Mercury General

-

This is the first rate filing to use the recently approved Verisk model.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

The company adjusts its rate options to expand California business under the new cat model.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

The ratings agency has revised Mercury’s outlook from stable to negative.

-

The company will ‘aggressively pursue subrogation’ for the Eaton Fire.

-

The LA-based carrier said it did not expect the event to result in credit defaults.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

Fitch said 1Q wildfire losses could add 6% to 10% to Mercury’s CoR.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

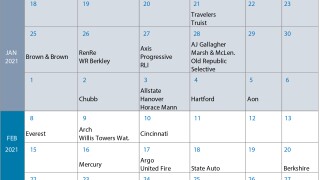

Insurance Insider US runs you through the earnings results for the day.

-

Sources said that TMA ran a profitable book in California that included personal auto and homeowners’ policies.

-

The executive will continue reporting directly to Mercury General CEO Gabriel Tirador.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The cat losses outweighed the Q1 $15mn reserve charge that resulted from lower-than-estimated losses and loss adjustment expenses in the homeowners’ business.

-

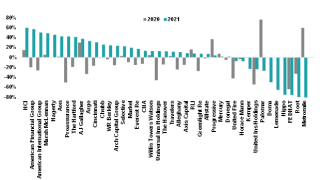

The downgrades have been implemented due to the group’s significant earnings deterioration in 2022 and declining investment performance.

-

On Tuesday, the personal auto-focused carrier reported a 10.4-point deterioration in its combined ratio to 115.8%.

-

The carrier cited inflation, repair and part costs, supply chain issues and labor shortages as the drivers behind an increase in auto loss severity.

-

-

The carrier cited inflation, supply chain issues and labor shortages as the drivers behind an increase in auto loss severity and its third-quarter loss ratio compared to Q3 2021.

-

Pressure on the Californian insurer’s stock mounted this morning after it reported a Q2 11.7-point deterioration in its combined ratio to 106.6% yesterday.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The California-based carrier, which focuses on personal auto, blamed rising costs for parts and labor, along with medical inflation, for the swing to an underwriting loss.

-

Mercury Insurance denies allegations that it did not comply with the state’s consumer protection laws.

-

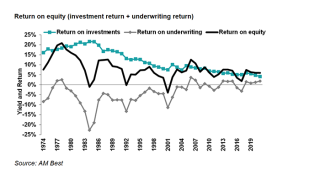

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

Auto-focused Mercury General swings to an operating loss as costs for auto parts, repairs mount, with the company also citing social inflation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Cat contribution on the combined ratio remained around 2% as the company was hit with $18mn cat losses during the last quarter of the year.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Mercury General reports a 47.5% drop in Q3 operating profit despite higher premiums.

-

Joseph, who's father founded Mercury General in 1961, has held positions within the company since 2009.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

Net written premiums at the carrier were down 0.4% in the quarter to $950mn.

-

Operating profits surged sixfold to $76mn during Q4.

-

Inside P&C’s research team examines some of the areas that will be closely watched during the results season.

-

The company reported diluted earnings per share of $1.23, comfortably beating an analyst consensus of $1.06 per share.

-

The “empty-street” economy has left auto exposed names in a relatively favorable position, highlighted by a second quarter of strong earnings growth and beats when compared to street estimates.

-

The move follows a trend of increased reinsurance buying by Mercury, since the devastating wildfires of 2018.

-

The firm expects to pay an additional $22mn in rebates for July premium in August.

-

Yesterday morning, Mercury General released its Q1 results, which included an earnings beat and a 1.3pt improvement in its headline combined to 95.9%.

-

Mercury General reported improved YoY earnings but a notable increase in frequency.

-

No loss was large enough to breach the per-occurrence limits of the carrier’s reinsurance treaties.

-

On Monday morning, Mercury General reported disappointing earnings for the quarter, including a 30% decline in its operating EPS to $0.78 per share. The result missed analyst estimates of $1.15 per share. The shares closed down 11%.