-

The cyber InsurTech sits at the top of the pyramid with a $5bn valuation, but it plays in a risky sphere.

-

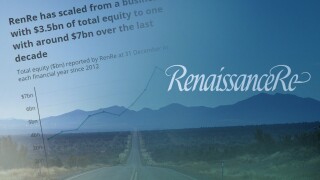

RenaissanceRe has always been a business with strong convictions and an assured management team, willing to carve out a path distinct from competitors.

-

The top-10 US retail broker has built probably the greatest growth story in the insurance market’s history.

-

A tougher environment for debt financing and a potential recession will reverse some of the remarkable tailwinds of recent years.

-

Selling Argo may be harder than you think given its Lloyd’s operation and questions around balance sheet strength.

-

The legislation aims to keep the homeowners market functional, but more change will be needed long term to make the Sunshine State an attractive place for insurance capital.

-

The Third Point hedge fund chief’s appointment to the board will provoke investor scrutiny of potential conflicts of interest.

-

The ~$60bn-premium marketplace is only going to grow, and in the aggregate can outperform insurers’ own underwriting.

-

These results will strengthen convictions on the turnaround, but questions remain around how it will fare in a market where all insurers are looking to grow.

-

The specialty insurer is trying to catch the end of favorable sector conditions, and macro conditions that could still support a listing if they stabilize.

-

The expectation that we would be talking about the slowing of the brokerage supercycle proved to be misplaced.

-

The insurance investor has what can feel like a sixth sense for timing the market to maximize value on exit.