Homeowners' insurance

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

Critics claim the dispute system denies consumers' key legal rights.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

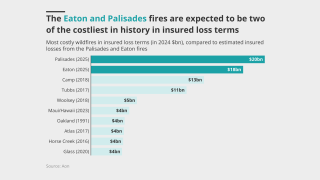

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The business has been ~70% owned by White Mountains since January 2024.

-

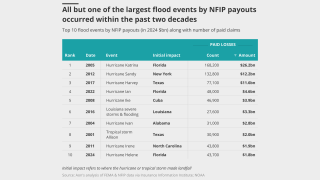

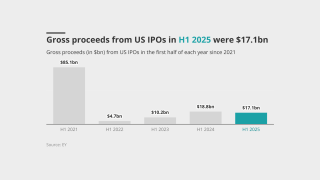

Neptune’s stock price jumped 25% on the first day of trading.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

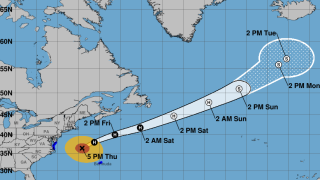

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

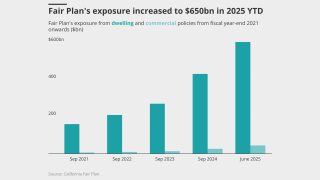

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The fundraising round brought in $50mn for the insurer.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The company generated $71.4mn in revenue for H1 2025.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

This is the first rate filing to use the recently approved Verisk model.

-

The insurer said it expects to begin writing business by the end of the month.

-

The company plans to launch in New York and New Jersey next year.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

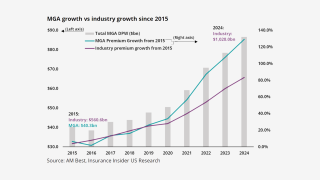

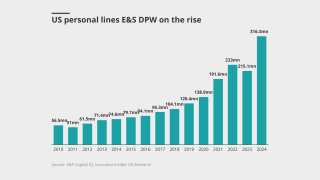

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

Rates continue to fall across the state but are firmer in the southeast region.

-

The carrier sees opportunities to grow in New York, the mid-Atlantic and Florida.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The gross loss ratio for the homeowners InsurTech fell by 12 points last quarter.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

Smaller accounts remain less affected by an influx of MGAs.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The company adjusts its rate options to expand California business under the new cat model.

-

At least 14 new companies have opened up shop in the state in recent years.

-

As the IPO window opened, American Integrity, Slide, Ategrity and others followed Aspen.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

The Floridian has been approved to potentially assume 81,000 policies total.

-

The class can collectively challenge State Farm’s property claims calculations.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Category 4 and 5 storms could become more common and hit further north.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

The floods have killed at least 81 people, with dozens more missing.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The company said the reduction was due to years of steady improvements.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

The insurer intends to take on up to 81,040 policies this year.

-

Much was learned after the fires, but it could take years before that data influences models.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

Slide will also expand its footprint to New York and New Jersey towards the end of the year.

-

The carrier is pricing shares at the upper end of the range announced this month.

-

Florida regulators have also approved takeouts for Mangrove and Slide.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

Lara approved an interim rate increase for the company just weeks ago.

-

Hippo will also provide capacity for existing and future MSI programs.

-

The regulator said further measures could still be passed in this session.

-

The Floridian is the third insurance company to go public in 2025.

-

White Mountains invested $150mn in the retail platform earlier this year.

-

Estimates on what a cat five in downtown Miami could cost vary, but it would be painful for reinsurers.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The program includes all perils coverage and subsequent event protection.

-

A week ago, this publication revealed that Slide was pressing ahead with its IPO plans with an S-1 filing.