-

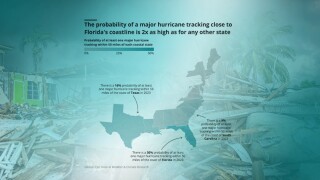

It’s unclear how long some insurers will be able to sustain the cost of doing business in Florida, whether the question is making it through another quarter, another hurricane season or another renewal.

-

The pivot from the industry’s arch decentralizer underscores the opportunities brokers are chasing in a deteriorating operating environment.

-

The group exited an off-strategy business at an attractive valuation – now it must give a clearer indication of where it is going.

-

Strong rhetoric from Munich Re means the US market will sooner or later have to take a position on cyber war wordings.

-

The company has been weakened somewhat, and the base case now is a return to grinding out new CEO Scott Egan’s refined strategy.

-

When a Grade A franchise like Hub refis at this kind of valuation, the read across to other assets is highly negative.

-

Senior departures, the Corebridge stock price and the arrival of Dan Loeb all throw up additional obstacles.

-

The billionaire’s mooted take-private will hinder CEO Egan’s efforts to steady the ship.

-

Cutting a multi-billion carrier in two looks likely to be the preserve of a select group.

-

While there were sparks of cheerfulness among attendees, a careful reading of the room showed that rationalism is superseding optimism.

-

Sources suggest that Aon has been proactive in weighing acquisitions since Q4, with a US mid-market platform the obvious gap.

-

The fronting carrier’s reinsurance write-down is the first crack in the segment’s impressive edifice – it won’t be the last.