Markel

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

The international division is seeking a new London market manager.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

The executive will oversee the direction and management of the firm’s liability portfolio across the US and Canada.

-

The deal was announced last month.

-

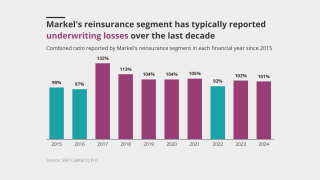

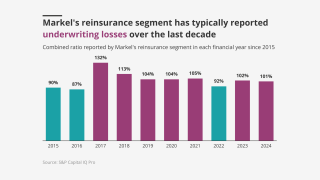

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The president expects to see benefits from the deal in H2 2026.

-

Lion's share of Markel Re staff have been offered roles at Ryan, with others to work on run-off.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

Finsness joined the carrier in 2014 and was head of casualty claims in Bermuda from 2017 to 2023.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

The latest E&S player planning to IPO remains a “show me” story.

-

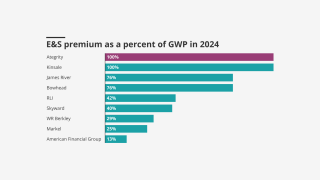

The moves come as the company said it will "double down" on US E&S.

-

Customers are demanding more in a larger move towards the E&S market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The business will divide into US wholesale and specialty, and programmes and solutions.

-

The insurer has not yet announced a successor for the 32-year company veteran.

-

Meco's 2024 gross written premiums totaled $63mn.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

Markel also announced the appointment of Jon Michael to its board.

-

Markel Insurance is made up of the firm’s three primary underwriting businesses.

-

Markel had announced the exit from the line of business in the US last year.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

The group should also tilt capital allocation away from M&A and deepen its disclosure.

-

The company did not take questions on its recently announced business review.

-

The insurer acknowledged additional claims in 2025 would be “reasonably possible”.

-

The specialty insurer reported favorable developments in both its insurance and reinsurance segments.

-

The board will lead the review following feedback from shareholders including activist investor Jana.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

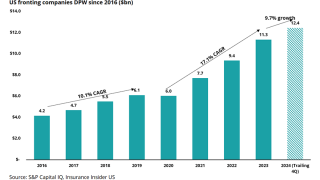

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

The executive joins RPS after almost 12 years at Markel.

-

The lawsuit involves an alleged $100mn+ Ponzi scheme.

-

Executives noted that US casualty and professional lines development has been close to flat this year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

This will not impact Markel International, which will continue to operate out of the UK.

-

Mullarkey joins from Allianz Global Corporate & Specialty.

-

State National will provide $160mn of coverage to James River as part of the deal.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Markel acquired 98% of Valor last month and has the option to buy the remaining equity stakes.

-

Jennifer Devereaux will provide overall leadership of casualty products.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

She will develop regional underwriting strategy and product offerings.

-

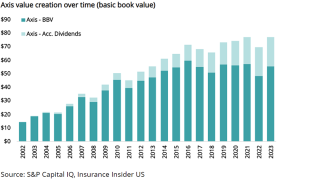

Industry trends show the Axis book value growth goal may be hard to hit.

-

She will oversee US and Bermuda claims operations.

-

He brings 23 years of insurance industry experience.

-

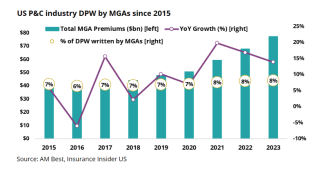

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

The exits represent less than 2% of the company’s insurance segment operations annually.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

-

The carrier stopped accepting new business starting February 7.

-

Rodrigues’s retirement caps nine years with Markel.

-

-

The executive discussed Markel’s performance in an annual shareholder letter.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

The carrier did not consider pursuing an LPT deal to address the GL and PL issues.

-

The figure was disclosed in the group's recent 8-K disclosure.

-

Insurance Insider US runs you through the earnings results for the day.

-

The committee claims Chaucer waited until it had ‘maximum leverage’ over other debtors.

-

Brian Costanzo, who joined the company in 2009, was previously CFO of Markel’s insurance business.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

After joining the firm in 2018 from Chubb, Cox oversaw the carrier’s Markel Specialty and Markel International divisions.

-

This replaces a $750mn program authorized in February 2022, under which $633mn of the company's common stock was repurchased as of November 29.

-

The programme services carrier will serve UK MGAs from 1 January.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

A credit loss owing to a fraudulent letter of credit from Vestto added 1 point to the combined ratio in Q3, insurance president Jeremy Noble told analysts during a conference call.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Markel named Alex Martin, Markel’s current CFO, as Sanders’ successor.

-

The start-up MGU will initially focus on real estate, hospitality and leisure, financial institutions and professional services industries.

-

Based in New York, the executive will report to Markel’s terrorism director Ed Winter, who is based in London.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This is manifesting itself in sharp rate gains in the specialty insurer’s property book, while public D&O continues to decline at alarming rates.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The appointments include elevations within wholesale and retail distribution, as well as commercial lines and construction.

-

Pollaro joined Markel in 2009 and most recently served as managing director of management and professional liability for Markel Specialty.

-

Markel established the new positions to address the unique needs of its wholesale and retail business models.

-

The company is making the change to provide greater definition around its three engines of insurance, investments, and a group of diverse businesses in Markel Ventures.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The loss portfolio transfer deal was completed in March of this year, covering £200mn of UK motor insurance claims.

-

This may slow premium growth but ensure sustainability long term, according to its insurance president.

-

Markel also disclosed that its Q1 2022 underwriting results included $35mn of losses attributed to the Russia-Ukraine conflict.

-

He has over 15 years of experience in the insurance business, working in multiple areas, including catastrophe risk management and ceded reinsurance.

-

The executive will be based in Markel's Glen Allen office and report to chief claims officer Nick Conca.

-

Scott Bailey previously spent 12 years at CFC managing the technology and media division.