PartnerRe

-

The loss was driven by nat cats and reserve adjustments in US casualty.

-

The segment’s underwriting results halved to $532mn in 2024 from $1.07bn in the prior year.

-

The executive will replace retiree Michael Miller.

-

The executive has also served as agriculture reinsurance VP at Navigators.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Markel executive Alan Rodrigues will lead the unit.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

The reinsurer experienced a “notable decrease” of catastrophe losses last year.

-

Jon Colello will become president in the management shake-up.

-

She succeeds Jonathan Schriber who joined Arch Reinsurance as US division president earlier this month.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Reinsurers have mostly grown since before the Covid crisis, but the type and timing of growth affects value creation,

-

Jarrier has been with the carrier for over two decades, most recently as head of worldwide pricing and analytics.

-

The non-life underwriting profit for the quarter came to $368mn compared with $313mn in the prior-year period.

-

Overall, the carrier posted $408mn of cat and man-made losses in Q3, up from $333mn a year earlier, of which $297mn related to Hurricane Ida and the European floods.

-

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

The carrier booked $45mn Q2 cat losses net of retrocession that included $41mn from Natal Floods and $4mn associated with the Australian floods.

-

The former Chubb exec will remain on the board as an independent director, along with president and CEO Jacques Bonneau.

-

The French mutual’s CEO Thierry Derez and chief of staff Sylvestre Frezal said the deal is a strategic move to adapt to new forms of risk.

-

Ruparelia, a former AIG executive, will be based in London and will join PartnerRe’s executive leadership team.

-

The firm posted a combined ratio of 81.3% for its P&C segment and 91.7% for its specialty unit, improving from 97.7% and 94.8% in Q1 2021, respectively.

-

The firm posted a combined ratio of 80% for its P&C segment and 72.5% for its specialty unit, improving from 97.6% and 100.2% in Q4 2020, respectively.

-

Inside P&C dissects the biggest deals of the year across broking, commercial lines and InsurTech.

-

The reincarnated $9bn deal is moving a step closer to completion.

-

The executive was speaking at an investor day following the deal to sell PartnerRe to Covea.

-

The Bermudian carrier took $188mn losses from Hurricane Ida and $60mn from the European floods.

-

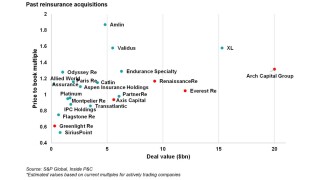

However, the deal is low-to-mid ranking in terms of book multiple.

-

If the deal does complete this time, the partnership will face a range of pitfalls and challenges.

-

The deal price is the same as was agreed in the transaction last year that Covea terminated.

-

Sowa spent 17 years with Aspen, including a stretch running Aspen Re North America.

-

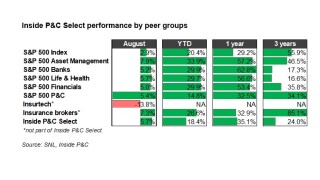

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.

-

Former Swiss Re actuarial executive Julie Halper has also joined Toa’s US branch, as its new chief actuary.

-

The company grew P&C net written premiums by 47%, while the non-life combined ratio improved 32 points to 89% during the second quarter.

-

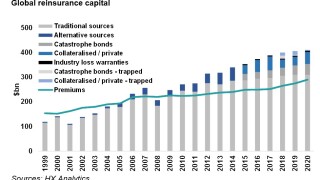

The changing reinsurance market dynamics are impacting reinsurers' ability to raise rates.

-

The executive recently stepped down from Lloyds after steering the bank through the aftermath of the financial crisis.

-

The carrier recorded average rate rises of 9% for P&C accounts renewing at April 1.

-

His arrival comes in the wake of a series of departures from Validus Re’s specialty reinsurance team.

-

-

-

The new board member has worked for the Agnelli family for over 20 years.

-

The Bermuda reinsurer's net income per share fell 5% to $206mn during the period.

-

The ratings agency says it is concerned about the impact of Covid-19 on the insurer and its future operating performance.

-

The Covea deal gives PartnerRe EUR500mn of third-party funds as the retro market heads for the rocks.

-

The tie-up is part of a EUR1.5bn investment deal between the French mutual and Exor

-

The incoming CEO plans growth in retro, cat and property per risk as pricing improves.

-

Hannover Re’s Henchoz elected vice-chair of the 12-company-strong forum.

-

The executive reports to recently arrived P&C Americas CEO Jon Colello.

-

The action follows similar moves by AM Best and Fitch after a proposed $9bn sale was dropped.

-

Fitch had earlier trimmed its outlook to negative after the carrier’s takeover by Covea collapsed.

-

An earlier positive outlook had reflected an anticipated benefit from ownership by a larger P&C, health and life insurance organisation.

-

Covea announced it would no longer be acquiring PartnerRe. The move seems likely to torch its reputation as a potential merger partner and will present challenges for its purported strategic goals.

-

The Exor chief reaffirms his long-term commitment to the reinsurer in an internal memo.

-

Exor rejects Covea’s attempts to renegotiate terms in light of the Covid-19 crisis.

-

PartnerRe CEO Emmanuel Clarke avowed that “continuity prevails” in describing how the global reinsurer will maintain its autonomy and business strategy despite a change in ownership.

-

S&P had earlier declared the mutual could comfortably digest even a sizeable acquisition.

-

PartnerRe's union with Covea gave it access to primary risk, leaving the reinsurer better placed, but the two must still address cultural challenges and the issues PartnerRe has faced in recent years.

-

Fitch today placed PartnerRe’s A+ strong financial strength rating on “rating watch positive”.