Legacy

-

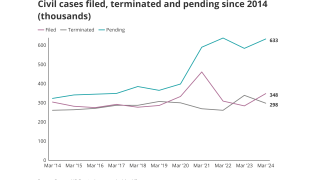

Civil case, nuclear verdict and claims count data show worrying trends.

-

The deal covered US and European P&C liabilities for Accelerant's 2020-2021 underwriting years.

-

The legacy firm said the deal would strengthen its Bermuda operations.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

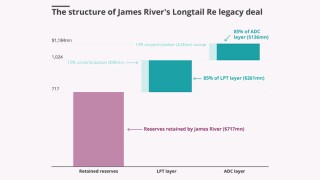

The Longtail Re deal buys the specialty insurer time to secure its future, or an exit for shareholders.

-

-

Acquirers are increasingly discerning around deals, according to a report.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

The liquidation will let the company sell its Accredited arm to Onex via an alternative transfer structure.

-

The Canadian PE house is delaying close and seeking to renegotiate aspects of the deal.

Related

-

Sixth Street completes $5.1bn acquisition of Enstar

July 02, 2025 -

Compre appoints HSCM’s Bardon to newly created CUO role

June 12, 2025 -

Enstar Q1 net profit falls 58% to $50mn

May 02, 2025