-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

The timing is unhelpful as the global insurer tries to get on the front foot with M&A.

-

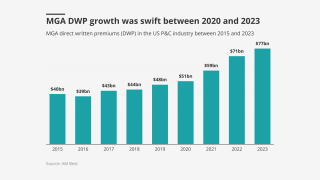

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

The global insurer will need to convince investors on the quality of the book.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

There’s nothing medical about SAM claims.

-

MGAs that are good operators will stick out compared to the rest.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

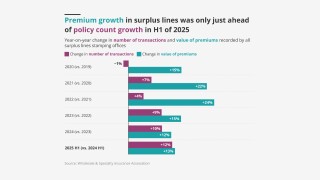

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

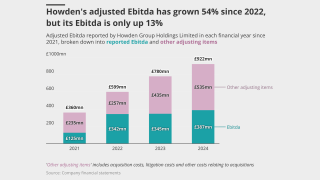

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

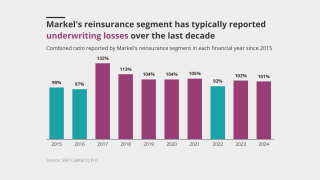

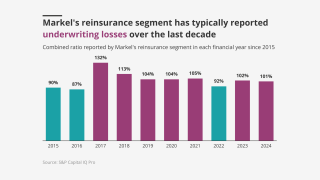

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

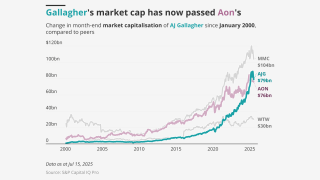

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

A London wholesaler broker would be a compelling second move.

-

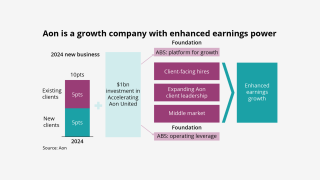

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The $10bn acquisition of Risk Strategies is the biggest broker deal relative to size we have seen.

-

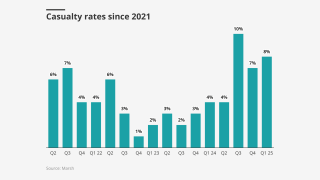

Rates and limits have done the heavy lifting to date – but there are other options.

-

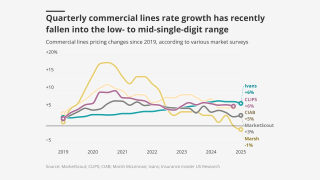

Large account and E&S property have gotten competitive faster than expected.

-

Writing credit wraps for LitFin firms and steering third-party assets to them should stop.

-

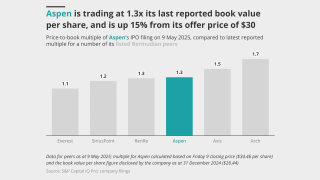

The company completed its upsized IPO last week and traded up to 1.3x book.

-

The take-up rate will depend on the price discount and market segment.

-

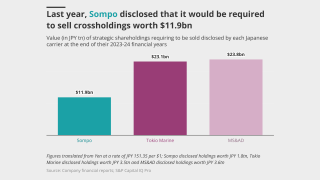

The conglomerate’s insurance subsidiaries will have to make do without some of their prior strategic advantages.

-

The facility is a nudge towards a structural change, not a full-out assault.

-

Business hates uncertainty and geopolitical tensions are off the charts.

-

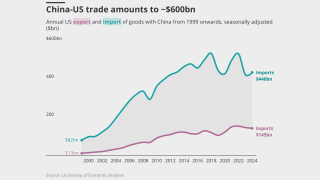

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Insurance Insider US examines potential tariffs’ impact on the PE-backed brokers amid the jammed conveyor belt.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

After a period of business building, MGAs will likely spend more time optimizing.

-

It makes sense for Next to secure a sale as an exit strategy in an increasingly challenging funding environment.

-

Cue a feeding frenzy from suitors and a frenzy of speculation from the market.

-

The non-peak peril is not secondary anymore.

-

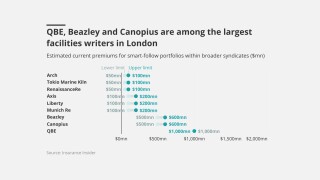

The big brokers are lining up London capacity to write follow lines on US risks.

-

The group should also tilt capital allocation away from M&A and deepen its disclosure.

-

Insureds often just want cover in place at the lowest price possible, and insurers oblige under the skeptical eye of regulators.

-

The Florida of 2022 lacked stability and saw many carrier insolvencies.

-

Challenges will include boosting the target’s organic growth, Building the Machine, and prepping for an IPO.

-

After a period of re-assessing risk appetite, underwriters were signalling growth again – that was, before the fires.

-

Risk Strategies looks like the deal that makes most sense, but other targets could include Galway or Hilb.

-

The transaction comes after Kestrel explored a deal last quarter to raise ~$150mn of capital.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

The deal is financially attractive, but risks diluting the jewel that is Gallagher’s US mid-market business.