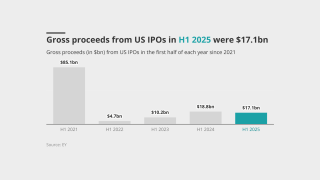

IPOs

-

Sources said the Floridian insurer has been working with Deutsche Bank on the listing preparations.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

The $21/share pricing falls in the middle of the expected range.

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

Sources said they expect the carrier’s listing to raise about $100mn.

-

Sources said that the carrier’s listing is expected to raise around ~$100mn.

-

The company is estimating its IPO price at $18-$20 per share.

-

The company generated $71.4mn in revenue for H1 2025.

-

The PE-backed MGA has Morgan Stanley, Bank of America and JPMorgan advising.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

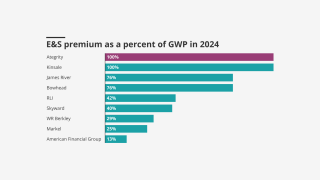

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

As the IPO window opened, American Integrity, Slide, Ategrity and others followed Aspen.

-

Shares opened at $28.50 each, well above the $21 offer price.

-

The IPO was priced at $21 per share, up from the previous target range of $18-$20.

-

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

The PE-backed MGA lined up Morgan Stanley, JP Morgan and Bank of America to advise.

-

The IPO price is expected to be $18-$20 per share.

-

The company resumed work on a public offering in September.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

Slide will also expand its footprint to New York and New Jersey towards the end of the year.

-

PwC reported that deal volume decreased to 209 deals from 297, but values climbed to $30bn from $20bn.

-

The carrier is pricing shares at the upper end of the range announced this month.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

The Floridian is the third insurance company to go public in 2025.

-

The offering comes after Acrisure’s $2.1bn convertible pref share raise.

-

The company filed its S-1 in March, with a 2024 CoR of 93.9%.

-

A week ago, this publication revealed that Slide was pressing ahead with its IPO plans with an S-1 filing.

-

Acrisure followed the recaps of Hub International and Broadstreet Partners.

-

This publication reported earlier today that the S-1 filing was imminent.

-

This publication reported earlier this year that the carrier is targeting a $250mn-$350mn raise.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Permanence and independence of a public company would be valuable, he told this publication.

-

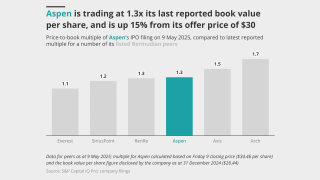

The company completed its upsized IPO last week and traded up to 1.3x book.

-

The Tampa-based insurer says it will use the capital for general corporate purposes.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

The initial offering includes 6,875,000 shares of common stock.

-

The preferred shares will mandatorily convert to common equity on an IPO.

-

The offering launched last week with a valuation between $103mn and $116.8mn.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The initial offering will include 6,875,000 shares of common stock.

-

The carrier is offering shares priced at $29-$31.

-

Sources said JP Morgan and RBC are advising the brokerage.

-

The Floridian company applied to be traded on the NYSE.