a deal last quarter to raise ~$150mn of capital.

-

The new, publicly listed specialty program group will be led by Luke Ledbetter.

-

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

The Bain-backed fronting carrier acquired Spinnaker’s shell subsidiary earlier this year.

-

Sources said that the AmTrust-backed fronting carrier has retained Evercore to run the process.

-

Capacity conversations centered around comp, trucking and cat, while new names emerged in collateralized re.

-

It is understood that the cut programs include Yachtinsure, Rhino, Paramount, Pinpoint and NTA.

-

Milton and Helene, casualty reserves and growth will be some of this year’s topics.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

The move comes amid improving conditions in the IPO market for insurance companies.

-

Balance sheet risk, limited synergies and a further restriction of exit options all tell against a roll-up playbook.

-

Negotiations come after Insurance Insider US revealed that the Bermudian was running an auction.