Homeowners' insurance

-

Through the reciprocal exchange, the homeowners InsurTech plans to enter new markets in the first half of 2023, including catastrophe-prone states.

-

The bill under discussion tackles key concerns like eliminating one-way attorney fees and getting rid of the state’s controversial assignment of benefits right.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

InsurTechs’ mounting losses and continuing cash burn combined with reinsurance market hardening could spell trouble for the sector.

-

The special session comes as the Florida market braces itself for the effects of the anticipated reinsurance market hardening, potential regional insolvencies and the dearth of private capital.

-

This marks Sure's first program in Florida, but the reciprocal has more than 120,000 policyholders across North Carolina, South Carolina, Alabama, Mississippi, Louisiana and Texas.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

Floridians had a hard quarter, but they are fighting to regain stability after Ian.

-

The homeowners’ InsurTech reported that it has received approximately 6,800 claims associated with Hurricane Ian to date.

-

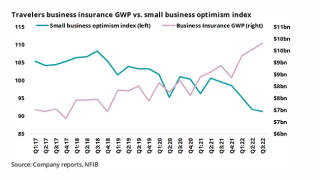

The firm reported better than anticipated earnings factoring in Ian, but a slowing economy could cloud the outlook.