-

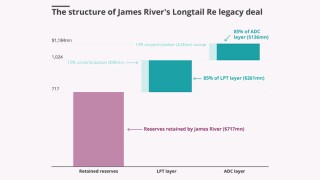

Fleming Re bought the James River Re legacy book in 2024.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Q2 saw a steady stream of activity in legacy, but volumes dipped slightly from Q1.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

The take-private deal was announced in July 2024.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

The reduction was due to impacts from investments and less favourable PYD.

-

Axis is retroceding $2.3bn of reinsurance segment reserves to Enstar.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

The legacy carrier reported an operating loss of $45.3mn for the year.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

Dickerson has spent over three years at the reinsurance broker.

-

The second half of the year was significantly more active for the legacy market.

-

The restructuring arrangement is designed to protect creditors.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

The three lines add up to 80% of the deal.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

The UK and Ireland have also seen “increased activity”, with four deals announced.

-

Nicola Gaisford joined RiverStone from R&Q last year.

-

RiverStone is assuming $1.2bn of a $1.6bn legacy deal.

-

Sources said the E&S insurer is seeking to draw a line and trade forward as an independent business.

-

Future deal flow in the US could come from more adequately reserved liability lines.

-

The take-private is expected to close by mid-2025.

-

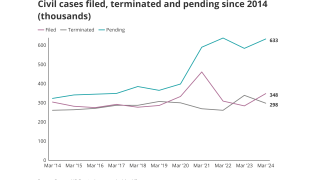

Civil case, nuclear verdict and claims count data show worrying trends.

-

The deal covered US and European P&C liabilities for Accelerant's 2020-2021 underwriting years.

-

The legacy firm said the deal would strengthen its Bermuda operations.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The Longtail Re deal buys the specialty insurer time to secure its future, or an exit for shareholders.

-

-

Acquirers are increasingly discerning around deals, according to a report.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

The liquidation will let the company sell its Accredited arm to Onex via an alternative transfer structure.

-

The Canadian PE house is delaying close and seeking to renegotiate aspects of the deal.

-

Of that total, $312.5mn was allocated to resolve the PFAS claims.

-

The vehicle will give the legacy carrier a US platform.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

The agreement from Fleming to honour original terms still leaves it open to long-term damage.

-

Increasingly, deals are being brought to market but not transacted on.

-

The market is shifting towards capital relief, with fewer, larger deals.

-

The company reiterated its commitment to consummating the Accredited sale.

-

Its PE owners have been exploring strategic options since May last year.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

The transaction would have been one of the largest the market has seen for years.

-

The executive joined the legacy carrier as CIO in 2020.

-

As part of the transaction, Carrick will assume the company’s staff and operations.

-

Just over half of votes cast were in favour of the $465mn sale to Onex.

-

The regulator has also paused the redemption of the company’s $20mn Tier 2 floating-rate subordinated notes.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

-

The R&Q share price has plummeted since the sale of the ~$1.8bn-premium fronting arm was announced 10 days ago.

-

The revised status follows the recent announcement that R&Q Insurance Holdings has agreed a sale of its Accredited program.

-

R&Q said it expects ongoing operating losses after the sale as it works on transitioning its legacy business to a fee-based model, with plans to explore further transactions to de-risk and reduce volatility.

-

R&Q CEO William Spiegel will transfer to the Accredited program management business.

-

Although the total deal values for 2022 and 2023 were almost identical, PwC noted that one-third fewer deals were announced in the more recent half-year period.

-

Catalina put its Irish subsidiary up for sale in May as it looks to streamline operations.

-