Medmal (Medical malpractice)

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

There’s nothing medical about SAM claims.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

The new chief executive has served on PI’s board since 2018, including as chair.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

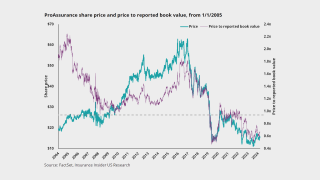

The change reflects the insurers’ recent deal with ProAssurance.

-

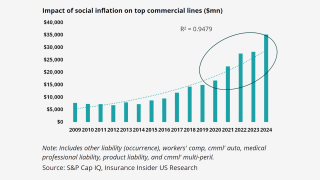

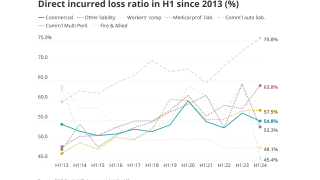

Despite tort reform, physicians’ insurers are struggling with the same loss inflation challenges as other liability peers.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

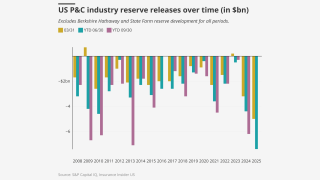

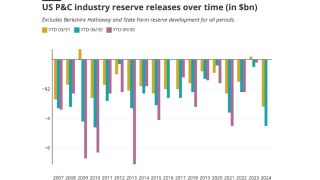

High H1 reserve releases of $7.4bn were driven by the largest of carriers.

-

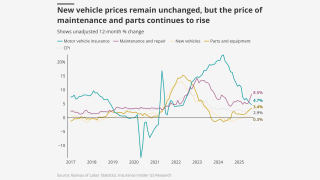

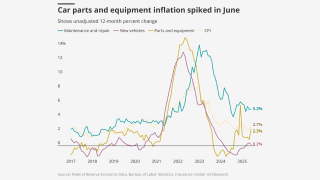

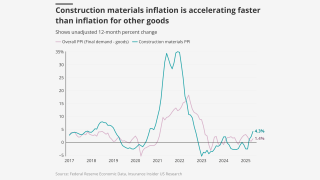

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

An industry veteran of 34 years, the executive is known for placing US healthcare business in London.

-

Rising inflation could raise claims severity but also increase investment income.

-

PL coverage is being stripped out of admitted, packaged policies and increasingly purchased in the E&S market.

-

The FTC granted early termination of the waiting period, leaving the acquisition on track to finish in early 2026.

-

The vote paves the way for the finalization of the deal in the first half of 2026.

-

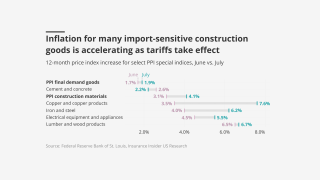

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

The impact of SAM claims is reverberating through the tower and the broader marketplace beyond hospitals.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

What insurers can learn from the history that led to this deal.

-

ProAssurance brands will be transitioned to The Doctors Company in "all/most markets" over time.

-

The Californian insurer is buying the medmal carrier for $25.00 per share, or a ~60% premium.

-

The executive is returning to Tysers after nearly four years at Price Forbes.

-

Profitability over growth continues to be the company’s “mantra”.

-

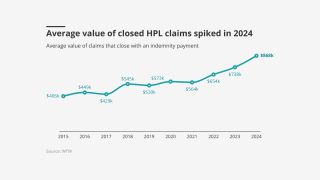

Frequency has rebounded, while severity has spiked beyond the pre-Covid-19 years.

-

Batch coverage is also coming into focus as insurers look for ways to reduce exposure to large losses.

-

Executives said the company continues to shrink its book of business in markets with poor underwriting conditions.

-

The carrier will only continue to offer lead capacity to some existing accounts.

-

The all-items CPI increased 2.5% over the last 12 months.

-

Increasing loss picks in difficult lines suggest top writers are accepting shifting loss trends.

-

The highest releases in nearly 15 years challenge conventional wisdom on reserving.

-

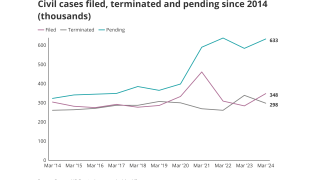

Civil case, nuclear verdict and claims count data show worrying trends.

-

Rand said the company remains “very bullish on the long-term value that NORCAL brings.”