James River

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

The two executives join from Markel and Arch, respectively.

-

Lisa Binnie will succeed him as president of the company’s specialty admitted segment effective September 1.

-

James River said the court was right to dismiss the fraud case.

-

The company said the judge overlooked key issues in dismissing its fraud case.

-

The carrier’s US redomicile is expected for later this year and brings a one-time $10mn-$13mn benefit.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

He will serve as an independent non-executive member.

-

The judge ruled the deal relied too heavily on Bermuda law for US law to apply.

-

The company has reduced its exposure on large commercial auto and property.

-

Richard Schmitzer will retire as E&S president and CEO, and Todd Sutherland will succeed him.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Shareholders say the stock has declined around 59% in the past year while book value has dropped ~30%.

-

On Monday, the firm reported a Q4 CoR of 155.1%, versus 98.1% a year ago.

-

Enacting SB 360 may have created a spike in construction claims in Florida.

-

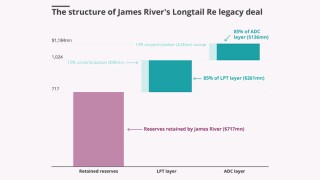

Q4 net retention was impacted by the previously announced ADC.

-

Enstar and Gallatin’s move into the common equity is a bull sign, but it will take years to know if the ADC will hold.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

The firm announced Q3 results alongside strategic actions that included an ADC deal with Enstar.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

Sources said the E&S insurer is seeking to draw a line and trade forward as an independent business.

-

Fleming alleges fraud and misrepresentations on the part of James River.

-

Negotiations come after Insurance Insider US revealed that the Bermudian was running an auction.

-

James River will also oppose a Fleming motion to uncover additional documents.

-

The firm’s submission flow rose 10%, driven by environmental and general casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Longtail Re deal buys the specialty insurer time to secure its future, or an exit for shareholders.

-

-

Fleming files claims against James River, its CEO Frank D’Orazio and group CFO Sarah Doran.

-

The backing represents a rare move from a collateralized reinsurer to take on risk in the legacy space.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

The move comes as the wait for a deal for the whole group passes the six-month mark.

-

During Q1, the firm’s E&S GWP dropped 6.6% to $213.7mn.