-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

The legal setback came as publication of a Fema reform report was postponed.

-

The company announced four internal promotions this week.

-

Trump’s shadow loomed over the beachside sessions.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

The highest portion of losses was experienced in Alberta.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Former chief growth officer Michael Anderson has taken on the CEO role.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The executives are based in Seattle and New York.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

A jury awarded $32.3mn for repair costs, and $80mn for business interruption.

-

The peril has been historically difficult to model compared to others.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

The deal to reopen the government also extended the NFIP.

-

The MGA began offering US commercial E&S property products in December.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The credit can now be applied to mitigation against operational losses.

-

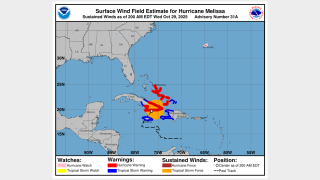

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has now posted rate increases for 37 consecutive quarters.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The global insurer will need to convince investors on the quality of the book.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

APIP is one of the world’s largest property programs.

-

September’s medical care index increase follows a 0.2% drop in August.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Old Republic said the acquisition is expected to close in 2026.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

A quiet wind season is also expected to further soften the property market.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.