Markel

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

The international division is seeking a new London market manager.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

The executive will oversee the direction and management of the firm’s liability portfolio across the US and Canada.

-

The deal was announced last month.

-

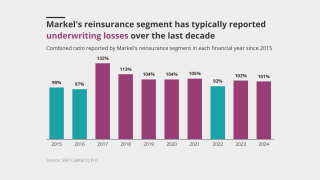

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The president expects to see benefits from the deal in H2 2026.

-

Lion's share of Markel Re staff have been offered roles at Ryan, with others to work on run-off.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

Finsness joined the carrier in 2014 and was head of casualty claims in Bermuda from 2017 to 2023.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

The latest E&S player planning to IPO remains a “show me” story.

-

The moves come as the company said it will "double down" on US E&S.

-

Customers are demanding more in a larger move towards the E&S market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The business will divide into US wholesale and specialty, and programmes and solutions.