Marsh McLennan

-

The federal judge said South has direct knowledge about a previous raid involving Aon.

-

The company also promoted Zulma Suarez to CEO of Colombia and Venezuela.

-

A motion to dismiss argues the case should not have been filed in federal court.

-

The policy includes a $200mn limit with an additional $100mn for side A coverage.

-

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

Fears relating to an economic downturn continue to dominate concerns.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Last month, Insurance Insider US revealed that MMA was set to buy Atlas following a sale process.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

GC continues to pursue Willis Re and individuals in court.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

A motion by defendants to dismiss the case was also denied.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The dismissal comes after the judge in the case had stayed it just a day earlier.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

Earlier this year, this publication revealed that Atlas was considering a potential sale.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Marsh is also suing a second tier of former Florida leaders.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

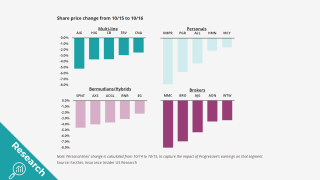

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Early Q3 earnings reports point to worsening market conditions.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

The selloff may hint at headwinds for equity investors.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.