The delegated underwriting authority (DUA) sector will head to Scottsdale, Arizona, next week for the Target Markets Program Administrators Association (TMPAA) annual conference, with hurricanes, casualty reserving and the sustainability of double-digit growth on its collective mind.

The fronting segment’s prospects will also form a key part of the discussion as last year’s flurry of M&A activity ebbed, leaving questions around exits for private-equity owners and consideration of the potential upside of consolidation.

Much attention is likely to focus on the broader P&C market’s issues, including making sense of recent losses from hurricanes Helene and Milton and the trajectory of the casualty market, where reserving fears have driven pricing into a positive microcycle.

After a period when multi-year, double-digit growth has reflected structural and cyclical tailwinds, there are questions around how performance issues for some of the immature books in the program space could impact access to capacity to sustain further growth.

This year’s agenda will look very different to last year’s discussions, where the Vesttoo debacle, James Allen’s capacity issues and Trisura’s impairment travails were some of the most discussed topics, as reported.

Cats and casualty

MGAs, fronting carriers and their capacity providers will assess the impact of recent cat activity – in particular, hurricanes Helene and Milton but also other storms – on the segment.

Current estimates from Moody’s RMS peg Helene and Milton losses at $30bn-$50bn, with Milton alone in the $22bn-$36bn range, although there is significant industry disagreement on the quantum of loss.

As modeling estimates emerged this week, forecasts for Helene and Milton fell well below Hurricane Ian losses, which were $40bn-$50bn.

As the market assesses the impact of Milton in particular, two schools of thought seem to be emerging, with the bulls confident insured losses can be contained in the $20bn-$30bn range and the bears fearful losses will mount to $40bn-$50bn.

The bullish camp noted that Milton’s southerly turn saved the industry from an “Armageddon-like” event.

Meanwhile, the bearish front pointed out that a Category 3 storm hitting the Sarasota area is, at the very least, a reinsurance event for the many Florida domestics, particularly factoring in the effects of a record number of tornadoes that spun off from the storm.

In addition, losses will be generated once the full extent of BI costs are realized.

According to Gallagher Re, insured nat cat losses during the first three quarters of 2024 totaled $108bn, or 5% above the decadal average but below $122bn at the same point last year, and $155bn in the first three quarters of 2022.

Besides property cat, the recent concerns around casualty reserves are also expected to garner attention this year at the conference.

As the Insurance Insider US research team recently outlined, casualty reserve discussions across commercial-lines insurers are expected to pick up in Q3.

The industry is on watch for additional adverse development and any accompanying workers’ compensation releases.

With these issues affecting property and casualty lines, program managers may struggle to find additional capacity to back their growth prospects following a period of impressive expansion.

A meteoric rise

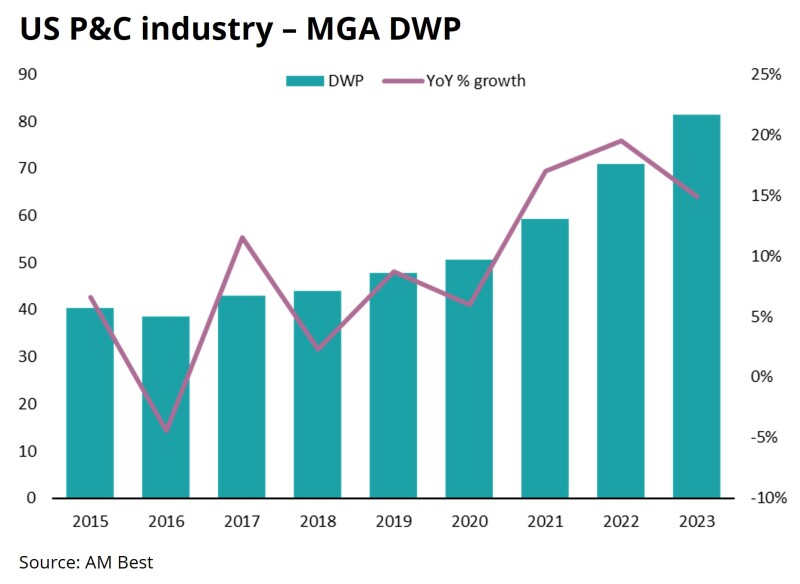

While the DUA sector faces some hurdles, it is also experiencing surging growth supported by the E&S expansion and the secular shift of talent and technology, among other drivers.

The non-admitted channel has been experiencing double-digit growth rates for six consecutive years and in 2023 surpassed the $100bn premium threshold for the first time, with $115.6bn in direct written premium.

The expansion seems to be moderating, as AM Best recently revealed that the 17.4% growth the surplus lines market saw in 2023 was below 2022 and 2021 rates.

Nonetheless, some still expect robust growth to persist, as corrective action in admitted markets continues to drive business into the wholesale channel.

Meanwhile, as our research team recently noted, MGAs that didn’t exist in 2021 now write 14%, or $11bn, of the market.

A similar trend was observed in the MGA space, where 14% of the growth came from new entrants. With the loss inflation and social-inflation climate evolving, the books haven’t seasoned enough to battle-test against initial expectations.

This $11bn premium came from 198 new companies that started writing business in 2022 or later, out of 711 total MGAs in the data set.

But, as noted, there are still questions around the quality of growth from new MGAs and what sort of systems they could develop and back-test to ensure their risks were written at an appropriate rate level.

The value chain will take a few years to digest this growth, and a clearer picture will emerge of the loss cost trends and how profitable this business is ultimately for MGAs’ carrier partners.

Fronting consolidation

A year ago, various franchises in the fronting sector were exploring a sale as they looked to monetize and capitalize on growth, while generating liquidity for sometimes ailing owners.

After much angst, R&Q salvaged a deal to sell its Accredited program management business to Onex but was not saved from insolvency, while Clear Blue and Sutton National launched sale processes, and Spinnaker and Falls Lake tested investor appetite.

Since then, however, much has changed. Both Clear Blue and Sutton National pulled their auctions, and the only active process is Falls Lake, which engaged in sales talks with Concert after relaunching a strategic review.

As this publication recently argued, consolidation in the ~$10bn-DWP fronting space is an idea some private-equity houses have on the drawing board.

There are multiple reasons why a roll-up playbook in the fronting space at multiples acceptable to sellers is not a good idea, including balance sheet and reserving risk, as well as the limited ability to harvest cost synergies.

In addition, it is hard to argue there is true franchise value in the fronting sector, while it is also unclear that the ‘bigger is better’ idea holds true for exit multiples in this space.

With these challenges, and taking aside Fall Lake-Concert talks, it remains to be seen whether the fronting segment will see a high-multiple deal that could restore PE confidence in the sector.

Ultimately, the ultimate advent of a soft market will put the brakes on fronting growth, and, under that test, some of the fronts may embrace consolidation.