-

He has pleaded not guilty to the criminal charges, which carry potential life sentences.

-

The broker also alleges a coordinated effort undermine client confidence.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

At the year’s mid-point, there were 111 new SCAs filed in federal courts.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

Under the new law, vehicles will only be required to carry $100,000 in PIP per person.

-

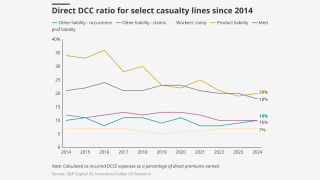

Litigation costs continue to weigh on long-tail lines, but effects of tort reform are visible.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

The MGA and parent company Roosevelt Road Re have until July 21 to file a second amended complaint.

-

The rules would require paid rest breaks, among other measures.

-

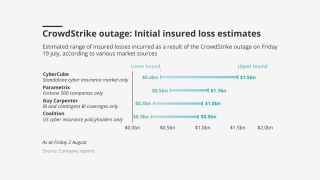

It didn’t have a major impact on insurers’ finances – instead, it served as a wake-up call.