-

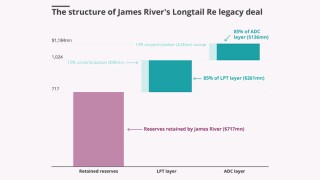

Fleming Re bought the James River Re legacy book in 2024.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Q2 saw a steady stream of activity in legacy, but volumes dipped slightly from Q1.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

The take-private deal was announced in July 2024.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

The reduction was due to impacts from investments and less favourable PYD.

-

Axis is retroceding $2.3bn of reinsurance segment reserves to Enstar.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

The legacy carrier reported an operating loss of $45.3mn for the year.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

Dickerson has spent over three years at the reinsurance broker.

-

The second half of the year was significantly more active for the legacy market.

-

The restructuring arrangement is designed to protect creditors.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

The three lines add up to 80% of the deal.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

The UK and Ireland have also seen “increased activity”, with four deals announced.

-

Nicola Gaisford joined RiverStone from R&Q last year.

-

RiverStone is assuming $1.2bn of a $1.6bn legacy deal.

-

Sources said the E&S insurer is seeking to draw a line and trade forward as an independent business.

-

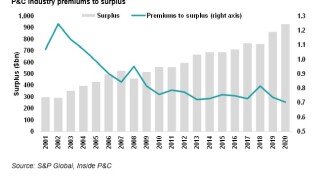

Future deal flow in the US could come from more adequately reserved liability lines.

-

The take-private is expected to close by mid-2025.

-

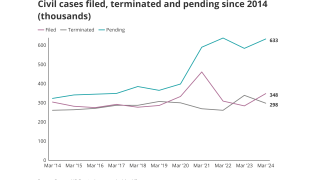

Civil case, nuclear verdict and claims count data show worrying trends.

-

The deal covered US and European P&C liabilities for Accelerant's 2020-2021 underwriting years.

-

The legacy firm said the deal would strengthen its Bermuda operations.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The Longtail Re deal buys the specialty insurer time to secure its future, or an exit for shareholders.

-

-

Acquirers are increasingly discerning around deals, according to a report.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

The liquidation will let the company sell its Accredited arm to Onex via an alternative transfer structure.

-

The Canadian PE house is delaying close and seeking to renegotiate aspects of the deal.

-

Of that total, $312.5mn was allocated to resolve the PFAS claims.

-

The vehicle will give the legacy carrier a US platform.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

The agreement from Fleming to honour original terms still leaves it open to long-term damage.

-

Increasingly, deals are being brought to market but not transacted on.

-

The market is shifting towards capital relief, with fewer, larger deals.

-

The company reiterated its commitment to consummating the Accredited sale.

-

Its PE owners have been exploring strategic options since May last year.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

The transaction would have been one of the largest the market has seen for years.

-

The executive joined the legacy carrier as CIO in 2020.

-

As part of the transaction, Carrick will assume the company’s staff and operations.

-

Just over half of votes cast were in favour of the $465mn sale to Onex.

-

The regulator has also paused the redemption of the company’s $20mn Tier 2 floating-rate subordinated notes.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

-

The R&Q share price has plummeted since the sale of the ~$1.8bn-premium fronting arm was announced 10 days ago.

-

The revised status follows the recent announcement that R&Q Insurance Holdings has agreed a sale of its Accredited program.

-

R&Q said it expects ongoing operating losses after the sale as it works on transitioning its legacy business to a fee-based model, with plans to explore further transactions to de-risk and reduce volatility.

-

R&Q CEO William Spiegel will transfer to the Accredited program management business.

-

Although the total deal values for 2022 and 2023 were almost identical, PwC noted that one-third fewer deals were announced in the more recent half-year period.

-

Catalina put its Irish subsidiary up for sale in May as it looks to streamline operations.

-

-

The insurer has been working to build a reputation for favorable reserve development after past sins.

-

The transactions were written into Darag Bermuda and offer full legal finality for the US workers’ compensation book of the latter and the US workers’ comp and automotive liability books of the former.

-

The legacy carrier reported significant unrealised investment losses.

-

Accredited and R&Q Legacy will now operate under two separate holding companies within the group.

-

The carrier had estimated a write-off in the range of $25mn-$35mn.

-

The legacy carrier’s wholly owned subsidiary will reinsure 80% of RACQ’s motor vehicle compulsory third-party insurance liabilities of accident years 2021 and prior.

-

Gallagher Re is looking to increase its presence in the North American large-account space, where it is underweight compared with rivals.

-

The loss portfolio transfer deal was completed in March of this year, covering £200mn of UK motor insurance claims.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The deal includes a diversified book of international and NA financial lines, European and NA reinsurance portfolios, and several US discontinued programs.

-

The company believes the program management and legacy businesses would work better as standalone operations.

-

The appointment comes as the legacy and investment banking divisions join under common management.

-

Last week, SiriusPoint and Compre signed an LPT deal covering $1.3bn of reserves.

-

In tandem, the company elevated David Ni as chief strategy officer, Paul Brockman as chief operating officer and Matthew Kirk as chief financial officer.

-

Following the completion of this transaction, Enhanzed Re became a wholly owned subsidiary of the legacy carrier.

-

2022 represented a period of bumper legacy deal-making for the legacy carrier.

-

After taking a $90mn capital charge relating to the former Ace run-off asbestos book in 2021, the group is looking to liquidate the entity.

-

RACQ will cede net reserves of approximately A$360mn (~$247mn), and Enstar will provide around A$200mn (~$130mn) of cover in excess of the ceded reserves.

-

The deal regards international and North America financial lines, European and North American reinsurance portfolios, and several US discontinued programs.

-

The number of global, non-life run-off deals dropped to 48 over 2022, compared with 54 in 2021, according to a report from PwC.

-

Dean Dwonczyk established Catalina in 2005 with former UK CEO Chris Fagan, who exited the business in February 2021.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Andrew Lewis has outlined growth plans for Xitus, a niche global legacy firm he has co-founded that will focus on non-life and reinsurance deals of $5mn-$50mn.

-

Legacy firm Darag has completed a reinsurance agreement with an undisclosed US carrier that carries a transaction value of around $15mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The transaction covers net reserves for losses and loss expenses of approximately $400mn and provides ground-up cover to a policy limit of $605mn.

-

The CEO addressed the progress of the strategic process in his first interview since taking the role.

-

The tech company contributed $139mn to its asbestos subsidiary companies as part of the deal.

-

Around 50% of the $100bn growth in the market emanated from deals struck in North America.

-

The company expects to announce another similarly sized deal soon, and the rest of the year’s pipeline is “beyond expectations”.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Guy Carp is advising the specialty insurer as it seeks to draw a line under adverse development from its historic program book.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The transaction will eliminate Enstar’s direct exposure to cat business and boost its book value.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The transaction would mark a fifth legacy deal struck by Argo as it seeks to clean up its back book amid a strategic review.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier was pushed to a net loss of $493mn by mark-to-market losses in its investment portfolio in Q2.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The sector saw a variety of deal sizes, with transaction values ranging in H1 from $10mn to $3.1bn.

-

The outgoing exec will remain as a board member, while chief strategy officer David Ni will lead the company’s M&A strategy going forward.

-

The redomicile is part of a diversification strategy to broaden the carrier’s focus from Continental Europe to Lloyd’s and North America.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The existing $770mn adverse development cover between the two parties has been absorbed as part of the deal.

-

The legacy specialist has faced a downturn in profits following a bumper run of results through 2020 and 2021.

-

As part of the recent LPT deal, the Cinven-backed legacy firm also acquired the team from SiriusPoint’s run-off division as part of its push into the US.

-

Inside P&C’s news team runs you through the key developments from the last week.

-

The deal is the largest in Enstar’s history and sets Aspen up either for a sale to a strategic buyer or a return to the public markets.

-

In addition, Fortitude Re’s subsidiary Fortitude Reinsurance Company has obtained approval to operate as a reciprocal jurisdiction reinsurer in the US.

-

The legacy acquirer announced last week the purchase of a Texas entity to use as its US-based carrier for legacy deals.

-

The transaction marks the legacy carrier’s first acquisition in Continental Europe.

-

Legacy acquirer Darag has entered into a Stock Purchase Agreement and received the relevant regulatory approval for the purchase of a Texas-based insurer in run-off.

-

Brid Reynolds will be responsible for the oversight and development of risk functions globally.

-

The deal brings an end to Prudential’s participation in non-core legacy property and casual business.

-

James River ceded approximately $345mn of commercial auto liabilities relating to business written for Uber’s ridesharing business.

-

The newcomers are finding it more difficult to disrupt the sector than they had expected.

-

Wolf will remain with the company to assist Gregory during a transition period lasting until September 30.

-

The deal follows a $37mn reserve charge taken by Third Point Re just ahead of the closing of its merger with Sirius International in February.

-

The PE house will inject growth equity capital into Premia after the all-paper deal.

-

The deal comes shortly after the legacy specialist established a $265mn sidecar, Elevation Re.

-

He has held a seat on the company’s board since 2017.

-

The deal with CNA subsidiary Continental Casualty reinsures excess workers’ compensation business relating to 2007 and prior-year business.

-

The reinsurance pact with Enstar’s Cavello Bay has an aggregate limit of $1bn.

-

The landmark transaction with Sentry requires court clearance after gaining the state insurance commissioner’s nod.

-

The legacy carrier is the first to utilise a recently enacted framework in Oklahoma.

-

The legacy bidder prevails over Enstar, Premia and start-up Marco.

-

Sources said the liabilities relate to business written by unit Mid-Continent Casualty Company.

-

Reserves in scope have not been finalised, but sources estimated the figure to be in the low hundreds of millions of dollars.

-

The deal sets an exit plan for Stone Point from the Bermuda group’s North Bay entity if that business isn’t reorganised by year-end.

-

The deal, first announced in March, secures Aspen $770mn in cover for losses in excess of $3.8bn, as well as $250mn in excess $4.8bn.

-

The carrier has agreed to reinsure legacy business underwritten by Zurich from 1 October 2015 to 30 September 2018.

-

Aspen is the latest to pass the risk of unfavourable reserve development on to reinsurers.

-

The carriers claim in a lawsuit that Maiden wrongfully stopped paying claims in late 2018.

-

The stock-performance-related plan comes as the carrier extends Dominic Silvester's contract, and those of the president and COO, by three years.

-

Legacy specialist continues expansion with first Montana captive.

-

The legacy carrier is understood to be looking for a replacement with public sector experience.

-

The Pine Brook founder (pictured) becomes deputy chairman immediately and will take the chairman's role in about a year's time.

-

The live carrier will cease writing business with immediate effect and become a platform for the legacy acquirer's Asian run-off expansion.

-

The legacy carrier is in line to seal RITC deals following the closure of its acquisition of CTMA and Syndicate 1884.

-

The ratings agency said the transaction reduced the carrier’s exposure to higher risk legacy products.

-

Investment income and an improved performance at StarStone lift the group result.

-

Liabilities involved are associated with asbestos and environmental claims.

-

The reinsurer's shares rose more than 9 percent on news of the board rejecting the offer.

-

The executive is understood to have teamed up with former colleagues Harris and Hernon.

-

Asbestos payments in 2018 declined by 14 percent to $2.1bn, according to the ratings agency.

-

The transaction has now received regulatory approval and has closed.

-

John Cashin said the legacy space is too complex to be easily tackled with technology solutions.

-

The executive has investment from private-equity house Partners Group and is already considering transactions.

-

The executive moves to the Hamburg-based company from the position of head of legacy solutions restructuring in North America.

-

The Canadian conglomerate will buy out all of Omers minority stake in Brit.

-

Global specialty insurer StarStone reported $51mn of adverse development